Guam General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion

Description

How to fill out General Form Of Trust Agreement For Minor Qualifying For Annual Gift Tax Exclusion?

Are you presently in a circumstance where you require documents for both commercial or personal purposes almost every day.

There are many legal document templates accessible online, but locating the ones you can trust is not easy.

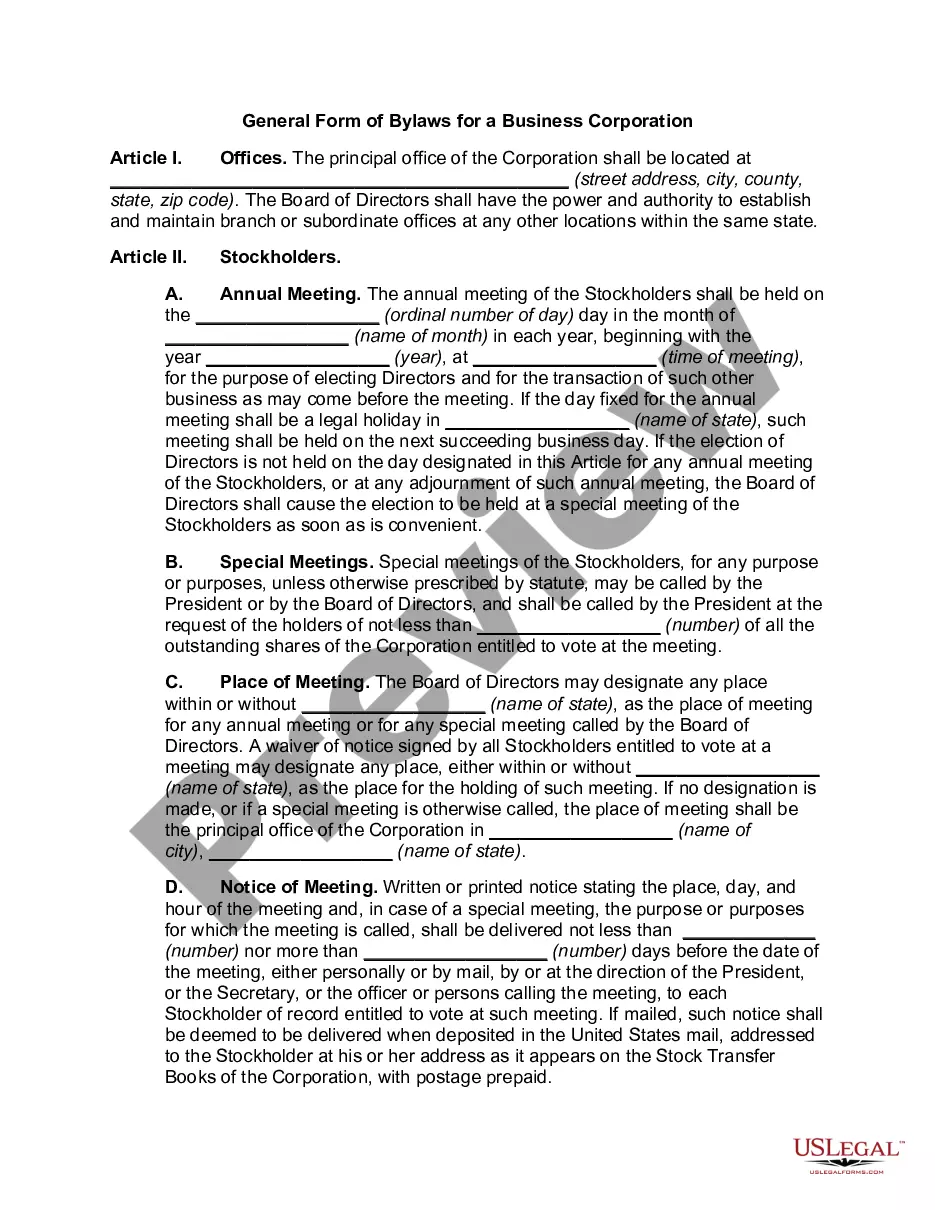

US Legal Forms offers a vast array of form templates, including the Guam General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion, which is designed to comply with state and federal regulations.

Once you find the appropriate form, simply click Get now.

