Guam Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc.

Description

How to fill out Subscription Agreement For Employee Stock Purchase Plan Of Gadzoox Networks, Inc.?

US Legal Forms - one of many greatest libraries of legal varieties in the USA - offers an array of legal document templates you can down load or print out. Making use of the website, you may get a huge number of varieties for organization and person functions, sorted by classes, suggests, or key phrases.You can get the most recent types of varieties much like the Guam Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc. within minutes.

If you already have a subscription, log in and down load Guam Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc. in the US Legal Forms local library. The Obtain button will appear on each develop you look at. You get access to all earlier saved varieties in the My Forms tab of your respective bank account.

In order to use US Legal Forms the very first time, here are simple directions to get you began:

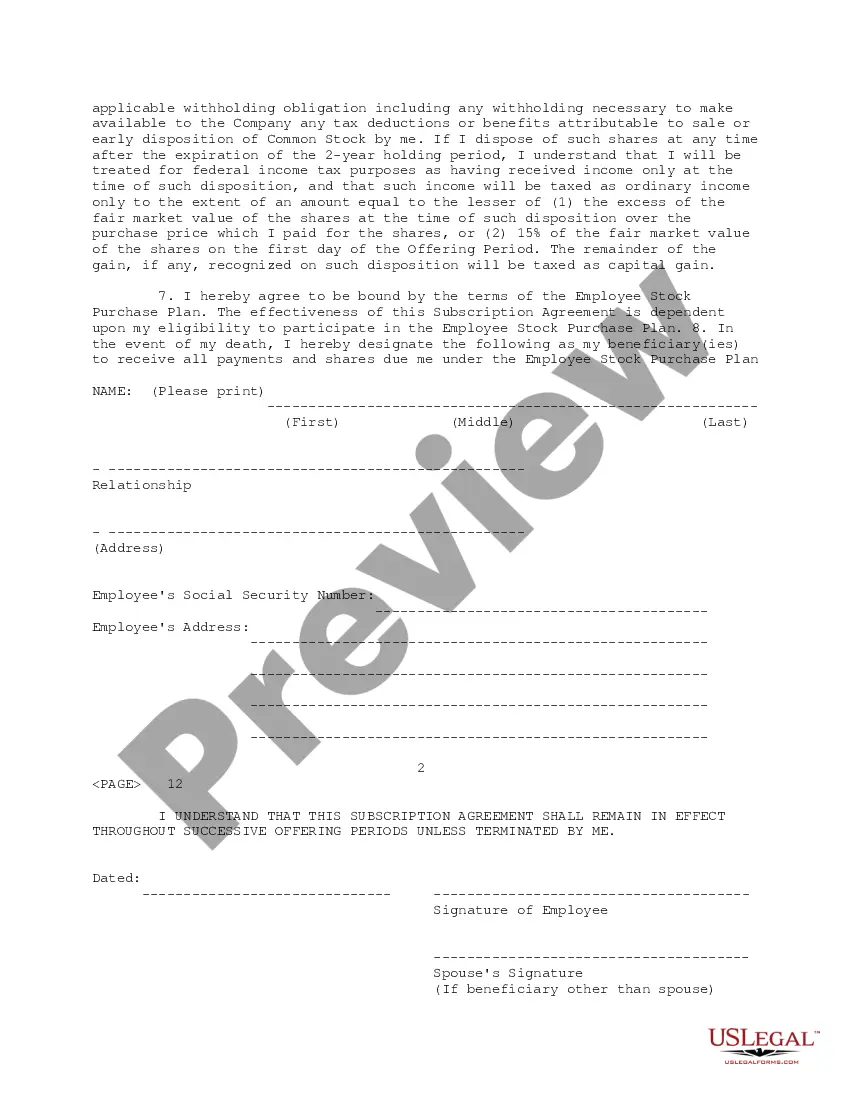

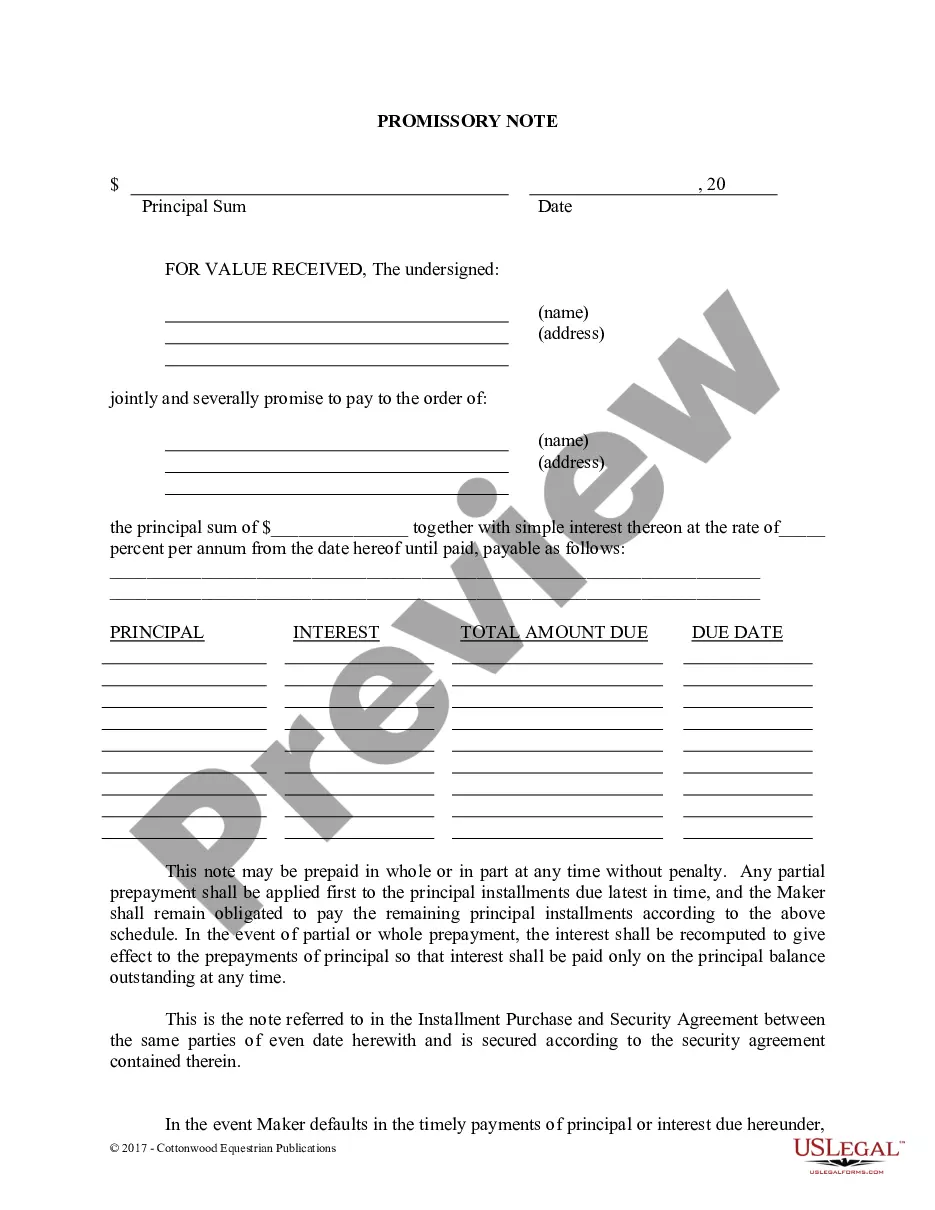

- Be sure you have selected the best develop for your city/region. Select the Preview button to examine the form`s content material. Look at the develop explanation to ensure that you have selected the proper develop.

- In the event the develop does not match your specifications, utilize the Look for field at the top of the display to find the one that does.

- When you are satisfied with the form, verify your option by simply clicking the Purchase now button. Then, select the prices strategy you want and supply your qualifications to register for an bank account.

- Method the financial transaction. Make use of credit card or PayPal bank account to accomplish the financial transaction.

- Choose the format and down load the form in your gadget.

- Make changes. Fill out, modify and print out and sign the saved Guam Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc..

Each format you included with your bank account lacks an expiry date and is also the one you have for a long time. So, in order to down load or print out an additional backup, just go to the My Forms section and then click about the develop you need.

