Guam Checklist - Key Employee Life Insurance

Description

Key-person insurance benefits are often used to buy out the insured person's shares or interest in the company. Buy-sell agreements, which require the deceased executive's estate to sell its stock to the remaining shareholders, legally facilitate this process. Proceeds from key-person insurance can also be used to recruit replacement management.

The following form contains some critical questions you should ask your agent or broker when considering this type of insurance.

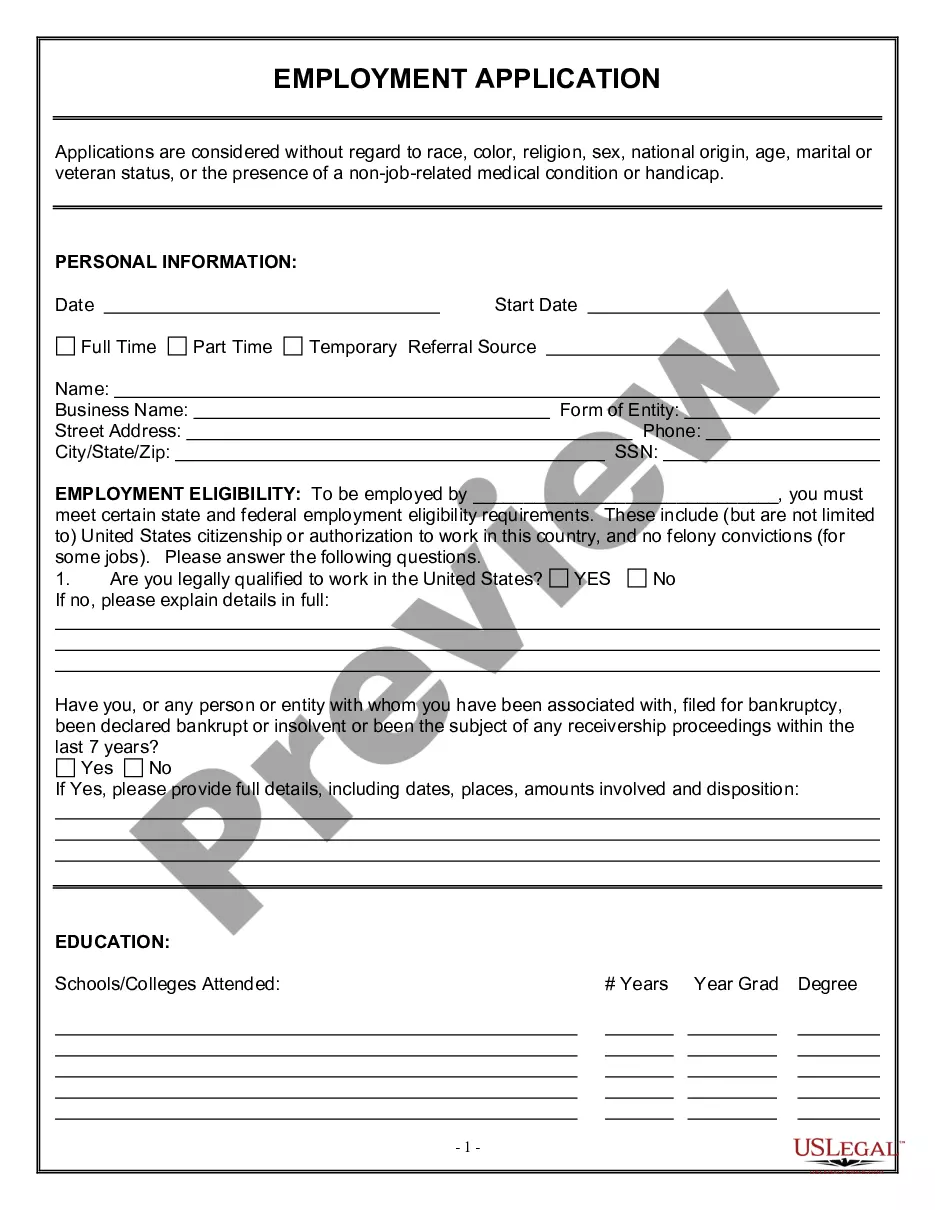

How to fill out Checklist - Key Employee Life Insurance?

