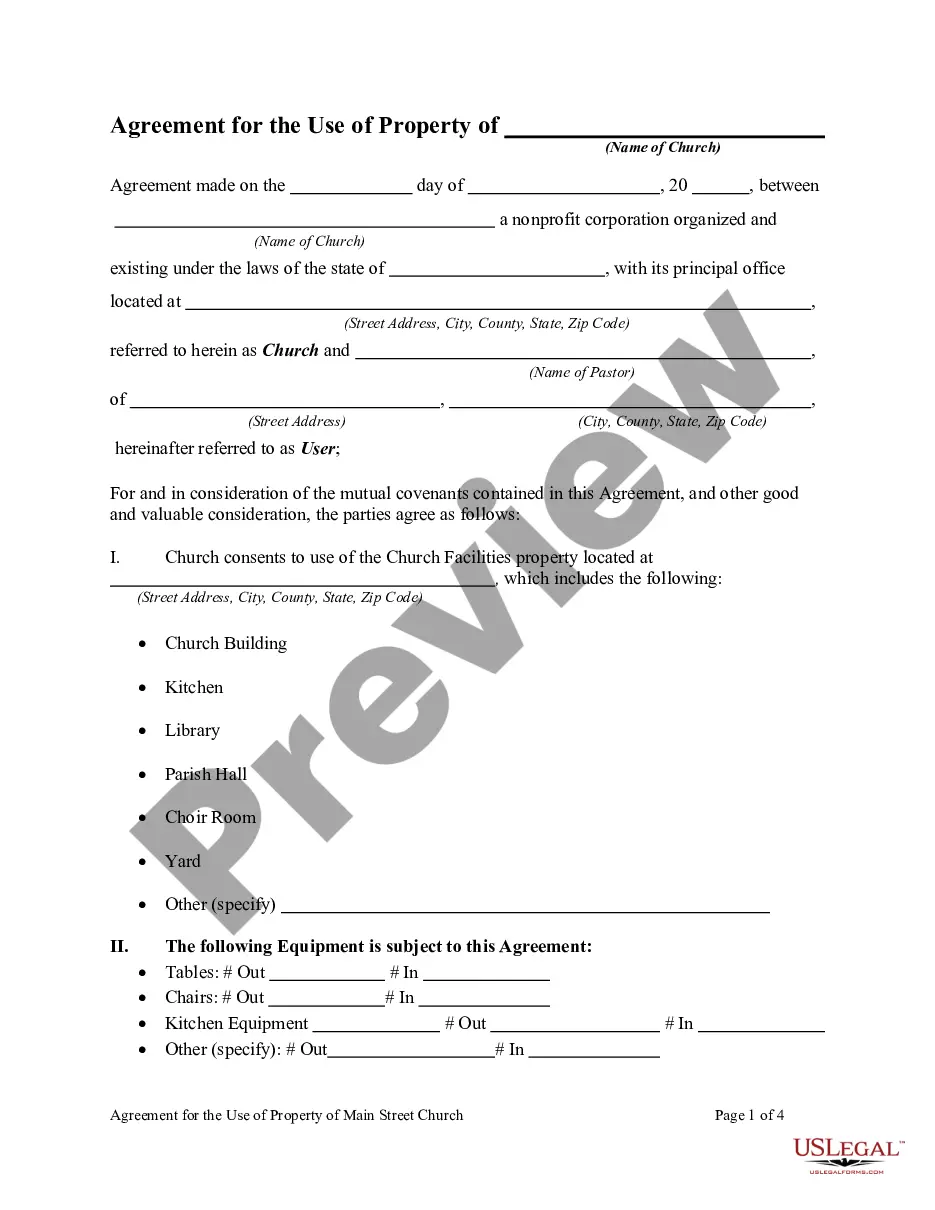

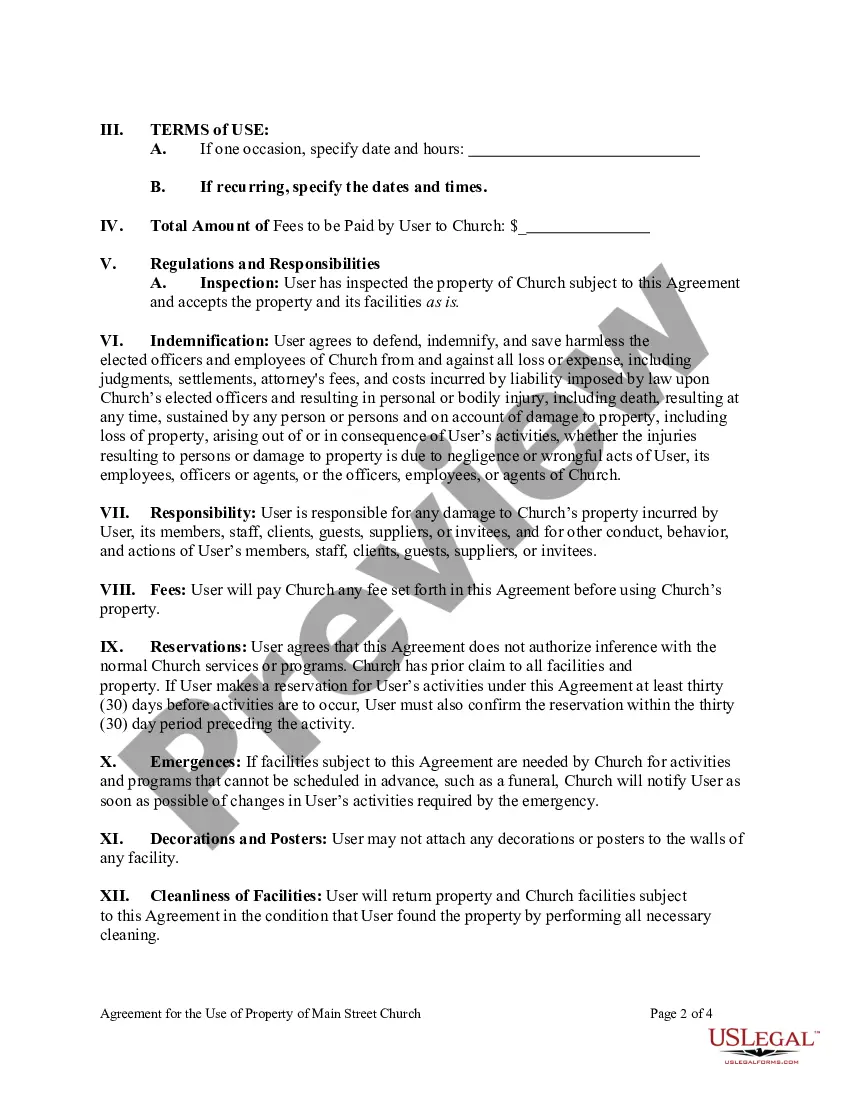

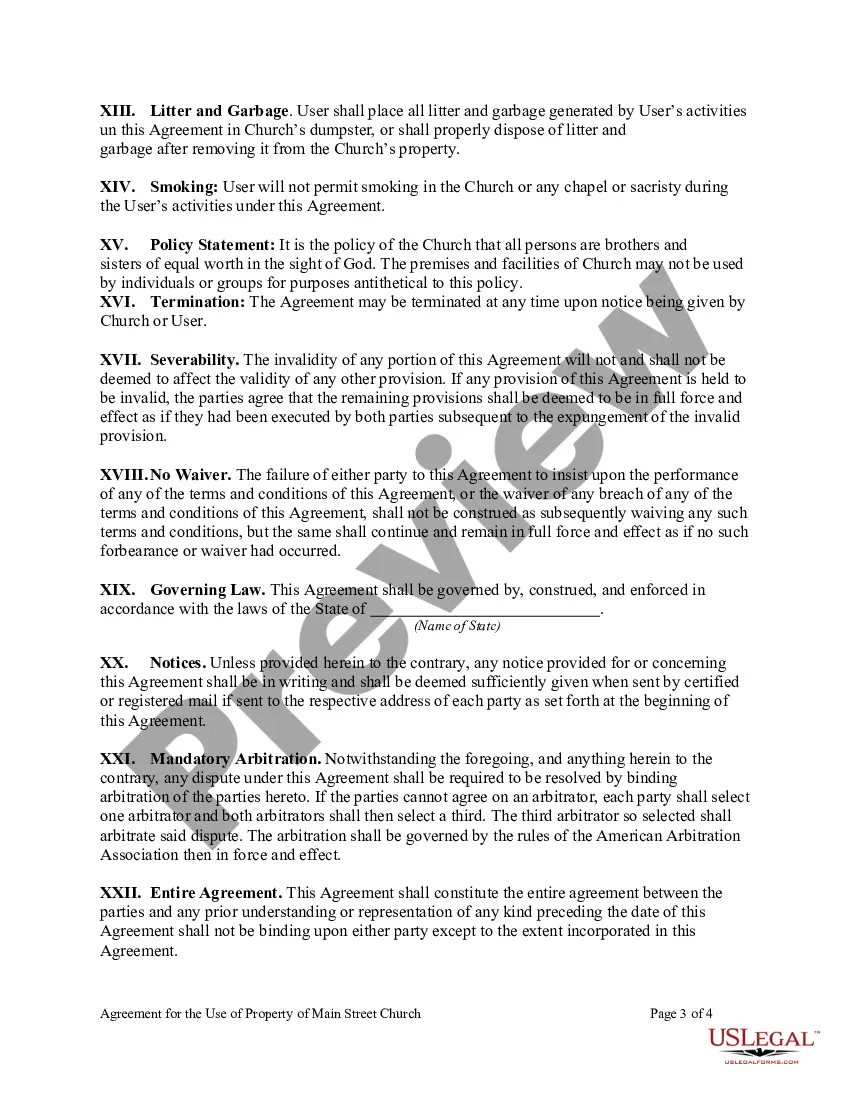

Guam Agreement for the Use of Property of a Named Church

Description

How to fill out Agreement For The Use Of Property Of A Named Church?

