Guam Audio Systems Contractor Agreement - Self-Employed

Description

How to fill out Audio Systems Contractor Agreement - Self-Employed?

If you wish to complete, acquire, or create authentic document templates, utilize US Legal Forms, the premier collection of legal forms, which can be accessed online.

Employ the site's straightforward and user-friendly search feature to find the documents you need. Various templates for business and personal purposes are organized by categories and states, or keywords.

Use US Legal Forms to obtain the Guam Audio Systems Contractor Agreement - Self-Employed with just a few clicks.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

Step 6. Choose the format of your legal form and download it to your system. Step 7. Complete, modify, and print or sign the Guam Audio Systems Contractor Agreement - Self-Employed. Every legal document template you acquire is yours indefinitely. You will have access to every form you saved in your account. Click on the My documents section and select a form to print or download again. Stay competitive and download, and print the Guam Audio Systems Contractor Agreement - Self-Employed with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to obtain the Guam Audio Systems Contractor Agreement - Self-Employed.

- You can also access forms you have previously saved in the My documents tab of your account.

- If you are using US Legal Forms for the first time, refer to the instructions below.

- Step 1. Ensure you have chosen the form for the correct city/state.

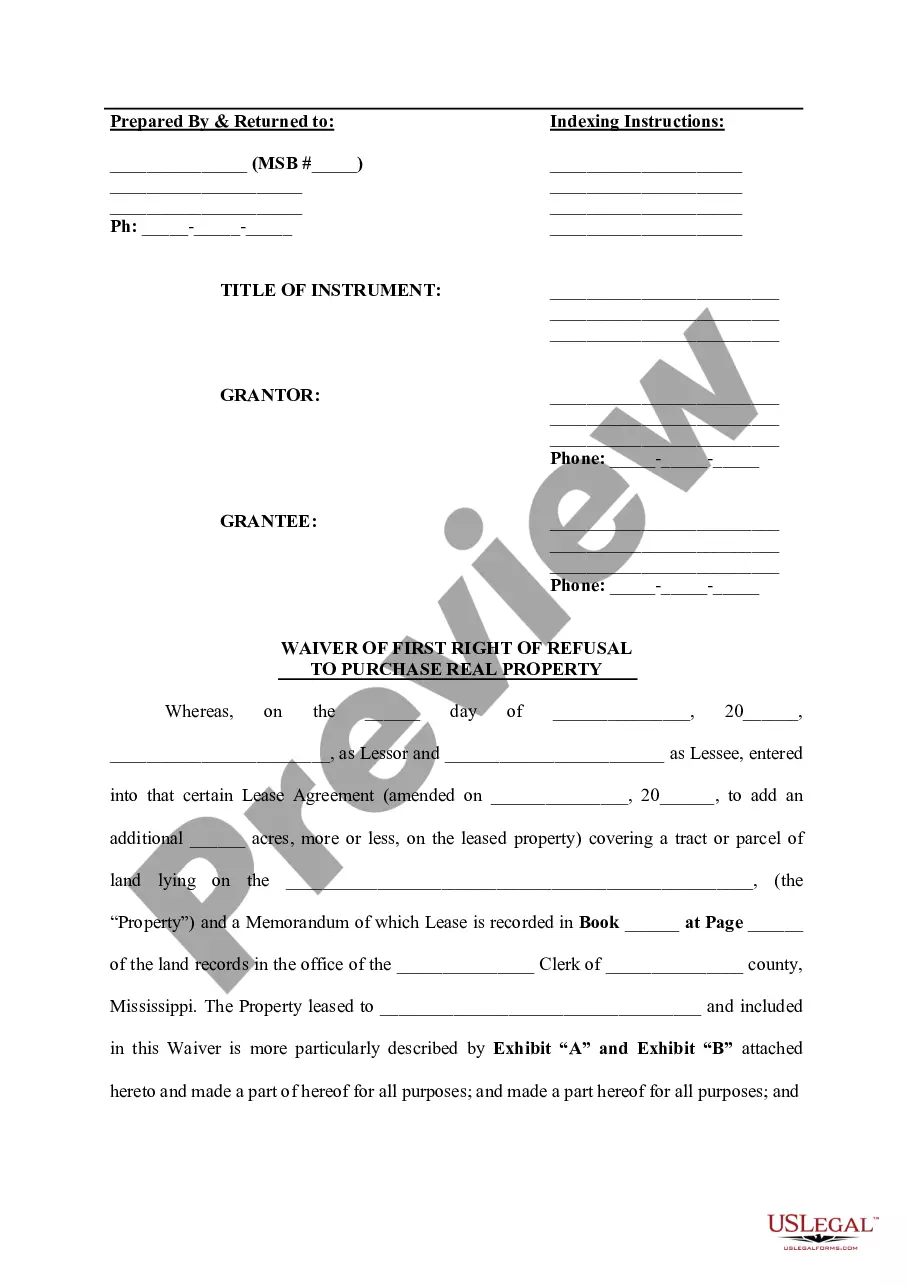

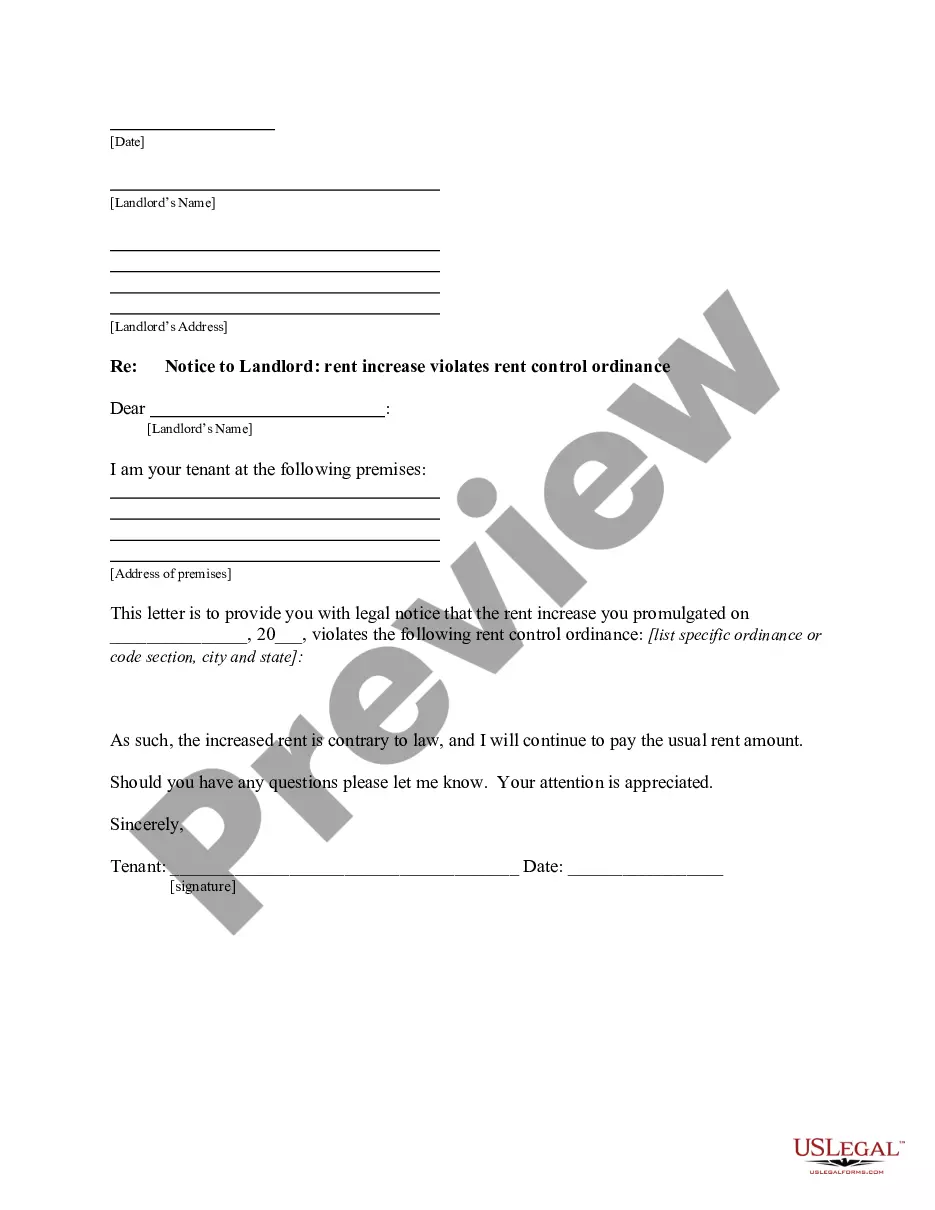

- Step 2. Utilize the Review feature to examine the form's content. Don't forget to review the summary.

- Step 3. If you are not satisfied with the form, use the Search section at the top of the screen to find other versions of your legal form template.

