Guam Federal Consumer Leasing Act Disclosure Form

Description

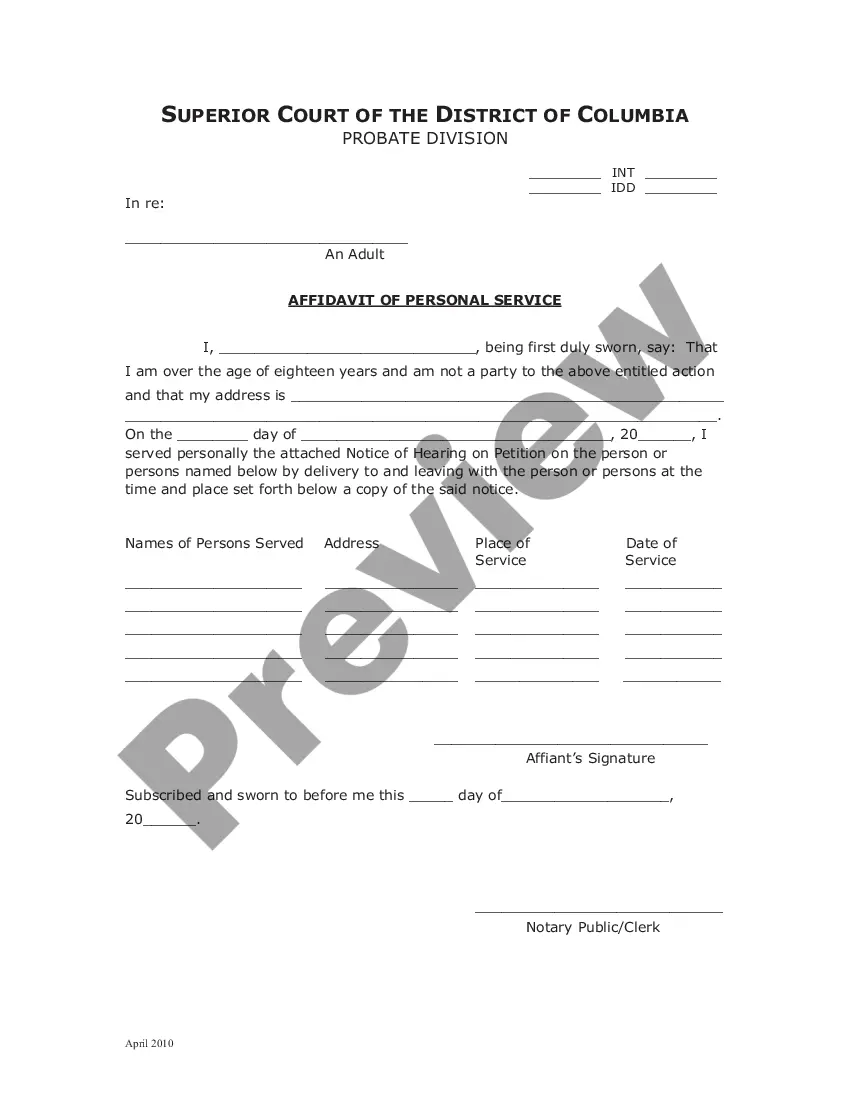

How to fill out Federal Consumer Leasing Act Disclosure Form?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates that you can download or print.

By utilizing the website, you can discover thousands of forms for both business and personal use, categorized by types, states, or keywords.

You can find the latest versions of forms such as the Guam Federal Consumer Leasing Act Disclosure Form in just moments.

Review the form summary to confirm you have chosen the correct one.

If the form doesn't meet your requirements, utilize the Search bar at the top of the screen to find the appropriate one.

- If you have a monthly membership, Log In to access the Guam Federal Consumer Leasing Act Disclosure Form in the US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously downloaded forms within the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple steps to get started.

- Ensure you have selected the correct form for your locality/region.

- Click the Preview button to view the form's content.

Form popularity

FAQ

The rules of the Consumer Leasing Act focus on providing consumers with clear and accurate information about lease terms. Lessors must clearly disclose all relevant details such as payment schedules, end-of-lease obligations, and any potential fees. By understanding the Guam Federal Consumer Leasing Act Disclosure Form, you can stay compliant and ensure a fair leasing experience. This knowledge empowers you to make smart financial decisions regarding leases.

Regulation M outlines specific disclosures that must appear in consumer lease agreements to protect lessees. These disclosures include the lease payment amount, the total number of payments, the residual value, and any fees applicable. The Guam Federal Consumer Leasing Act Disclosure Form compiles all this essential information, ensuring that you are well-informed about your leasing terms. Accessing this form makes finding the required details simpler and more straightforward.

The disclosure of the Consumer Leasing Act requires lessors to provide clear information about leasing terms and conditions. This includes details about payment amounts, the risks associated with leasing, and any penalties for early termination. Understanding the Guam Federal Consumer Leasing Act Disclosure Form will help you make informed decisions when considering a lease. By providing transparency, this disclosure aims to protect consumers and enhance trust in leasing agreements.

A car lease agreement typically includes several key disclosures, such as the monthly payment, interest rate, and fees. Other vital information may involve mileage limits and the condition in which the car must be returned. Familiarizing yourself with these disclosures, like those in the Guam Federal Consumer Leasing Act Disclosure Form, ensures that you understand your obligations and helps you avoid unexpected costs.

Disclosures must be made to the consumer at the time of the leasing transaction, before signing the lease agreement. This ensures that consumers fully understand their rights and obligations under the lease. Timely disclosures help prevent misunderstandings and foster transparency, especially concerning the Guam Federal Consumer Leasing Act Disclosure Form.

A lease disclosure statement is a document that outlines all relevant terms and conditions of a lease agreement. This statement provides critical information such as payment amounts, fees, and the duration of the lease. When entering a leasing agreement, reviewing this disclosure, including the Guam Federal Consumer Leasing Act Disclosure Form, is essential for making confident and informed decisions.

The 90% rule in leasing refers to a guideline that helps determine the proportional use of the leased asset. Essentially, if a lessee uses the asset for 90% or more of its intended purpose, the agreement may qualify for more favorable tax treatment. This rule is significant for both lessees and lessors, particularly when evaluating the Guam Federal Consumer Leasing Act Disclosure Form.

The Federal Consumer Leasing Act disclosure is a legal requirement that ensures consumers receive essential information about leasing terms. This disclosure provides transparency to potential lessees, outlining important lease terms that affect their financial decisions. Understanding this disclosure can help you make informed choices when considering any leasing agreement, especially regarding the Guam Federal Consumer Leasing Act Disclosure Form.