Guam Assignment of Production Payment Measured by Value Received

Description

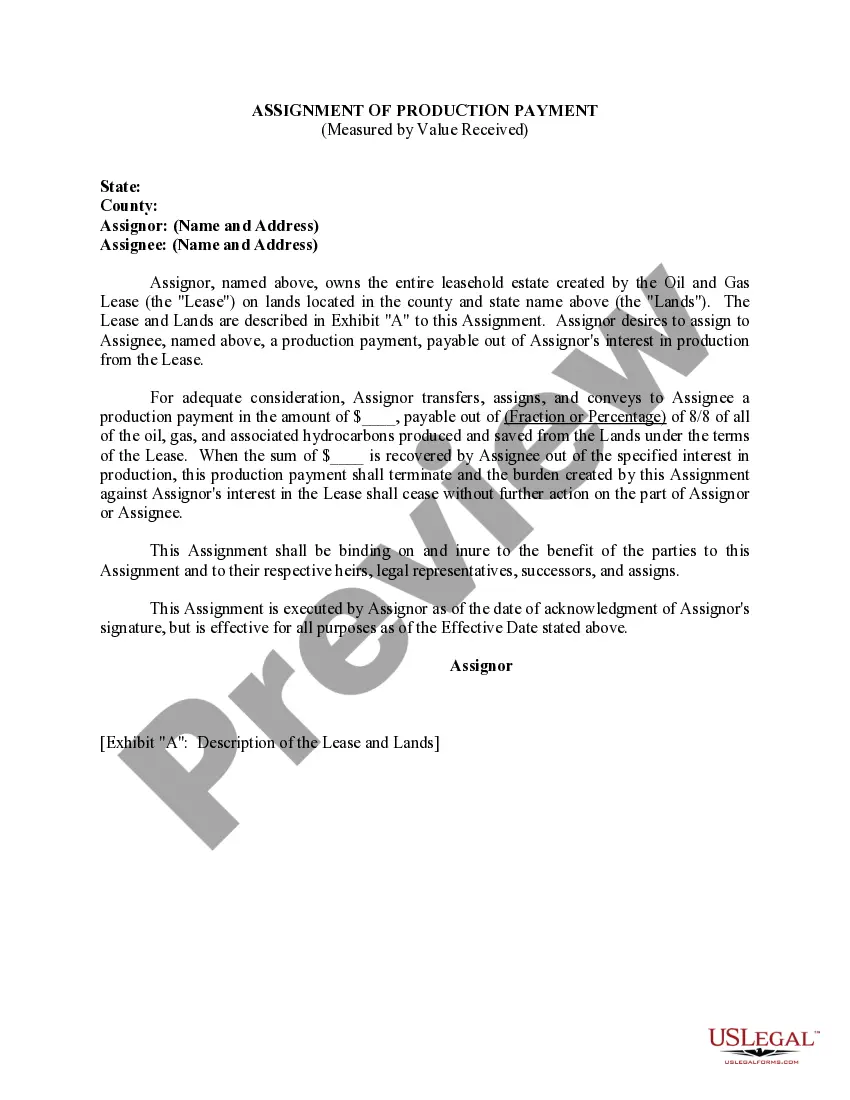

How to fill out Assignment Of Production Payment Measured By Value Received?

If you want to total, acquire, or produce authorized file themes, use US Legal Forms, the most important selection of authorized forms, which can be found on the web. Take advantage of the site`s basic and practical research to find the files you require. A variety of themes for business and person purposes are sorted by types and states, or search phrases. Use US Legal Forms to find the Guam Assignment of Production Payment Measured by Value Received with a number of click throughs.

In case you are presently a US Legal Forms customer, log in to your accounts and click on the Acquire button to have the Guam Assignment of Production Payment Measured by Value Received. You can even gain access to forms you formerly saved from the My Forms tab of your respective accounts.

If you use US Legal Forms for the first time, refer to the instructions under:

- Step 1. Ensure you have chosen the form for that appropriate metropolis/region.

- Step 2. Use the Preview option to look over the form`s information. Do not forget to see the description.

- Step 3. In case you are not satisfied using the kind, take advantage of the Lookup industry near the top of the screen to find other versions of the authorized kind web template.

- Step 4. Once you have found the form you require, click on the Buy now button. Pick the rates plan you favor and add your accreditations to sign up for an accounts.

- Step 5. Approach the deal. You may use your bank card or PayPal accounts to perform the deal.

- Step 6. Pick the format of the authorized kind and acquire it on your own device.

- Step 7. Comprehensive, modify and produce or sign the Guam Assignment of Production Payment Measured by Value Received.

Each and every authorized file web template you acquire is your own for a long time. You possess acces to each kind you saved in your acccount. Select the My Forms segment and choose a kind to produce or acquire again.

Remain competitive and acquire, and produce the Guam Assignment of Production Payment Measured by Value Received with US Legal Forms. There are millions of expert and express-certain forms you may use for your business or person demands.

Form popularity

FAQ

Sales and Use Tax If you sell taxable goods or services to customers, you'll need to register for a GuamTax.com business account and collect Guam's 2% sales tax. However, the following services are exempt from Guam sales tax: Banking and lending services. Foreign currency services.

Guam will rebate 75% of income taxes for 20 years on income from qualifying Guam businesses. If the business is conducted as an "S" corporation, the rebate is available to shareholders.

Regardless of where they live, those with overseas contractor jobs will need to file a US tax return ? but they may need to file taxes in their country of residence as well. But with a little bit of research and organization, you'll feel more comfortable with what your taxes include and how to handle them. Taxes & Overseas Contractor Jobs: Your Complete Guide - Bright!Tax brighttax.com ? blog ? tax-guide-overseas-contrac... brighttax.com ? blog ? tax-guide-overseas-contrac...

If you are a bona fide resident of Guam for the entire tax year, then you must file a tax return with Guam reporting gross income from worldwide sources. If you are also a U.S. citizen or resident alien, you must file a U.S. Tax Return reporting your worldwide income, with the exception of income from Guam. Guam Income Tax Returns. Tax Form 5074 Complete Online - eFile.com efile.com ? state-tax ? guam-state-tax efile.com ? state-tax ? guam-state-tax

Guam will rebate 75% of income taxes for 20 years on income from qualifying Guam businesses. If the business is conducted as an "S" corporation, the rebate is available to shareholders. Establishing Residency in the US Possessions parsonsbehle.com ? insights ? establishing-residen... parsonsbehle.com ? insights ? establishing-residen...

Tax rate decreased to four percent (4%). The filing requirements also changed. The return (Form GRT) is required to be filed on a monthly basis and is due on the twentieth (20th) day of the following month, even if no taxes are due. The payment of the tax is also due on the twentieth (20th) of the following month.

The Guam Code states that the BPT tax rate to be levied, assessed, and collected on contractors is 4 percent of the contractor's gross income for goods and services performed. The BPT applies to all persons or contractors doing work on Guam, whether or not their business is located on the island.

Personal and Corporate Income Tax Bona fide residents of Guam are subject to special U.S. tax rules. In general, all individuals with income from Guam will file only one return?either to Guam or the United States. If you are a bona fide resident of Guam during the entire tax year, file your return with Guam. Guam Tax Structure guamtax.com ? info ? structure guamtax.com ? info ? structure