- Step 4. Once you have found the form you need, select the Purchase now button. Choose the payment plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Writing a contract as an independent contractor involves several steps. First, identify the services you will provide and include them in the agreement. Next, define payment terms, deadlines, and any specific conditions relevant to the Guam Audio Systems Contractor Agreement - Self-Employed. To ensure clarity and legality, you might want to leverage resources like uslegalforms, which can help you draft a comprehensive and professional contract.

A basic independent contractor agreement outlines the working relationship between a contractor and a client. It typically covers aspects like the services to be provided, payment rates, deadlines, and termination conditions. This type of agreement is crucial for defining expectations and protecting both parties involved in a Guam Audio Systems Contractor Agreement - Self-Employed. Utilizing uslegalforms can simplify this process by offering structured templates tailored to your needs.

Yes, you can write your own legally binding contract, including a Guam Audio Systems Contractor Agreement - Self-Employed. To do this effectively, ensure you include essential elements such as the scope of work, payment terms, and the rights and responsibilities of each party. It's vital to use clear language to avoid misunderstandings. However, consider using a template from uslegalforms for guidance, as it provides a solid foundation and can help you craft a strong agreement.

When filling out an independent contractor agreement, start by listing contact information for both parties and the project's description. Clearly define compensation terms, deadlines, and other expectations to prevent misunderstandings. Using a standardized template like the Guam Audio Systems Contractor Agreement - Self-Employed can help streamline this process and ensure you cover all necessary points for your agreement.

