Guam Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced

Description

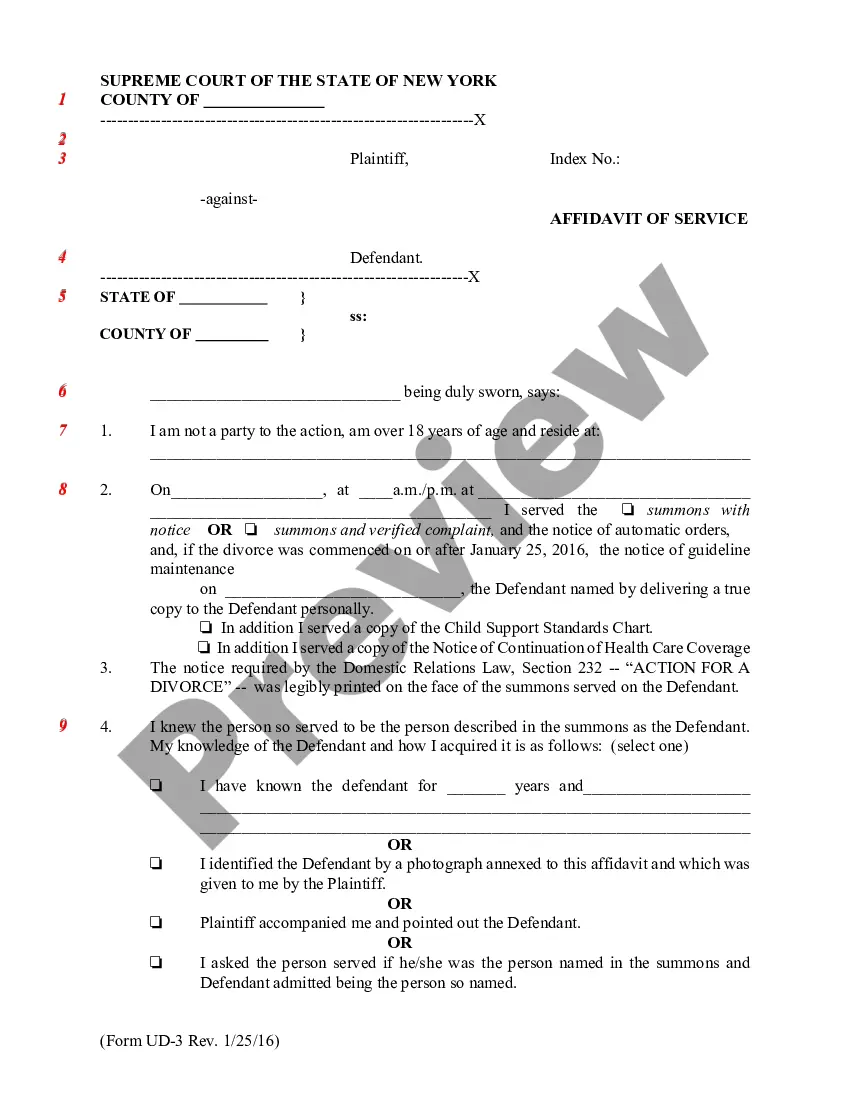

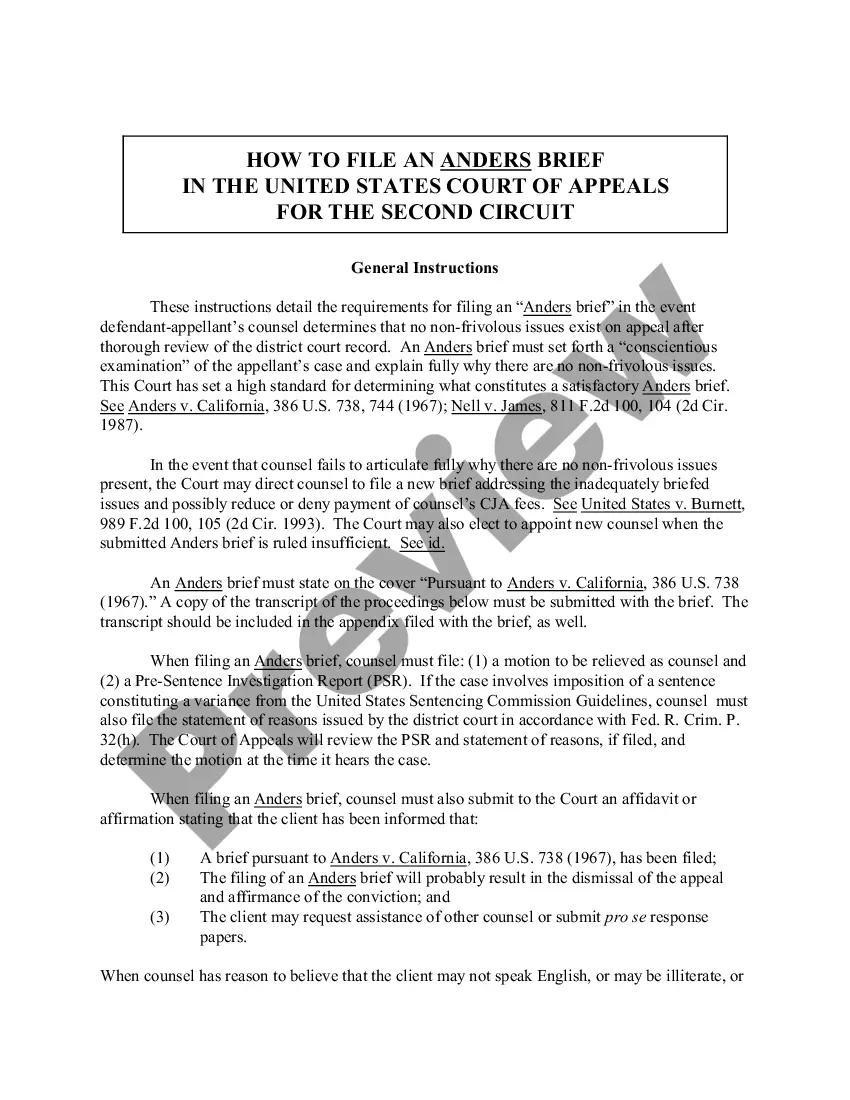

How to fill out Assignment Of Overriding Royalty Interest To Become Effective At Payout, With Payout Based On Volume Of Oil Produced?

Choosing the best lawful record template can be a struggle. Of course, there are a variety of templates accessible on the Internet, but how do you discover the lawful develop you will need? Utilize the US Legal Forms website. The support offers 1000s of templates, such as the Guam Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced, that can be used for company and private demands. Each of the varieties are inspected by pros and fulfill federal and state needs.

Should you be presently registered, log in to your accounts and click the Download button to get the Guam Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced. Utilize your accounts to appear throughout the lawful varieties you might have bought previously. Proceed to the My Forms tab of the accounts and get an additional version from the record you will need.

Should you be a fresh consumer of US Legal Forms, listed here are easy guidelines that you should comply with:

- First, make sure you have chosen the right develop for the city/county. You can examine the form making use of the Preview button and read the form information to make certain it is the right one for you.

- When the develop is not going to fulfill your preferences, make use of the Seach industry to find the correct develop.

- Once you are certain the form is proper, select the Get now button to get the develop.

- Choose the costs plan you desire and type in the required information. Design your accounts and buy an order using your PayPal accounts or charge card.

- Choose the data file structure and down load the lawful record template to your system.

