A debt collector may not use any false, deceptive, or misleading representation or means in connection with the collection of a debt. This includes falsely representing or implying that someone is an attorney or that any communication is from an attorney.

Guam Notice to Debt Collector - Misrepresenting Someone as an Attorney

Description

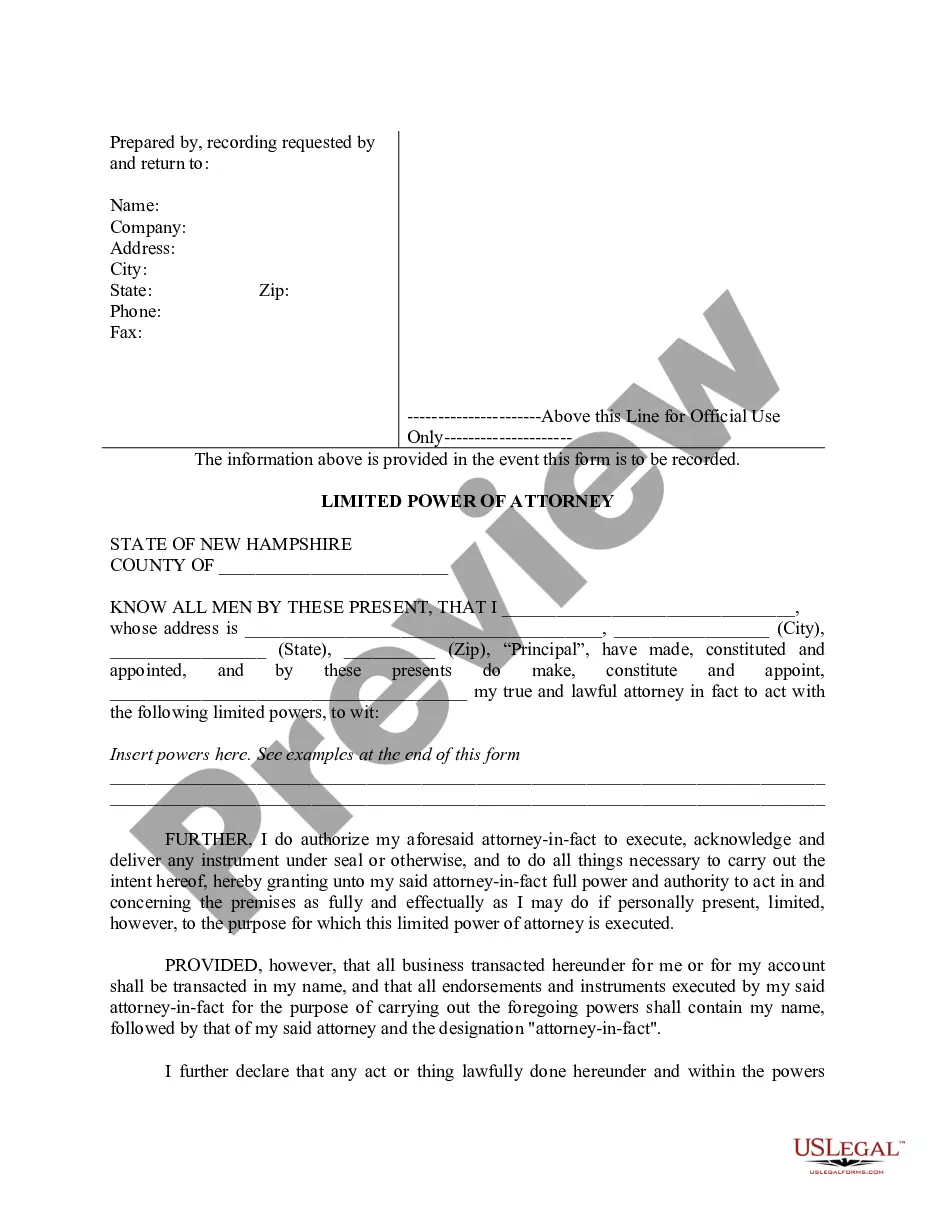

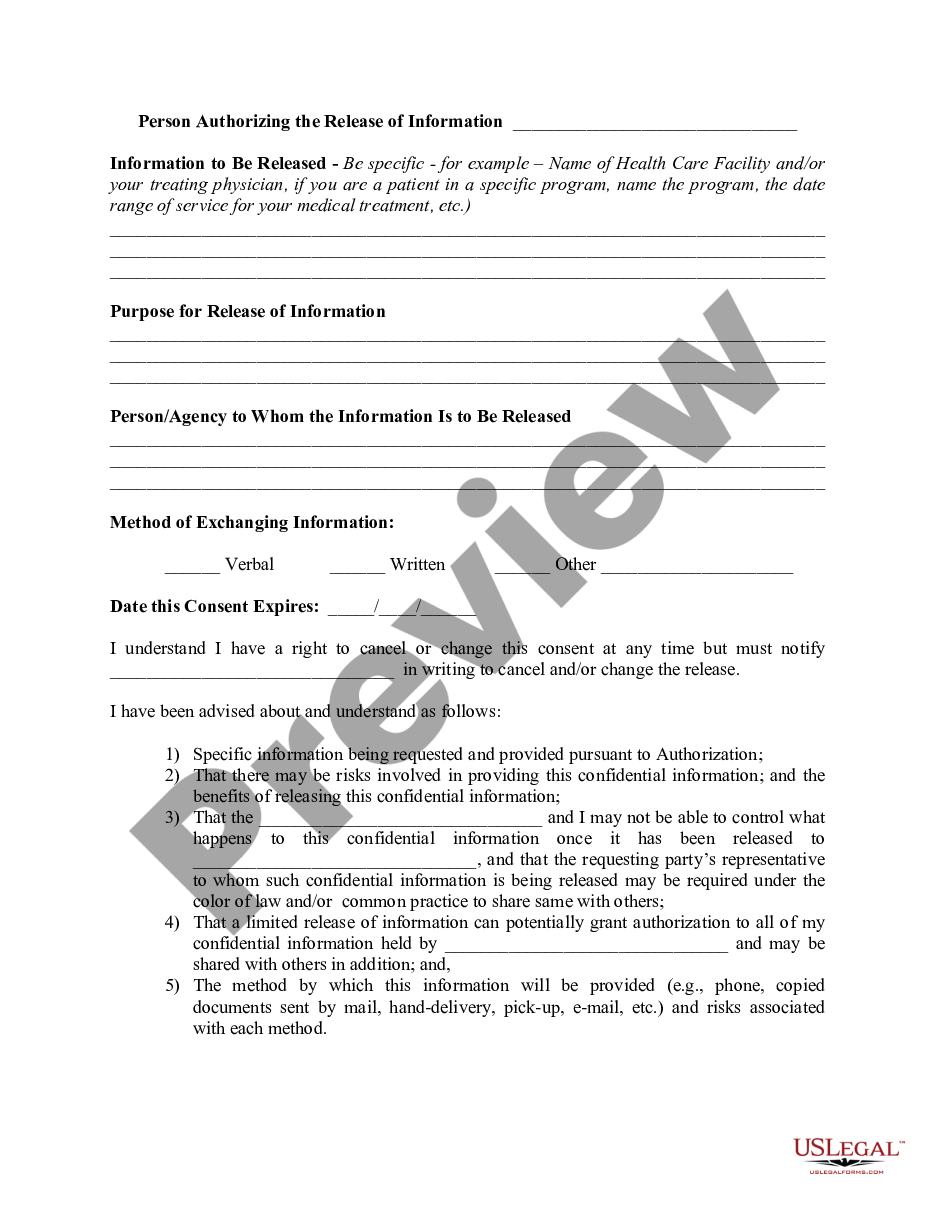

How to fill out Notice To Debt Collector - Misrepresenting Someone As An Attorney?

Are you within a situation the place you will need papers for possibly organization or individual functions almost every working day? There are tons of authorized document templates accessible on the Internet, but finding types you can rely is not simple. US Legal Forms delivers thousands of develop templates, just like the Guam Notice to Debt Collector - Misrepresenting Someone as an Attorney, that happen to be written to meet federal and state specifications.

Should you be presently acquainted with US Legal Forms website and get a merchant account, merely log in. Following that, you are able to obtain the Guam Notice to Debt Collector - Misrepresenting Someone as an Attorney format.

Should you not come with an account and need to start using US Legal Forms, follow these steps:

- Find the develop you require and ensure it is for that proper town/county.

- Use the Preview switch to review the shape.

- See the explanation to actually have selected the right develop.

- If the develop is not what you`re looking for, take advantage of the Look for area to find the develop that meets your requirements and specifications.

- When you obtain the proper develop, click Buy now.

- Select the prices prepare you want, fill in the desired details to create your money, and buy the transaction making use of your PayPal or bank card.

- Select a hassle-free file structure and obtain your duplicate.

Discover every one of the document templates you possess purchased in the My Forms menus. You can get a further duplicate of Guam Notice to Debt Collector - Misrepresenting Someone as an Attorney any time, if needed. Just go through the needed develop to obtain or print out the document format.

Use US Legal Forms, probably the most considerable variety of authorized kinds, to save some time and prevent errors. The assistance delivers skillfully manufactured authorized document templates which can be used for an array of functions. Generate a merchant account on US Legal Forms and begin creating your way of life a little easier.