Select the pricing plan you want, complete the necessary information to create your account, and pay for the order using your PayPal or credit card. Choose a convenient file format and download your copy. You can find all the form templates you have purchased in the My documents section. You may obtain an additional copy of the Guam General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion at any time if needed. Just select the desired form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally crafted legal document templates that can be utilized for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- After that, you can download the Guam General Form of Trust Agreement for Minor Qualifying for Annual Gift Tax Exclusion template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/county.

- Utilize the Preview button to review the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and requirements.

Form popularity

FAQ

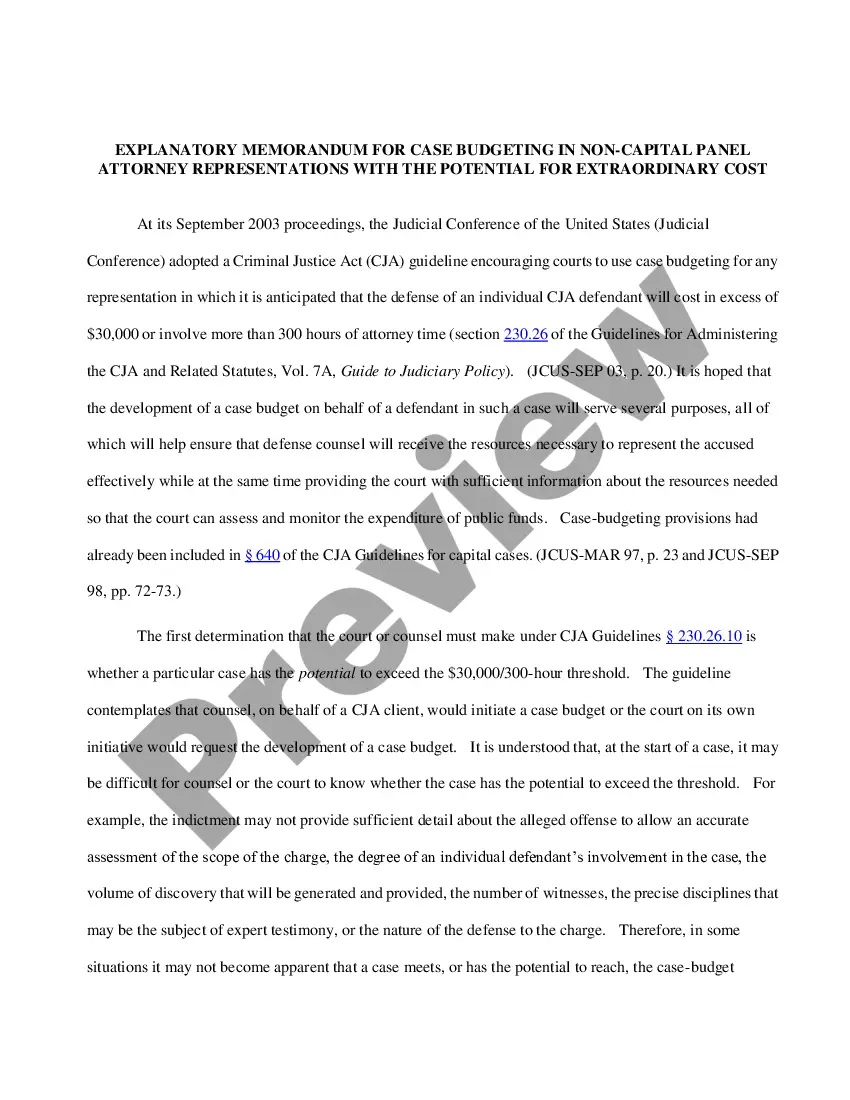

A gift in trust is a way to avoid taxes on gifts that exceed the annual gift tax exclusion amount. One type of gift in trust is a Crummey trust, which allows gifts to be given for a specific period, establishing the gifts as a present interest and eligible for the gift tax exclusion.

The Annual Gift Exclusion Amount Can Be Saved Every Year in a Crummey Trust. You can use your annual exclusion amount, and provide guidance and instruction on how the funds will be used to benefit members of your family. An annual exclusion trust, also known as a crummey trust, is one way to do this.

The IRS does not levy gift taxes on trusts, nor does it consider payments from the trust to a beneficiary as a gift (it may be taxable income to the beneficiary, however).

