Guam Sample Letter for New Business with Credit Application

Description

How to fill out Sample Letter For New Business With Credit Application?

Have you ever found yourself in a situation where you require documentation for both professional or personal purposes almost every day.

There are many legitimate document templates available online, but finding ones you can trust is challenging.

US Legal Forms offers thousands of form templates, such as the Guam Sample Letter for New Business with Credit Application, which are designed to comply with state and federal requirements.

Once you have the right form, click on Purchase now.

Choose the pricing plan you want, complete the required information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, just Log In.

- Then, you can download the Guam Sample Letter for New Business with Credit Application format.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct state/region.

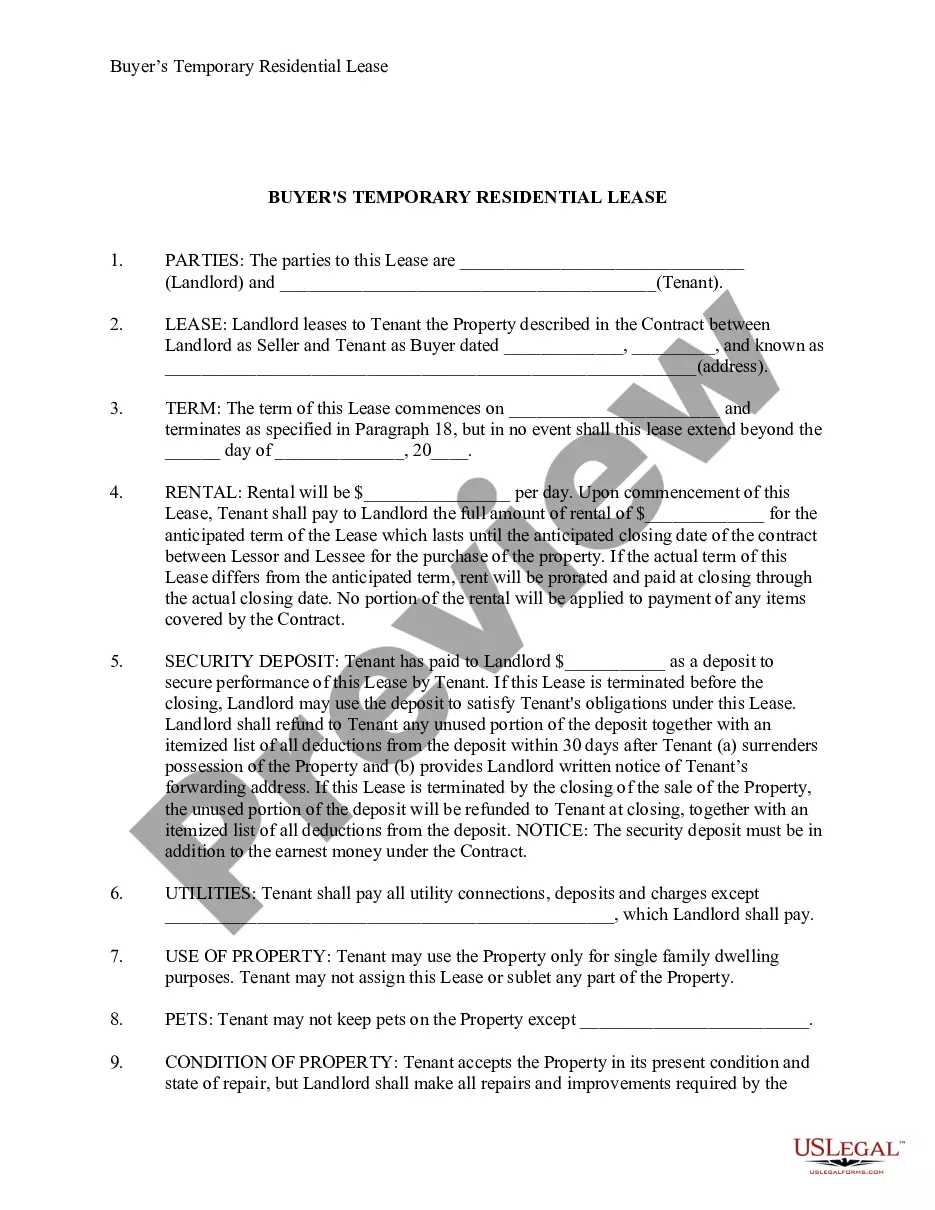

- Use the Preview option to examine the form.

- Check the summary to make sure you have selected the right form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs.

Form popularity

FAQ

A credit application form for business is a document that companies use to request credit from suppliers or lenders. This form includes essential information about the business, including its financial status and credit history. When starting a new business, a Guam Sample Letter for New Business with Credit Application helps you present your request clearly and professionally. It not only streamlines the process but also increases your chances of obtaining credit, which is vital for growth.

Filling out a letter of credit involves entering pertinent information, such as beneficiary details, the amount of credit, and terms of payment. You should also specify the documents required for payment. A Guam Sample Letter for New Business with Credit Application serves as an excellent reference to ensure you include all necessary components effectively.

An example of a letter of credit typically includes the letterhead of a bank, recipient details, and a statement guaranteeing payment under specific conditions. This document is structured to provide clarity on terms, amounts, and expiration dates. Utilizing a Guam Sample Letter for New Business with Credit Application can offer visual clarity to this important business tool.

To write a credit application, start by gathering required information about your business and its financial standing. Be sure to detail your business operations, the purpose of the credit, and any previous credit history. A well-prepared Guam Sample Letter for New Business with Credit Application can simplify this task and enhance your chances of approval.

The credit approval process for a business typically involves submitting an application, providing financial documents, and assessing creditworthiness. After submitting your application, lenders review your business's financial health and history, which may take several days. A Guam Sample Letter for New Business with Credit Application can clarify what information lenders commonly seek.

A letter of credit is a financial document issued by a bank or financial institution to guarantee payment for goods and services. For beginners, it's essential to understand that it ensures sellers receive payment while providing buyers with security. By using a Guam Sample Letter for New Business with Credit Application, beginners can grasp the structure and purpose of this essential document.

Writing a credit application letter involves clearly stating your business name and purpose. Include your financial information and the reason for seeking credit. Ensure to express how your business will benefit from the credit granted. A Guam Sample Letter for New Business with Credit Application offers a solid template to streamline your writing.

To fill a letter of credit application form, begin by entering your business details, including name, address, and contact information. Next, provide financial information such as your business type and income sources. Be sure to attach any required documents to support your application. Utilizing a Guam Sample Letter for New Business with Credit Application can guide you through this process efficiently.

Yes, if you meet specific earning thresholds or have income from Guam sources, you will need to file a Guam tax return. Filing accurately prevents penalties and ensures compliance with local laws. Consider creating a Guam Sample Letter for New Business with Credit Application to effectively organize your documentation and filing process.

If you have sources of income in Guam, you likely need to file a Guam tax return. It’s important to evaluate your earnings to determine your filing requirements. Using a Guam Sample Letter for New Business with Credit Application can provide essential details needed for your tax return submission.