Guam Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property

Description

How to fill out Renunciation And Disclaimer Of Right To Inheritance Or To Inherit Property From Deceased - Specific Property?

Choosing the best legal document format can be quite a have difficulties. Obviously, there are tons of themes accessible on the Internet, but how do you obtain the legal kind you want? Take advantage of the US Legal Forms internet site. The support provides a huge number of themes, like the Guam Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property, which can be used for company and personal requirements. Each of the types are examined by pros and meet federal and state requirements.

When you are already registered, log in in your profile and then click the Obtain key to obtain the Guam Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property. Use your profile to appear through the legal types you might have purchased previously. Visit the My Forms tab of your own profile and acquire yet another copy of your document you want.

When you are a brand new consumer of US Legal Forms, allow me to share basic instructions that you should adhere to:

- Very first, be sure you have chosen the appropriate kind for the area/area. You are able to look through the shape utilizing the Preview key and study the shape outline to ensure it will be the right one for you.

- If the kind is not going to meet your preferences, take advantage of the Seach industry to get the correct kind.

- Once you are certain the shape is suitable, click on the Buy now key to obtain the kind.

- Choose the pricing plan you need and enter in the required information and facts. Make your profile and buy your order with your PayPal profile or Visa or Mastercard.

- Opt for the data file structure and obtain the legal document format in your product.

- Total, revise and printing and sign the acquired Guam Renunciation and Disclaimer of Right to Inheritance or to Inherit Property from Deceased - Specific Property.

US Legal Forms is the largest collection of legal types for which you will find different document themes. Take advantage of the service to obtain expertly-produced documents that adhere to state requirements.

Form popularity

FAQ

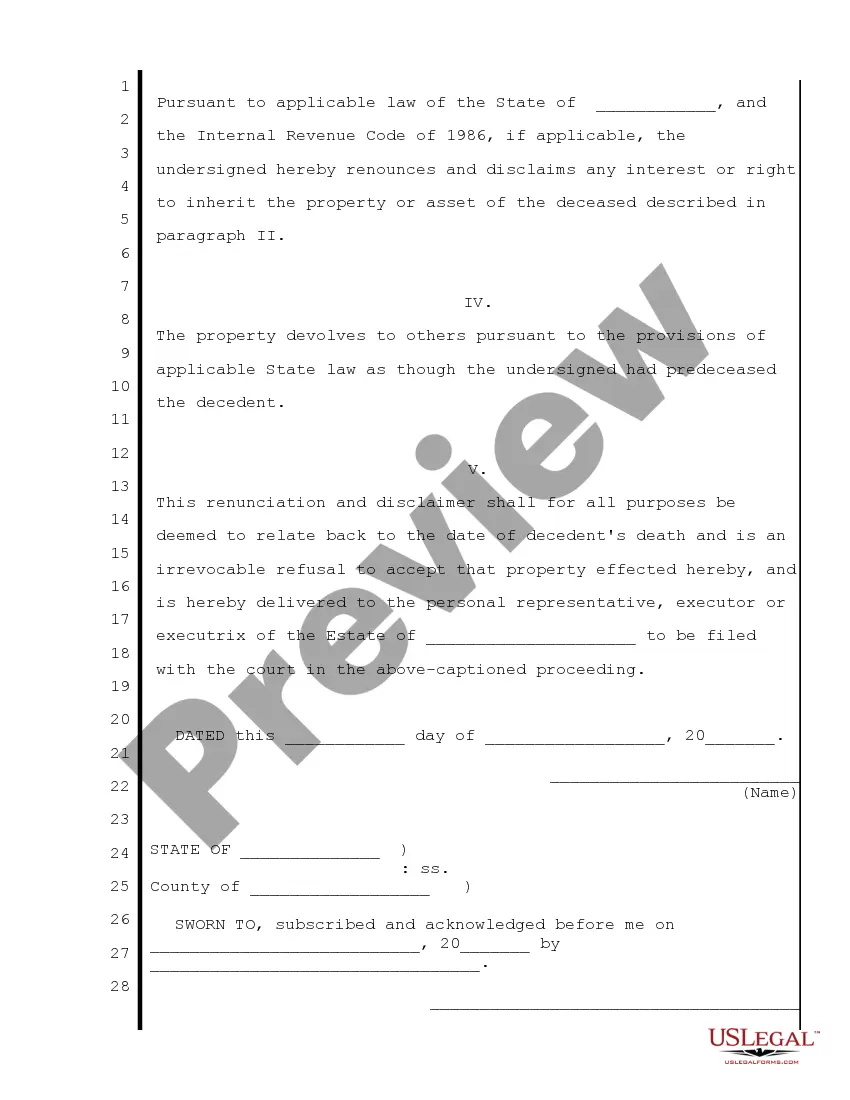

The disclaimer must be in writing: A signed letter by the person doing the disclaiming, identifying the decedent, describing the asset to be disclaimed, and the extent and amount, percentage or dollar amount, to be disclaimed, must be delivered to the person in control of the estate or asset, such as an executor, ... Thanks, But No Thanks! How To Refuse An Inheritance By Disclaiming greatoakadvisors.com ? disclaiming greatoakadvisors.com ? disclaiming

In order to disclaim an inheritance, you will need to write a Disclaimer, which states that you are disclaiming your inheritance in writing. Within your Disclaimer, you will need to explain what is being disclaimed, whether it is only part of your inheritance or all of it, as well as sign the document to make it legal. Reasons to Disclaim an Inheritance - Trust & Will trustandwill.com ? learn ? reasons-to-disclaim-an-i... trustandwill.com ? learn ? reasons-to-disclaim-an-i...

A qualified disclaimer is an irrevocable refusal by a beneficiary, including a beneficiary of retirement assets, to accept an interest in property pursuant to IRC Sec. 2518(b). A beneficiary can refuse to accept her entire interest in property or a partial share under certain circumstances.

You make your disclaimer in writing. Your inheritance disclaimer specifically says that you refuse to accept the assets in question and that this refusal is irrevocable, meaning it can't be changed. You disclaim the assets within nine months of the death of the person you inherited them from. How to Disclaim an Inheritance (And Why You Would) SmartAsset ? financial-advisor ? disclaim-in... SmartAsset ? financial-advisor ? disclaim-in...

Inheritance advance paperwork may include: The death certificate for the person whose will you are named in. A copy of the legal will, if such a document is available. A document from the estate executor or administrator explaining who they are and their relation to the estate.

If you decide to disclaim an inheritance, there are specific steps you must follow to ensure that the process is legally valid. First, the disclaimer must be in writing and signed by the potential heir. The disclaimer must also be delivered to the executor of the estate or the trustee in charge of the assets. Disclaiming an Inheritance. Why and How Would I Do It? themckenziefirm.com ? disclaiming-an-inhe... themckenziefirm.com ? disclaiming-an-inhe...

DISCLAIMER OF INHERITANCE RIGHTS I have been fully advised of my rights to certain property of the Estate of __________________ and waive and disclaim my right to same voluntarily and without duress or undue influence. This disclaimer applies to all real and personal property I would have received.

This disclaimer should be signed, notarized, and filed with the probate court and/or the executor of the last will and testament in a timely manner. The IRS time frame is within nine months of the death of the decedent?or if the disclaiming beneficiary is a minor, after they reach age 21.