Obtain access to the Guam Subscription Agreement for Employee Stock Purchase Plan of Gadzoox Networks, Inc. with US Legal Forms, one of the most considerable local library of legal document templates. Use a huge number of skilled and condition-specific templates that fulfill your company or person requirements and specifications.

Form popularity

FAQ

Tips to Determine How Much to Contribute to Your ESPP Total amount of debt you have (credit cards, student loans, cars, etc.) Total amount of expenses you pay every month. Total amount of savings you have. Total amount of investment accounts. Total amount of company stock you already own.

Qualifying disposition: You sold the stock at least two years after the offering (grant date) and at least one year after the exercise (purchase date). If so, a portion of the profit (the ?bargain element?) is considered compensation income (taxed at regular rates) on your Form 1040.

Maximum contributions: Tax rules cap the amount of company stock an employee can accrue in an ESPP at $25,000 of the fair market value of the stock per year. Most plans allow employees to elect a payroll deduction between 1% and 15%.

If you can afford it, you should participate up to the full amount and then sell the shares as soon as you can. You might even consider prioritizing your ESPP over 401(k) contributions, depending on your specific financial situation, because your after-tax returns could be higher.

If your company offers a tax-qualified ESPP and you decide to participate, the IRS will only allow you to purchase a maximum of $25,000 worth of stock in a calendar year. Any contributions that exceed this amount are refunded back to you by your company.

An employee stock purchase plan allows you to buy company stock at a bargain price. Discounts usually range from 5% to 15%. For example, if you work and participate in Hilton's ESPP, you can buy Hilton stock at a 15% discount. If Hilton's stock is trading at $130/share, they'll buy it at $110.50/share for you.

Payroll deduction just means it will come out of your paycheck. It doesn't mean it's pre-tax. An ESPP discount is nice, but it ultimately comes down to whether or not you believe the stock price will appreciate. A 5% discount on shares that depreciate 10% is still a loss.

ESPP Offering Periods and Purchase Periods ESPPs usually have 3- to 24-month offering periods. This is the period of time during which cash contributions are made to the plan via payroll deductions. The first day of the offering period is known as the offering date.