Guam Proposed Amendment to create a class of Common Stock that has 1-20th vote per share

Description

How to fill out Proposed Amendment To Create A Class Of Common Stock That Has 1-20th Vote Per Share?

If you want to complete, acquire, or printing legitimate document web templates, use US Legal Forms, the greatest variety of legitimate kinds, which can be found on-line. Make use of the site`s easy and practical lookup to obtain the documents you want. Numerous web templates for company and person functions are sorted by groups and claims, or keywords. Use US Legal Forms to obtain the Guam Proposed Amendment to create a class of Common Stock that has 1-20th vote per share in a couple of click throughs.

In case you are already a US Legal Forms customer, log in to the profile and click the Acquire option to find the Guam Proposed Amendment to create a class of Common Stock that has 1-20th vote per share. You may also gain access to kinds you earlier delivered electronically from the My Forms tab of your profile.

Should you use US Legal Forms the very first time, follow the instructions under:

- Step 1. Be sure you have chosen the shape for the proper area/region.

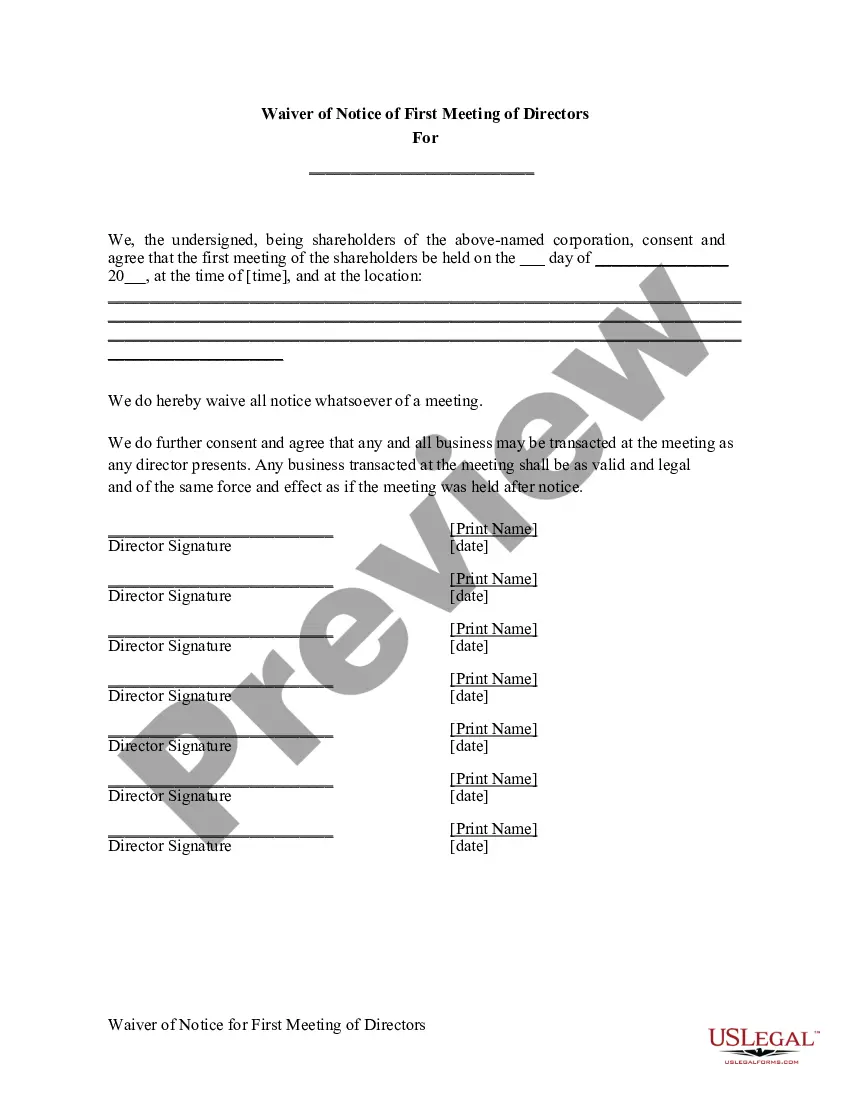

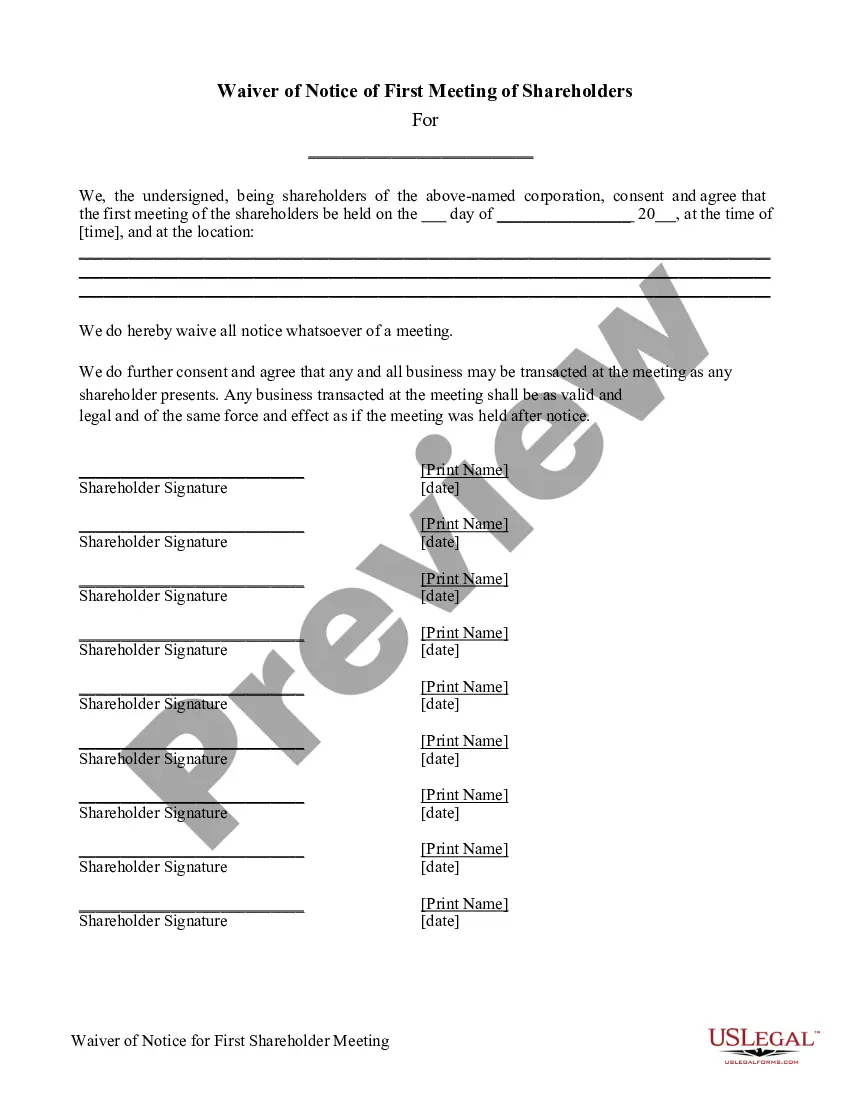

- Step 2. Utilize the Review method to look through the form`s information. Never forget about to read through the explanation.

- Step 3. In case you are unsatisfied using the kind, make use of the Research field towards the top of the monitor to get other versions from the legitimate kind format.

- Step 4. Once you have identified the shape you want, click on the Purchase now option. Select the prices strategy you choose and include your accreditations to sign up to have an profile.

- Step 5. Approach the financial transaction. You can utilize your credit card or PayPal profile to accomplish the financial transaction.

- Step 6. Pick the structure from the legitimate kind and acquire it on your own gadget.

- Step 7. Full, modify and printing or signal the Guam Proposed Amendment to create a class of Common Stock that has 1-20th vote per share.

Every single legitimate document format you acquire is your own for a long time. You possess acces to each and every kind you delivered electronically in your acccount. Click on the My Forms section and choose a kind to printing or acquire once more.

