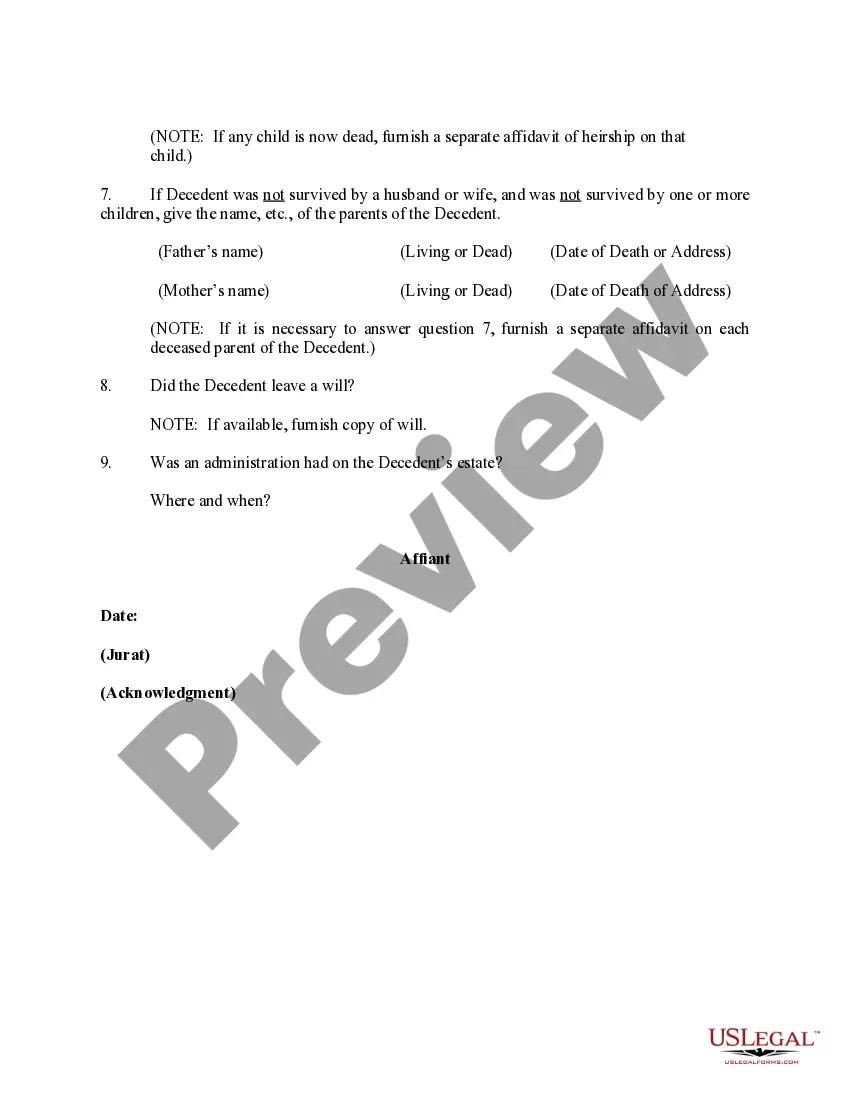

Guam Affidavit of Heirship for House

Description

How to fill out Affidavit Of Heirship For House?

US Legal Forms - one of many most significant libraries of legitimate types in the States - gives a variety of legitimate record layouts you can acquire or print out. Using the web site, you can find a large number of types for business and specific uses, categorized by types, suggests, or key phrases.You can find the newest types of types much like the Guam Affidavit of Heirship for House in seconds.

If you already possess a registration, log in and acquire Guam Affidavit of Heirship for House from the US Legal Forms library. The Obtain switch will show up on every single type you view. You have accessibility to all previously downloaded types within the My Forms tab of your respective account.

If you would like use US Legal Forms the very first time, allow me to share basic directions to get you started:

- Be sure to have chosen the best type for the metropolis/area. Click the Preview switch to analyze the form`s articles. Look at the type description to ensure that you have chosen the correct type.

- When the type doesn`t satisfy your demands, take advantage of the Look for industry towards the top of the screen to obtain the one which does.

- When you are content with the shape, validate your decision by clicking the Purchase now switch. Then, select the prices program you want and give your qualifications to register to have an account.

- Process the deal. Use your credit card or PayPal account to perform the deal.

- Select the structure and acquire the shape on your own gadget.

- Make changes. Complete, revise and print out and sign the downloaded Guam Affidavit of Heirship for House.

Each format you included with your bank account does not have an expiry particular date and is the one you have forever. So, if you wish to acquire or print out one more copy, just go to the My Forms area and then click in the type you need.

Gain access to the Guam Affidavit of Heirship for House with US Legal Forms, one of the most considerable library of legitimate record layouts. Use a large number of specialist and state-specific layouts that satisfy your small business or specific demands and demands.

