Guam Security ownership of directors, nominees and officers showing sole and shared ownership

Description

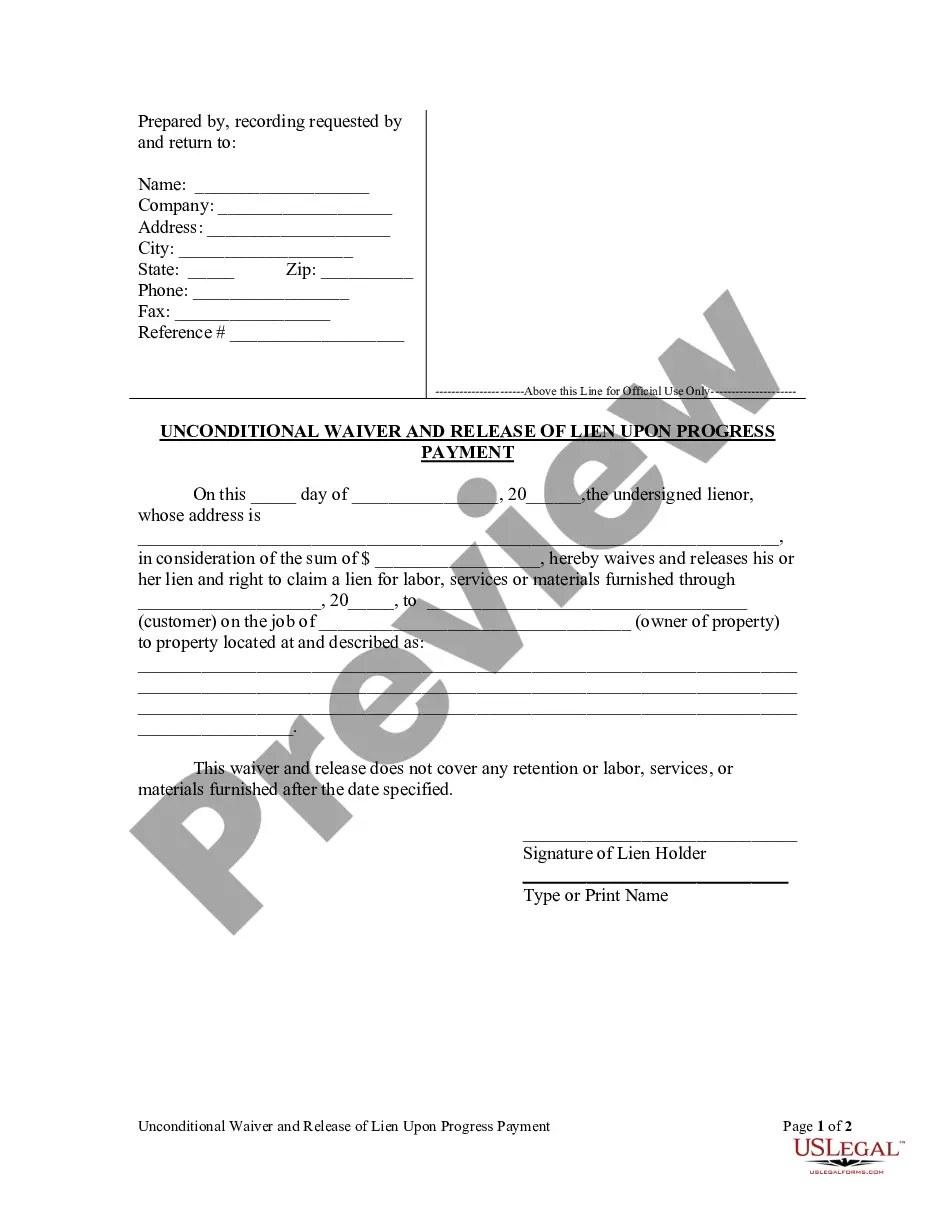

How to fill out Security Ownership Of Directors, Nominees And Officers Showing Sole And Shared Ownership?

You are able to invest time on the Internet attempting to find the legitimate document template which fits the federal and state demands you will need. US Legal Forms provides 1000s of legitimate forms which can be analyzed by experts. It is simple to acquire or print out the Guam Security ownership of directors, nominees and officers showing sole and shared ownership from my assistance.

If you already possess a US Legal Forms accounts, it is possible to log in and click the Down load switch. Next, it is possible to comprehensive, modify, print out, or signal the Guam Security ownership of directors, nominees and officers showing sole and shared ownership. Every legitimate document template you purchase is yours forever. To obtain one more duplicate associated with a obtained develop, visit the My Forms tab and click the corresponding switch.

Should you use the US Legal Forms web site the first time, adhere to the straightforward instructions under:

- Very first, make certain you have selected the proper document template for that state/area that you pick. Read the develop description to ensure you have chosen the proper develop. If accessible, take advantage of the Review switch to check with the document template also.

- If you want to find one more edition in the develop, take advantage of the Research industry to get the template that fits your needs and demands.

- Once you have located the template you want, click Get now to move forward.

- Select the rates program you want, enter your credentials, and register for a free account on US Legal Forms.

- Full the transaction. You can use your Visa or Mastercard or PayPal accounts to cover the legitimate develop.

- Select the formatting in the document and acquire it in your gadget.

- Make adjustments in your document if necessary. You are able to comprehensive, modify and signal and print out Guam Security ownership of directors, nominees and officers showing sole and shared ownership.

Down load and print out 1000s of document templates utilizing the US Legal Forms website, which offers the greatest variety of legitimate forms. Use professional and status-certain templates to take on your small business or individual requires.

Form popularity

FAQ

In order to prevent them from doing business with criminal parties, financial service providers, all companies operating internationally, are obliged to draw up a UBO declaration establishing the identity of a UBO or the Ultimate beneficiary, depending on the country they are doing business in.

In the case of a company, a minimum threshold of over 25% interest has been established, while for a partnership firm or trust, the minimum ownership interest required for someone to be deemed a beneficial owner is 15%.

Rights to acquire beneficial ownership: Under Rule 13d-3(d)(1), a person is deemed a beneficial owner of an equity security if the person (1) has a right to acquire beneficial ownership of the equity security within 60 days or (2) acquires the right to acquire beneficial ownership of the equity security with the ...

Section 16(a) of 1934 Act defines any person who is an executive officer, a director, or a 10- percent shareholder of an equity security of a ?reporting company? as a statutory insider for Section 16 purposes. Only applies to officers who have discretionary policy-making authority.

A beneficial owner of a company is any individual who, directly or indirectly, exercises substantial control over a reporting company, or who owns or controls at least 25 percent of the ownership interests of a reporting company.

Beneficial Ownership Percentage is calculated by dividing the number of Ordinary Shares and Share Equivalents of which a person is a Beneficial Owner as of a specific date by the total number of Ordinary Shares outstanding at that moment.

In the context of legal arrangements such as trust, beneficial owner refers to natural person(s), at the end of the chain, who ultimately owns or controls the legal arrangement, including those persons who exercise ultimate effective control over the legal arrangement.

Under financial regulations, a beneficial owner is considered anyone with a stake of 25% or more in a legal entity or corporation. Beneficial owners can also be considered anyone with a significant role in the management or direction of those entities, or any trusts that own 25% or more of an entity.