Guam Private Investigator Agreement - Self-Employed Independent Contractor

Description

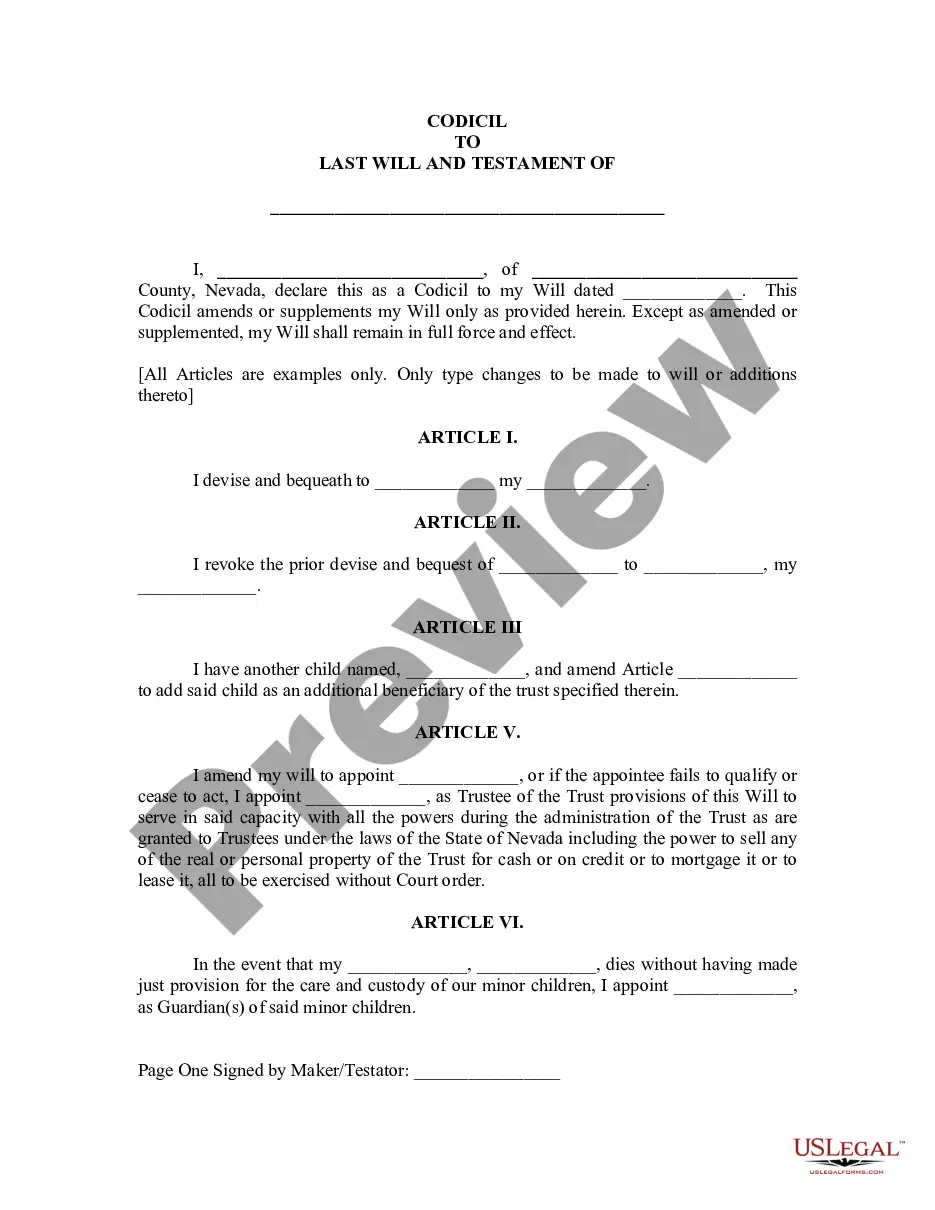

How to fill out Private Investigator Agreement - Self-Employed Independent Contractor?

You can spend considerable time online attempting to find the legal document template that satisfies the state and federal requirements you need.

US Legal Forms offers a vast array of legal documents that are assessed by experts.

You can obtain or create the Guam Private Investigator Agreement - Self-Employed Independent Contractor with my help.

Should you need to find an additional version of your form, use the Search field to locate the template that fits your requirements and specifications.

- If you already possess a US Legal Forms account, you may Log In and select the Download option.

- Subsequently, you can complete, modify, print, or sign the Guam Private Investigator Agreement - Self-Employed Independent Contractor.

- Every legal document template you purchase is yours indefinitely.

- To retrieve an additional copy of a purchased form, navigate to the My documents section and click on the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, make sure you have chosen the correct document template for the county/region of your choice.

- Review the document description to confirm you have selected the correct form.

Form popularity

FAQ

As a contractor, if you do not have an ABN before doing work, your hirer may legally withhold the top rate of tax, plus the Medicare levy, from your payment. Labour hire workers aren't entitled to an ABN, so you need to check if you're entitled before applying.

Article 82 of the Labor Code states that employees under all establishments and undertakings need to complete a certain set of working hours, except: Government employees. Managerial employees. Field personnel.

And in fact, under the law, employers cannot be held liable for the acts of their independent contractors. However, just because an employer asserts that a negligent worker is an independent contractor does not shut down the question of employer liability.

A sham contracting arrangement is when an employer attempts to disguise an employment relationship as a contractor relationship. They may do this to avoid certain taxes and their responsibility for employee entitlements like: minimum wages. superannuation. leave.

Employees at businesses with fewer than two employees. Employees at businesses that have an annual revenue of less than $500,000 and who do not engage in interstate commercei Railroad workers (covered instead by the Railway Labor Act) Truck drivers (covered instead by the Motor Carriers Act)

Unlike full-time employment, the fee of a contractor will not include employee insurance, holiday pay, sick leave, equipment, office space or employee benefits. You can enjoy greater flexibility One key reason business managers choose a contractor vs employee is because of flexibility.

Generally, the FLSA applies to employees of enterprises that have an annual gross volume of sales made or business done totaling $500,000 or more, and to employees individually covered by the law because they are engaged in interstate commerce or in the production of goods for commerce.

FEHA typically protects independent contractors as well as employees.

A few employers, including small farmsthose that use relatively little outside paid laborare explicitly exempt from the FLSA. Many airline employees are exempt from the FLSA's overtime provisions. And most companions for the elderly are exempt from both minimum wage and overtime provisions.

Some general protections provided under the Fair Work Act 2009 extend to independent contractors and their principals. Independent contractors and principals are afforded limited workplace rights, and the right to engage in certain industrial activities.