Selecting the appropriate authentic document template can be a challenge.

Certainly, there are plenty of designs available online, but how do you locate the authentic form you need.

Utilize the US Legal Forms website. The platform offers thousands of templates, including the Guam Checklist - Key Employee Life Insurance, which is suitable for business and personal purposes.

You can preview the form using the Preview option and read the form description to confirm that this is indeed the right one for you. If the form does not satisfy your requirements, use the Search field to find the correct form. Once you are confident that the form is suitable, click the Acquire now button to obtain the form. Choose the pricing plan you prefer and provide the necessary details. Create your account and pay for the transaction using your PayPal account or Visa or MasterCard. Select the submission format and download the legal document template to your device. Complete, modify, print, and sign the obtained Guam Checklist - Key Employee Life Insurance. US Legal Forms is the largest repository of legal forms where you can find numerous document templates. Use the service to download properly crafted documents that meet state requirements.

- All forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to access the Guam Checklist - Key Employee Life Insurance.

- Use your account to review the legal forms you have purchased earlier.

- Go to the My documents section of your account and obtain an additional copy of the document you require.

- If you are a new user of US Legal Forms, here are easy steps for you to follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

Typically, individuals who significantly impact your business's financial success qualify for key person insurance. This includes owners, executives, and other critical employees whose absence would disrupt operations or revenue. Utilize the Guam Checklist - Key Employee Life Insurance to assess who fits these criteria within your organization.

Term life insurance is frequently the preferred option for key employee identification, as it offers substantial coverage for a specified period. This type of insurance balances affordability with adequate protection, making it a practical choice. Explore the Guam Checklist - Key Employee Life Insurance to ensure you're making informed decisions.

The amount of insurance necessary for a key employee typically depends on their role and contribution to your company. Many businesses consider factors such as salary, operational costs, and potential revenue loss. A Guam Checklist - Key Employee Life Insurance provides guidance on figuring out the appropriate coverage for your key personnel.

Acquiring key man insurance involves a few straightforward steps. First, identify the key employees essential to your business continuity. Next, consult with a licensed insurance agent who specializes in Guam Checklist - Key Employee Life Insurance to understand your options and get tailored quotes.

Yes, key man insurance provides vital financial support for businesses facing the loss of crucial employees. This coverage can protect against revenue disruptions and help maintain stability during transitions. When assessing your organization's health, consider how a Guam Checklist - Key Employee Life Insurance can safeguard your interests.

Key employee life insurance premiums are typically not tax-deductible for businesses. While this coverage plays a crucial role in safeguarding your company's financial stability, tax benefits do not apply directly. It is essential to incorporate this understanding into your Guam Checklist - Key Employee Life Insurance strategy. For additional clarity, refer to resources available on the uslegalforms platform.

Filing for life insurance benefits involves contacting the insurance provider and completing a claims form. You will need to provide pertinent information such as the policy number and death certificate. Each insurance company may have unique requirements, so reviewing the Guam Checklist - Key Employee Life Insurance ensures you complete the process efficiently. Consider utilizing uslegalforms to guide you through filing.

To claim federal employee life insurance, you must fill out the appropriate claim form and submit it to the insurance carrier. Gather all necessary documents, including proof of the employee's death and any relevant identification. For guidance on this process as it relates to the Guam Checklist - Key Employee Life Insurance, you can explore resources available on the uslegalforms platform, which can help simplify your experience.

An example of key person life insurance would be a policy taken out by a tech startup on the founder, who is instrumental to the company’s success. If something were to happen to this key individual, the payout from the life insurance policy could help cover operational costs or assist in finding a suitable replacement. This type of protection is crucial for maintaining stability. As you create your Guam Checklist for Key Employee Life Insurance, think about including scenarios tailored to your business's specific needs.

A key employee life insurance policy specifically covers individuals who are vital to the operations and success of a business. This policy compensates the organization, rather than the employee’s family, providing funds that can be used for recruiting, training, or other operational expenses. By including a key employee life insurance policy in your Guam Checklist, you can better protect your company's interests and ensure continuity, even in difficult times.