This form of release is used when Lessor releases, relinquishes, and quit claims to the present owners of the Lease all of a Production Payment interest. From and after the Effective Date, the Production Payment interest in the Lease is deemed to have terminated and is no longer a burden on the leasehold estate created by the Lease.

Guam Release of Production Payment by Lessor

Description

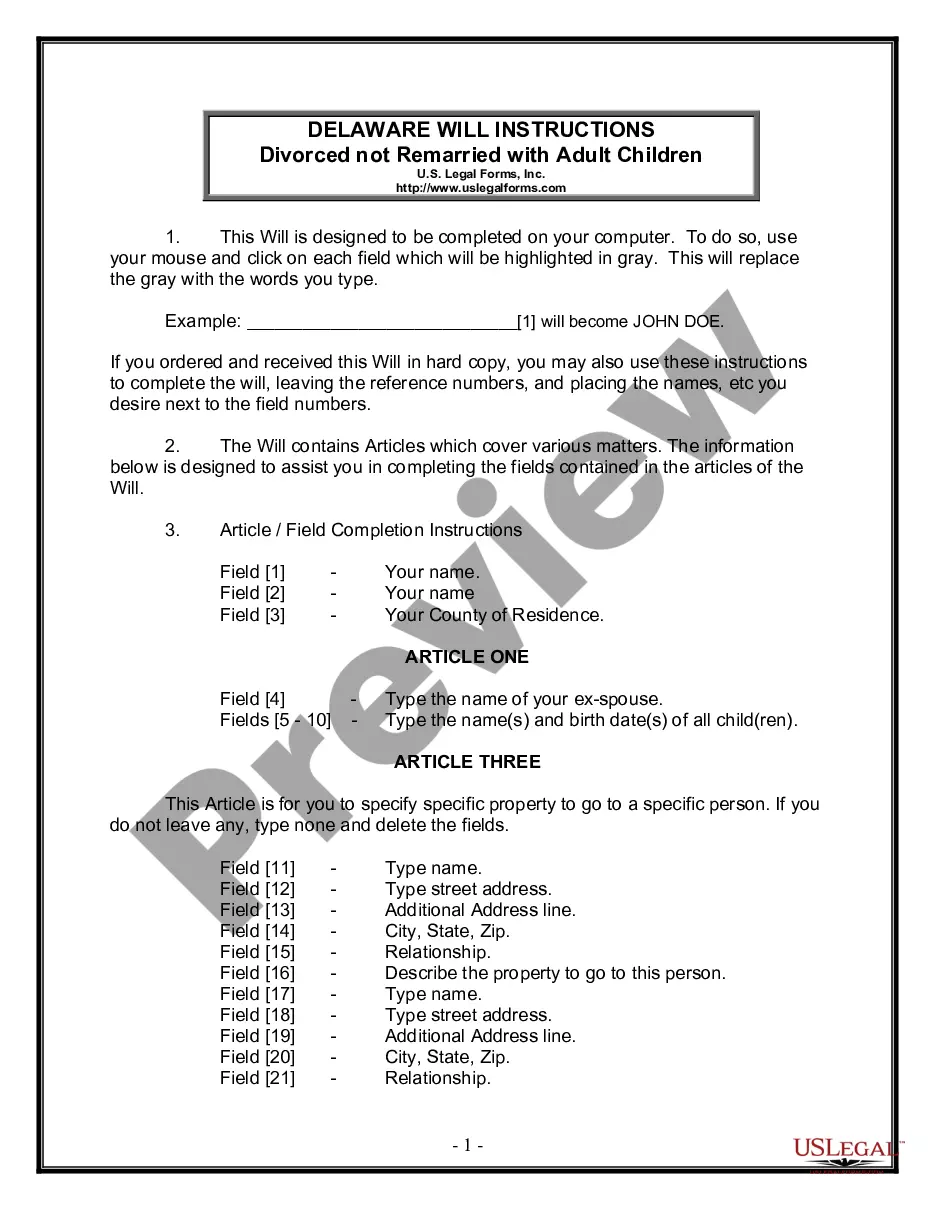

How to fill out Release Of Production Payment By Lessor?

Choosing the right legitimate record design might be a have a problem. Obviously, there are a lot of themes available on the net, but how will you discover the legitimate form you will need? Take advantage of the US Legal Forms internet site. The support provides 1000s of themes, such as the Guam Release of Production Payment by Lessor, that can be used for business and private demands. Each of the types are checked by experts and satisfy state and federal specifications.

If you are presently authorized, log in for your account and click the Acquire key to find the Guam Release of Production Payment by Lessor. Make use of your account to appear through the legitimate types you might have ordered previously. Check out the My Forms tab of your account and acquire another copy of your record you will need.

If you are a whole new customer of US Legal Forms, listed below are straightforward instructions that you can comply with:

- Initial, make sure you have selected the appropriate form for your personal area/area. You can look through the form using the Review key and read the form explanation to make sure this is basically the right one for you.

- In case the form fails to satisfy your expectations, utilize the Seach area to discover the appropriate form.

- Once you are sure that the form is acceptable, click on the Buy now key to find the form.

- Opt for the prices strategy you need and type in the essential information. Design your account and purchase the order utilizing your PayPal account or credit card.

- Opt for the document formatting and acquire the legitimate record design for your device.

- Full, revise and printing and sign the attained Guam Release of Production Payment by Lessor.

US Legal Forms will be the greatest catalogue of legitimate types in which you will find various record themes. Take advantage of the service to acquire expertly-produced paperwork that comply with express specifications.