You can dedicate countless hours online searching for the legal document template that meets your state and federal requirements.

US Legal Forms offers a vast array of legal forms that have been evaluated by experts.

You can easily download or print the Guam Agreement for the Use of Property of a Named Church from the platform.

If available, use the Review option to browse the document template as well.

- If you already have a US Legal Forms account, you can sign in and select the Acquire option.

- Then, you can complete, modify, print, or sign the Guam Agreement for the Use of Property of a Named Church.

- Every legal document template you purchase is yours to keep indefinitely.

- To obtain an additional copy of any purchased form, visit the My documents section and click the appropriate option.

- If you are using the US Legal Forms website for the first time, follow these simple instructions below.

- First, ensure you have chosen the correct document template for your area/city.

- Review the form description to verify you have selected the correct template.

Form popularity

FAQ

The minimum lot size in Guam varies depending on the zoning designation of the property. Generally, residential zones may start at around 1,200 square feet, while agricultural and commercial areas have different requirements. If a church intends to establish a presence, understanding lot size regulations is vital, particularly when negotiating a Guam Agreement for the Use of Property of a Named Church to ensure all legal aspects are addressed.

M1 5 zoning in Kansas City signifies a specific category of light industrial use tailored to accommodate a range of businesses. This classification allows operations while ensuring compatibility with surrounding land uses, potentially including churches looking to share resources or space. Familiarity with M1 5 zoning can benefit church leaders interested in pursuing a Guam Agreement for the Use of Property of a Named Church, thereby aligning their goals with local land use policies.

M1 zoning in Guam designates areas primarily for light industrial uses. This zoning encourages businesses that have minimal impact on surrounding residential properties, allowing for the establishment of services and facilities that support local economies. If a church seeks to utilize light industrial properties, understanding M1 zoning is essential, especially when creating a Guam Agreement for the Use of Property of a Named Church to ensure compliance with local regulations.

Quiet hours in Guam typically refer to the designated times during which noise disturbances should be minimized to respect the peace and comfort of the community. These hours often take place during the night and early morning, generally from 10 PM to 7 AM. Understanding these quiet hours is important, especially when drafting a Guam Agreement for the Use of Property of a Named Church, as it helps maintain harmony with neighbors and fosters a peaceful environment for church activities.

The business tax rate in Guam varies based on income levels and the type of business activity conducted. Generally, you can expect the rates to range around 4% to 5%. If your organization engages with the Guam Agreement for the Use of Property of a Named Church, being mindful of tax obligations can help maintain financial health. Regularly reviewing tax rates ensures that you remain compliant and informed.

Guam operates under certain US tax laws, but it also maintains its unique tax system. Businesses must understand how these laws interact with local regulations, especially in relation to agreements like the Guam Agreement for the Use of Property of a Named Church. Compliance is key, and awareness of both federal and local laws is essential for any organization. Always stay informed of changes that may affect your tax filings.

Business tax privilege refers to the right of businesses to operate within Guam while paying the associated taxes, including the business privilege tax and GRT. This privilege is essential for ensuring compliance with local laws, especially for organizations governed by the Guam Agreement for the Use of Property of a Named Church. Adhering to these tax obligations safeguards your organization’s position in the community. Always consult with professionals to ensure your business maintains its privilege.

The Gross Receipts Tax (GRT) in Guam typically varies based on the type of business activity. It usually ranges from 4% to 5%, depending on specific services and products sold. If your organization is connected to the Guam Agreement for the Use of Property of a Named Church, understanding GRT implications may impact your financial planning. Regularly check for updates as changes in tax rates could apply.

Yes, you generally need to file a Guam tax return if you generate income in Guam. This requirement can apply to businesses engaged in activities linked to the Guam Agreement for the Use of Property of a Named Church. Filing accurately ensures that you remain compliant with Guam tax laws while maintaining any tax benefits provided by specific agreements. It’s wise to review your situation annually to confirm your filing obligations.

The business privilege tax in Guam is a tax imposed on businesses that generate income within the territory. It’s essential for business owners to understand how this tax relates to the Guam Agreement for the Use of Property of a Named Church. This agreement may help entities navigate tax obligations specific to church property use and ensure compliance with local regulations. Consulting a tax professional can provide clarity on how the tax affects your organization.