Form popularity

FAQ

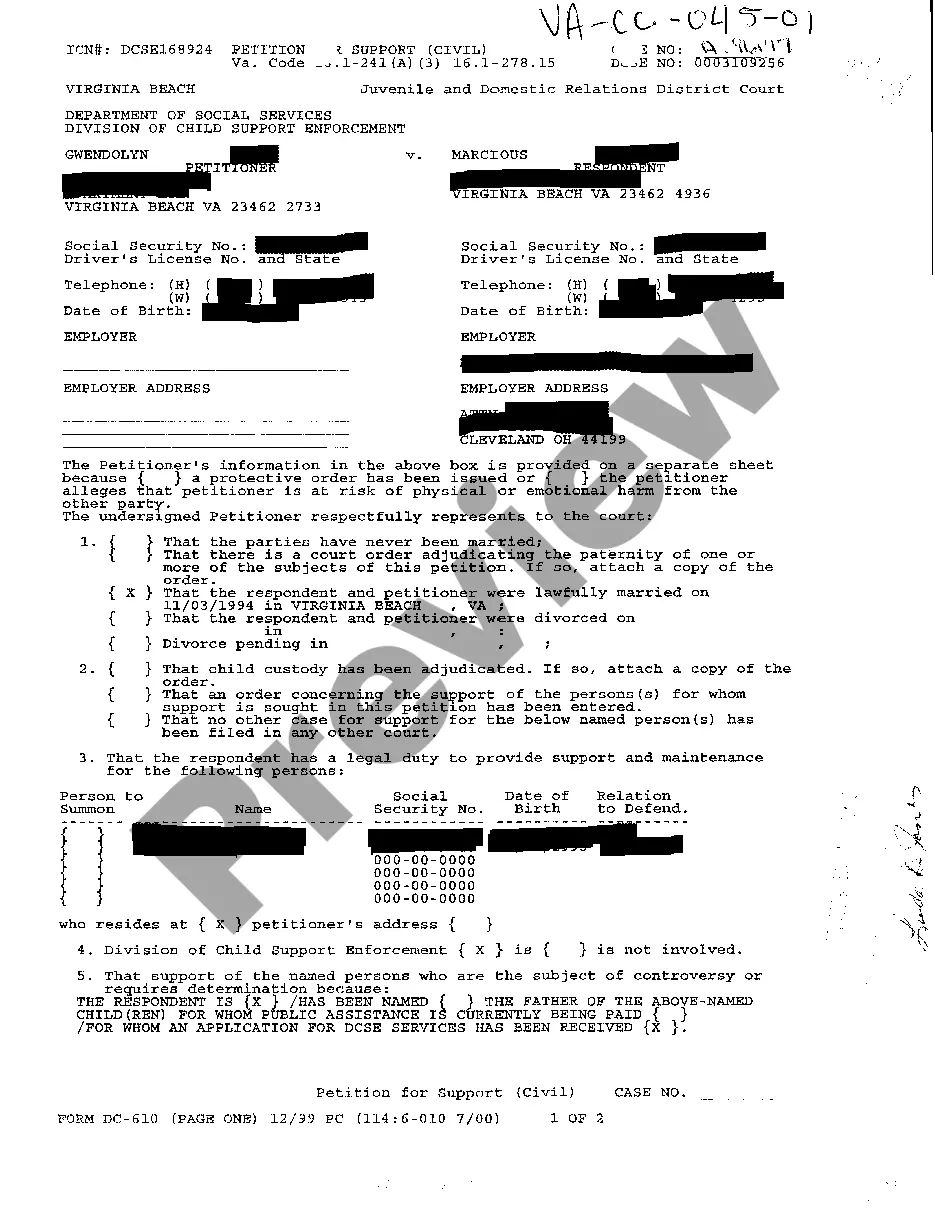

Once the affidavit has been recorded, the heirs are identified in the property records as the new owners of the property. Thereafter, the heir or heirs may transfer or sell the property if they choose to do so.

An affidavit of heirship is a document used to give property to the heirs of a person who has died. It may be needed if the person did not have a will, or if the will was not approved within four years of their death.

To fill out an Affidavit of Heirship in California, you must provide information about the deceased individual, including their name, date of death, and last known address. You must also provide information about the heirs, including their names, relationship to the deceased, and addresses.

Each county in Texas has a different filing fee, but the cost of filing an affidavit of heirship runs from $50 to $75. You will likely also need to pay a notary public to witness the document signing.

An affidavit of heir is a written statement that allows an estate to move forward with an uncontested probate. The person who signs the affidavit is agreeing that they are the rightful owner of the assets and that they will transfer them to the appropriate parties as soon as the probate process is complete.

If the deceased property owner had a Will stating who the property should be transferred to, the Will should be filed for Probate within 4 years of the date of death. The property may subsequently be transferred or sold by the Executor named in the Will ing to the wishes of the deceased owner.

What is an heir property owner? You are considered to be an heir property owner if you inherited your primary residence (also called a ?residence homestead?) by (1) will, (2) transfer on death deed, or (3) intestacy ? regardless of whether your ownership interest is recorded in the county's real property records.

All beneficiaries must agree to the terms of the sale, and the purchase must be made at fair market value.