Guam Sample Letter for Pending Cancellation of Life Insurance Policy

Description

How to fill out Sample Letter For Pending Cancellation Of Life Insurance Policy?

Are you currently in a scenario that requires documents for either professional or personal use regularly.

There are numerous document templates available online, but finding reliable ones is not straightforward.

US Legal Forms provides an extensive collection of form templates, such as the Guam Sample Letter for Pending Cancellation of Life Insurance Policy, designed to comply with state and federal regulations.

Once you locate the appropriate form, click Get now.

Choose the price plan you prefer, fill in the necessary details to create your account, and complete your purchase using your PayPal or credit card. Select a convenient document format and download your copy. Access all the document templates you’ve purchased from the My documents section. You can obtain another copy of the Guam Sample Letter for Pending Cancellation of Life Insurance Policy at any time if needed. Just select the necessary form to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legal documents, to save time and prevent errors. The service provides expertly crafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start simplifying your life.

- If you are already familiar with the US Legal Forms website and have an account, simply sign in.

- Afterward, you can download the Guam Sample Letter for Pending Cancellation of Life Insurance Policy template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct region/state.

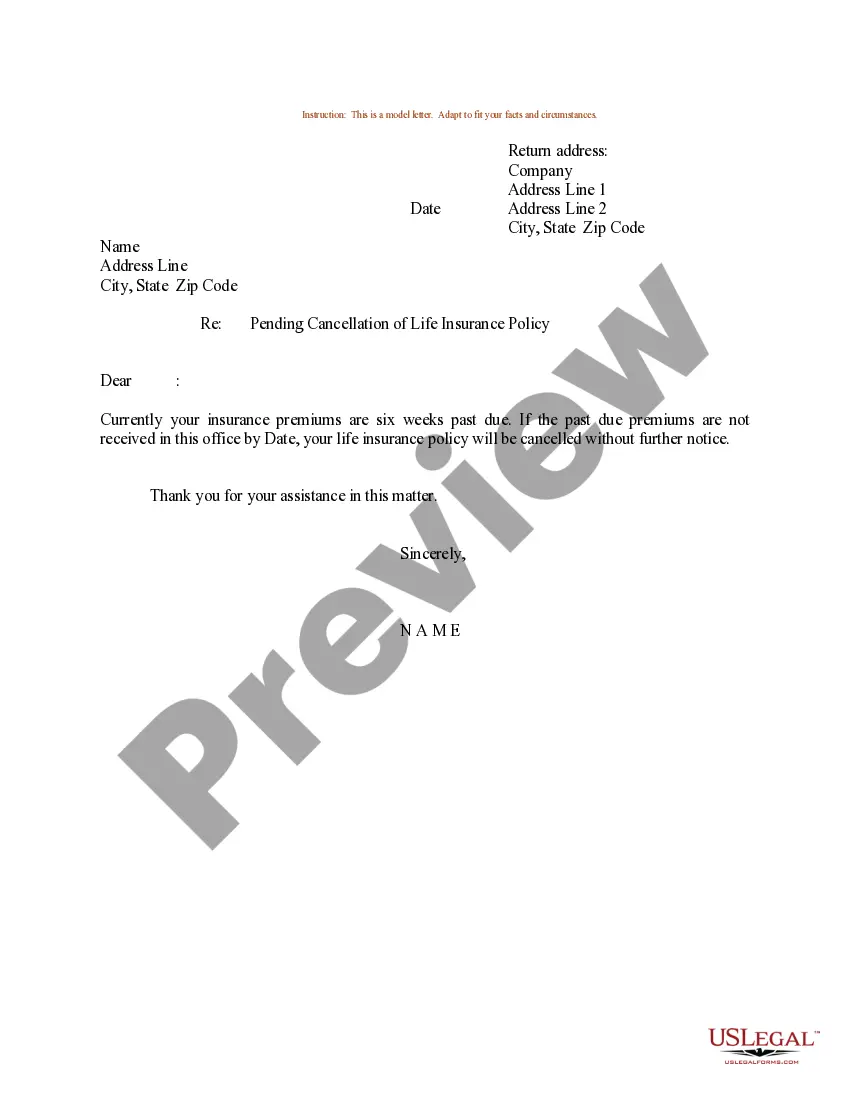

- Use the Preview button to review the document.

- Read the description to confirm that you have selected the correct form.

- If the form is not what you're looking for, use the Search section to find the form that suits your needs.

Form popularity

FAQ

The policy holder can terminate an insurance policy at the end of the term by either: Failing to pay premiums once the designated term for the policy has run. Canceling the policy midterm.

A policyowner must be given at least 10 days after delivery of the policy to cancel the policy. In this case, the policyowner is entitled to a full return of all premiums paid for the policy." "Which of the following statements regarding the insuring clause is NOT correct? A) It is usually signed by the insured.

In most states, an insurance company must give a policyholder written notice of cancellation at least 30 days before canceling the policy.

Canceling your term policy couldn't be easier: just stop paying your premium and write a letter or call your insurer to let them know you are canceling the policy. Check the website of your insurer, too there may be a form there you can fill out to terminate your policy.

A claimant is the person or entity claiming the death benefit under a policy. Each beneficiary must complete a separate Claimant's Statement.

The insurance grace period can vary depending on the insurer and policy type. Depending on the insurance policy, the grace period can be as little as 24 hours or as long as 30 days. The amount of time granted in an insurance grace period is indicated in the insurance policy contract.

A grace period is an insurance policy provision that gives you extra time to pay your premium before your coverage expires.

The notice of claim provision requires that the insurer be notified of a claim within 20 days of the date of loss.

As per the time limits set by the Insurance Regulatory and Development Authority (IRDA) of India, insurers should settle death claim within 30 days. This condition applies to all claims where the insurer does not see the need to investigate the cause of death.

Depending on the type of policy you have, you can either stop paying the premiums, or surrender your policy. Like with auto insurance, you can typically cancel a life insurance policy at any time, and you usually do not have to pay a cancellation fee.