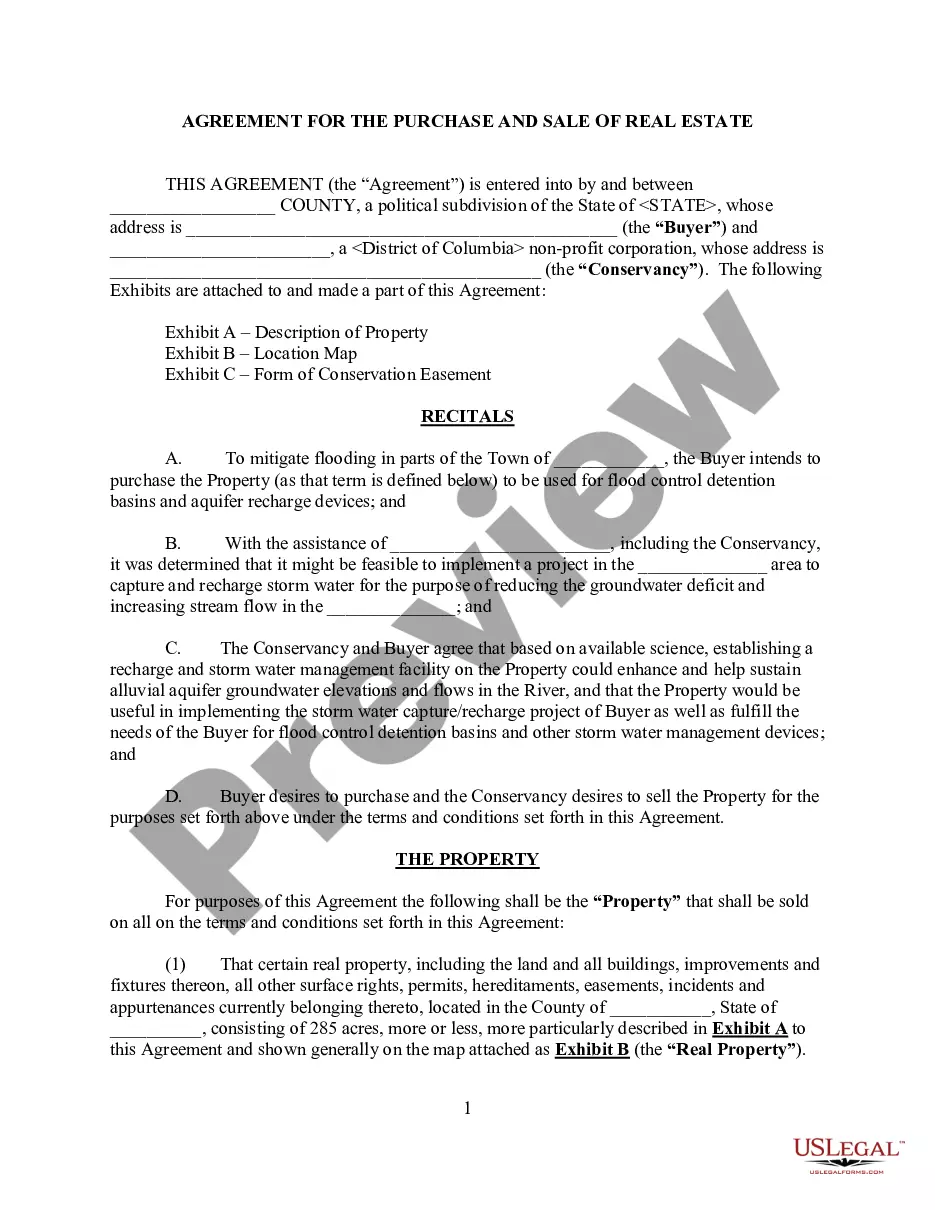

The key difference between a 2503(c) trust and a 2503(b) trust is the distribution requirement. Parents who are concerned about providing a child or other beneficiary with access to trust funds at age 21 might be better off with a 2503(b), since there is no requirement for access at age 21.

The trust allows the trustee to gift from the trust to the current beneficiary's issue up to the annual gift exclusion (currently $15K).

Gifts in trust do not qualify for the annual exclusion unless the trust either qualifies as a Minor's Trust under Internal Revenue Code Section 2503(c) or has certain temporary withdrawal powers called Crummey powers.

The federal gift tax law provides that every person can give a present interest gift of up to $14,000 each year to any individual they want.

Gifts in trust are commonly used to pass wealth from one generation to another by establishing a trust fund. Typically, the IRS taxes the value of a gift being transferred up to the annual gift tax exclusion amount. A gift in trust is a way to avoid taxes on gifts that exceed the annual gift tax exclusion amount.