Form popularity

FAQ

Debt collectors are legally required to send you a debt validation letter, which outlines what the debt is, how much you owe and to who, as well as when you need to pay the debt. If you're still uncertain about the debt you're being asked to pay, you can request a debt verification letter to get more information.

Evidence you should send Send a letter to the bailiffs, you can find their address on the notice of enforcement. Say you don't owe the debt and include evidence that shows you're not the person named on the notice of enforcement. You could send any of these things: a benefit letter from the last 3 months.

You may also report your complaint to the FTC. The FTC enforces the federal Fair Debt Collection Practices Act, which prohibits abusive, unfair, or deceptive debt collection practices. You may also report your complaint to the CFPB, which may forward it to the company and work to get you a response.

What is the proper way to dispute collections? To dispute collections, send a letter to the debt collector within 30 days requesting proof of the debt and asking not to report it to the credit agency until the dispute is resolved. Keep a copy of the letter and any correspondence. Seek legal help if needed.

Dispute in writing, and include any evidence that supports your claims (such as copies of cancelled checks showing you paid the debt or a police report in the case of identity theft). If the debt collector knows that you don't owe the money, it should not try to collect the debt.

You should dispute a debt if you believe you don't owe it or the information and amount is incorrect. While you can submit your dispute at any time, sending it in writing within 30 days of receiving a validation notice, which can be your initial communication with the debt collector.

In most cases, the original creditor will offer better repayment options than a debt collector will. However, if your debt has been sold to a debt buyer and the original creditor no longer owns it, you'll need to pay the collection agency to clear up the debt.

If you dispute the debt, make a copy of your written dispute and send the original to the debt collector. It's also generally a good idea to send the dispute by certified mail. If you pay for a "return receipt," you'll have proof the debt collector received your mail.