Remain competitive and acquire, and printing the Guam Proposed Amendment to create a class of Common Stock that has 1-20th vote per share with US Legal Forms. There are thousands of professional and express-certain kinds you may use to your company or person requires.

Form popularity

FAQ

Form 20-F amendments: New Item 16J to require disclosure about whether insider trading policies and procedures governing the purchase, sale, and other disposition of the issuer's securities, which are designed to promote compliance with applicable insider laws, rules, regulations, and standards have been adopted.

SEC Form 20-F is a form issued by the Securities and Exchange Commission (SEC) that must be submitted by all "foreign private issuers" with listed equity shares on exchanges in the U.S. Form 20-F calls for the submission of an annual report within four months of the end of a company's fiscal year or if the fiscal year- ...

SEC Form F-1 is the registration required for foreign companies that want to be listed on a U.S. stock exchange. Any amendments or changes that have to be made by the issuer are filed under SEC Form F-1/A. After the foreign issuer's securities are issued, the company is required to file Form 20-F annually.

A of Form 20-F requires disclosure of the underlying reasons for period-to-period material changes in a line item of a company's financial statements in quantitative and qualitative terms, including where material changes within a line item offset one another.

A of Form 20-F requires disclosure of the underlying reasons for period-to-period material changes in a line item of a company's financial statements in quantitative and qualitative terms, including where material changes within a line item offset one another.

SEC Form 20-F is an annual report filing for non-U.S. and non-Canadian companies that have securities trading in the U.S. SEC Form 20-F helps standardize the reporting requirements of foreign-based companies. The company must also make the report available to shareholders through the company's website.

What Is a 20-F Filing? The 20-F filing is a report foreign private share companies submit to the SEC. This form, akin to the 10-K annual report for domestic U.S. companies, is designed for foreign entities with securities registered with the SEC or listed on U.S. exchanges.