Guam Release of Security Interest - Termination Statement

Description

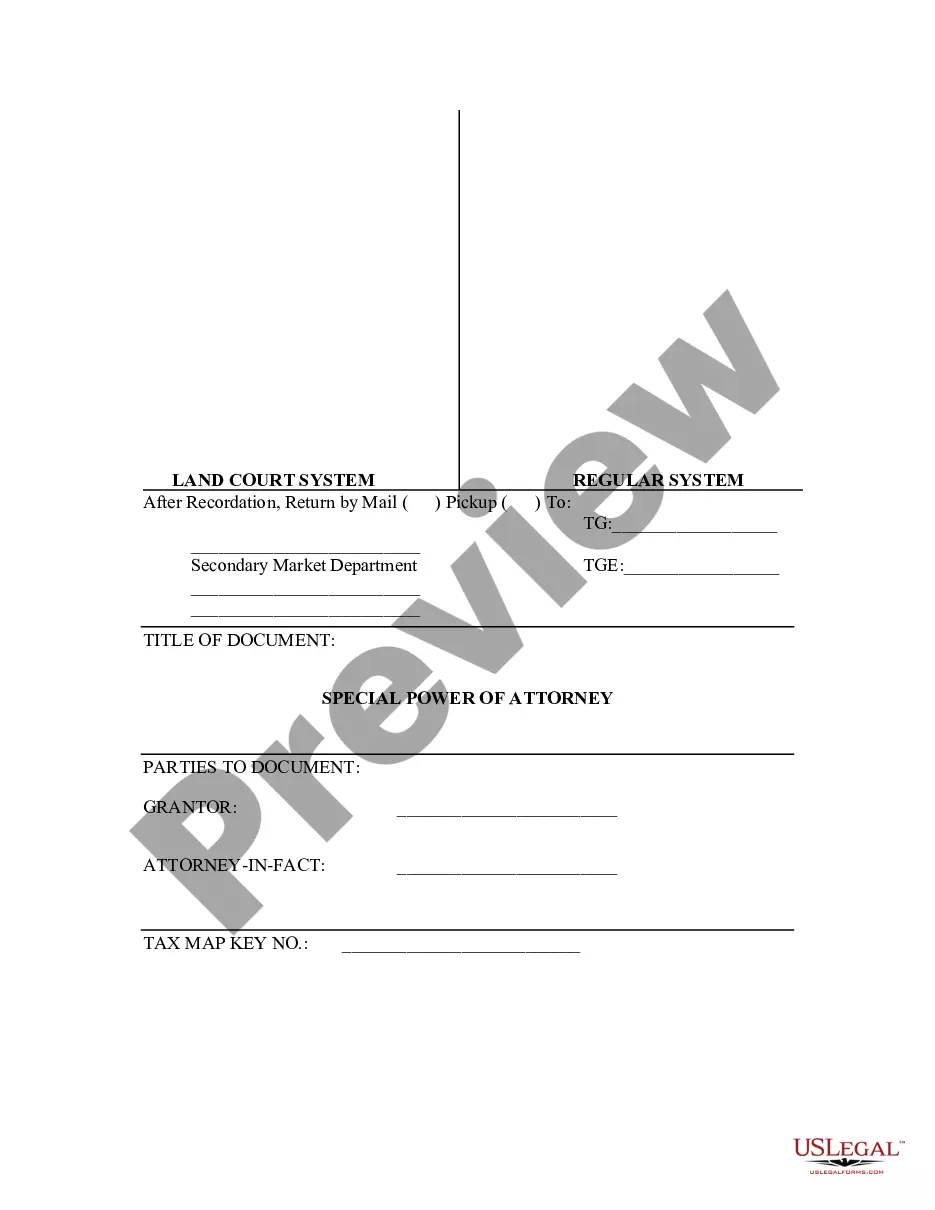

How to fill out Release Of Security Interest - Termination Statement?

If you wish to full, acquire, or printing legal document templates, use US Legal Forms, the greatest collection of legal varieties, which can be found on-line. Make use of the site`s simple and practical lookup to get the paperwork you require. Various templates for business and individual functions are sorted by categories and states, or keywords. Use US Legal Forms to get the Guam Release of Security Interest - Termination Statement with a couple of mouse clicks.

Should you be presently a US Legal Forms customer, log in to the profile and then click the Obtain key to get the Guam Release of Security Interest - Termination Statement. You may also access varieties you in the past downloaded within the My Forms tab of your profile.

If you use US Legal Forms for the first time, follow the instructions beneath:

- Step 1. Ensure you have chosen the form to the appropriate metropolis/nation.

- Step 2. Use the Review method to examine the form`s content material. Never forget about to learn the outline.

- Step 3. Should you be not happy together with the form, utilize the Search discipline at the top of the display screen to locate other variations in the legal form design.

- Step 4. After you have found the form you require, click the Get now key. Opt for the rates prepare you choose and add your qualifications to sign up for the profile.

- Step 5. Approach the financial transaction. You can use your Мisa or Ьastercard or PayPal profile to finish the financial transaction.

- Step 6. Pick the structure in the legal form and acquire it on the gadget.

- Step 7. Comprehensive, modify and printing or indication the Guam Release of Security Interest - Termination Statement.

Each and every legal document design you buy is the one you have forever. You might have acces to each and every form you downloaded in your acccount. Click the My Forms portion and pick a form to printing or acquire again.

Contend and acquire, and printing the Guam Release of Security Interest - Termination Statement with US Legal Forms. There are many skilled and express-certain varieties you may use for the business or individual requires.

Form popularity

FAQ

What authorization is required to file a financing statement? A secured party must be authorized to file a financing statement against the assets of the debtor. If the debtor is bound by a security agreement, authorization to file a financing statement is implied.

In order for a security interest to be enforceable against the debtor and third parties, UCC Article 9 sets forth three requirements: Value must be provided in exchange for the collateral; the debtor must have rights in the collateral or the ability to convey rights in the collateral to a secured party; and either the ...

Article 9 regulates the creation of security interests, and the enforcement of those interests, in movable or intangible property and fixtures. It encompasses a wide variety of possessory liens and determines the legal right of ownership if a debtor does not meet their obligations.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

Security interest is an enforceable legal claim or lien on collateral that has been pledged, usually to obtain a loan. The borrower provides the lender with a security interest in certain assets, which gives the lender the right to repossess all or part of the property if the borrower stops making loan payments.

Security interest is an interest in personal property or fixtures that secures payment or performance of an obligation. Secured party is a lender, seller, or other person in whose favor a security interest exists. Debtor is the person who owes payment or performance of the obligation that is secured.

(35) "Security interest" means an interest in personal property or fixtures which secures payment or performance of an obligation. "Security interest" includes any interest of a consignor and a buyer of accounts, chattel paper, a payment intangible, or a promissory note in a transaction that is subject to Article 9.

UCC § 1-201(35) defines a ?Security Interest? as ?an interest in personal property or fixtures that secures payment or performance of an obligation.? In the context of suretyship, the security agreement is usually found in the Indemnity Agreement.