Filling out an independent contractor form involves providing your personal information, details about the project, and the expected payment. Include any applicable taxes and specify the payment method. To simplify this process, consider using a structured format or template like the Guam Audio Systems Contractor Agreement - Self-Employed that outlines necessary fields, ensuring all important details are captured.

To write an independent contractor agreement, begin by including your and the contractor's contact information and clearly define the project scope. Specify payment terms, timelines, and any additional obligations for both parties. For added protection, you may want to use a template specifically designed for a Guam Audio Systems Contractor Agreement - Self-Employed to ensure that all necessary elements are included.

To set up as a self-employed contractor, start by choosing a business name and deciding on a legal structure, such as an LLC or sole proprietorship. Next, register your business with the appropriate state authorities in Guam, obtaining any required licenses. Additionally, consider creating a Guam Audio Systems Contractor Agreement - Self-Employed to formalize your work relationships and outline terms with your clients.

To write an independent contractor agreement, start by clearly defining the parties involved, including their names and addresses. Next, outline the scope of work, specifying tasks and timelines to avoid misunderstandings. Ensure to include payment terms and conditions, detailing how and when the contractor will be compensated. Finally, incorporate clauses that address confidentiality and termination conditions, helping to establish a foundation for a strong Guam Audio Systems Contractor Agreement - Self-Employed.