Guam Business Deductions Checklist

Description

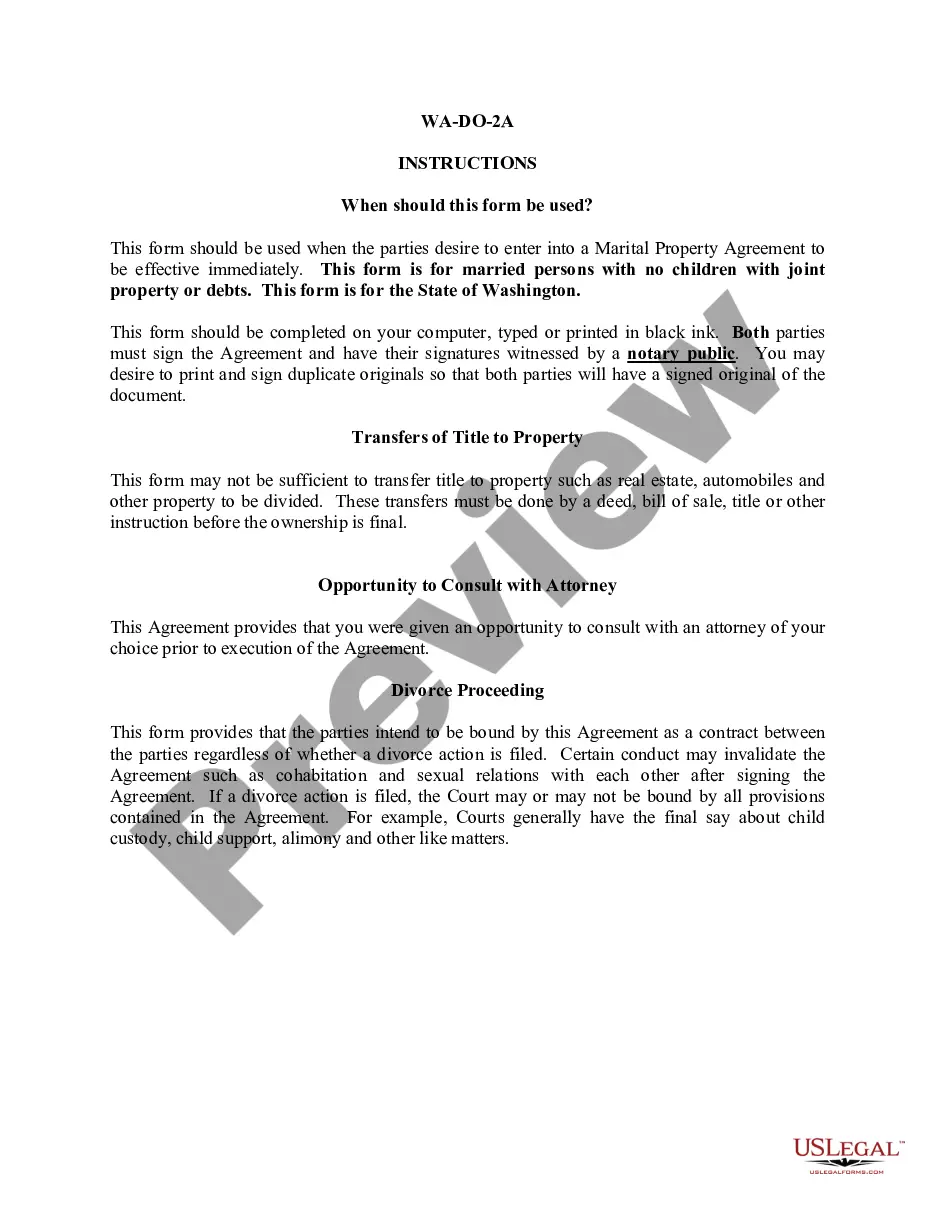

How to fill out Business Deductions Checklist?

Are you located in a location where documentation is occasionally required for an organization or individual that is utilized almost daily.

There are numerous valid document templates available online, but locating reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Guam Business Deductions Checklist, that are designed to comply with state and federal regulations.

Once you find the correct document, simply click Buy now.

Choose a convenient document format and download your copy.

- If you are already acquainted with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Guam Business Deductions Checklist template.

- If you lack an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you require and ensure it is for the correct city/state.

- Utilize the Preview option to review the form.

- Check the description to confirm you have chosen the appropriate document.

- If the document isn’t what you are looking for, use the Lookup field to find the document that meets your needs and criteria.

Form popularity

FAQ

To take business deductions, you must keep thorough records of all eligible expenses that directly relate to your business operations. Utilize a Guam Business Deductions Checklist to guide you through this process, ensuring that you document everything from operational costs to equipment purchases. Consult with a tax professional or use platforms like uslegalforms to simplify the application of these deductions in your tax return. This proactive approach can significantly lower your taxable income.

Yes, Guam is a territory of the United States, and this status affects tax obligations. Residents and businesses in Guam must adhere to federal tax laws, but there are specific rules that apply. When considering your Guam Business Deductions Checklist, it is important to understand how local regulations align with federal guidelines. This ensures you maximize your deductions while remaining compliant.

The business tax rate in Guam is typically 5% on gross receipts for most industries. However, some businesses may face different rates based on specific activities, so it is essential to review your business classification. For detailed guidance, refer to the Guam Business Deductions Checklist, which can help you understand your obligations and potential deductions.

The business privilege tax in Guam is a tax imposed on all businesses operating within the territory. This tax applies to gross receipts and varies based on the nature of the business activities. By utilizing the Guam Business Deductions Checklist, you can get a clearer picture of how this tax affects your operations and what you can do to optimize your tax situation.

Businesses that qualify as pass-through entities, such as sole proprietorships, partnerships, S corporations, or certain LLCs, can benefit from a 20% tax deduction. This deduction aims to reduce the effective tax rate for these businesses. Utilizing the Guam Business Deductions Checklist can help you ensure you meet the criteria for this valuable deduction.

To deduct business expenses, you must ensure they are ordinary and necessary for your trade or profession. Keep comprehensive records, including receipts and invoices, to substantiate your claims. The Guam Business Deductions Checklist can assist you in identifying eligible expenses, helping you remain compliant with local tax laws.

Guam is a US territory, so it has unique tax regulations. For most purposes, it is treated differently from states, but it is not considered a foreign country when it comes to US tax obligations. This distinction is important, especially when using the Guam Business Deductions Checklist to identify applicable deductions and credits that differ from those available in the mainland.

You report business deductions on your tax return. Typically, you'll use Schedule C if you're a sole proprietor, or the appropriate forms if you operate as an LLC or corporation. For a comprehensive overview, refer to the Guam Business Deductions Checklist. This checklist highlights specific deductions allowed in Guam that can maximize your tax benefits.

For U.S. federal tax purposes, Guam is not considered a foreign country; instead, it is treated as a territory. However, Guam follows its own tax regulations that differ from the states. Understanding these differences can be simpler with the help of the Guam Business Deductions Checklist.

Filing a Guam tax return is a requirement if you meet specific conditions, such as earning income in the territory. This applies to individual taxpayers and business entities alike. Referencing the Guam Business Deductions Checklist will help clarify your filing responsibilities.