- Full, revise and print and sign the attained Guam Assignment of Overriding Royalty Interest to Become Effective At Payout, With Payout Based on Volume of Oil Produced.

US Legal Forms may be the biggest catalogue of lawful varieties for which you can find numerous record templates. Utilize the service to down load expertly-manufactured documents that comply with express needs.

Form popularity

FAQ

The formula to calculate NPRI without proportionate share reduction is LRR ? RI = NPRI. As an example, reducing your revenue interest from 25% LRR results in 1/16 NPRI, leaving 75% NRI for working interest owners.

Overriding Royalty Interest: A given interest severed out of the record title interest or lessee's share of the oil, and not charged with any of the cost or expense of developing or operation. The interest provides no control over the operations of the lease, only revenue from lease production.

There are three main types of royalty interests: Overriding royalty interest: Unlike mineral and royalty interests, an overriding royalty interest runs with a lease and not with the land. Therefore, they only remain in effect for as long as a lease is in effect and they expire when a lease expires.

How to calculate the overriding royalty interest? ORRI = NRI * 5 percent. $750,000 * 0.005 = $3,750.

To calculate the number of net royalty acres I'm selling, I use this formula: [acres in tract] X [% of minerals owned] X 8 X [royalty interest reserved in lease] X [fraction of royalty interest being sold]. 640 acres X 25% X 8 X 1/4 X 1/2 = 160 net royalty acres.

If at any time Assignee desires to transfer or dispose of all or any portion of the Overriding Royalty Interest, Assignee must first give to Assignor written notice thereof stating: (a) the amount of the Overriding Royalty Interest offered by Assignee; (b) the form of consideration (which shall be either cash or a ...

If there is more than one mineral owner, multiply the net revenue by the fractional interest of each owner to determine their respective royalty interest.