Guam Affiliate Program Agreement

Description

How to fill out Affiliate Program Agreement?

Are you presently in a situation where you require documents for either business or personal reasons nearly every day.

There are numerous legal document templates accessible online, but finding trustworthy options isn't straightforward.

US Legal Forms provides thousands of form templates, including the Guam Affiliate Program Agreement, designed to meet state and federal requirements.

After you find the appropriate form, click Get now.

Choose the pricing plan you want, fill out the required information to create your account, and complete your purchase using PayPal or Visa or MasterCard.

- If you are familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Guam Affiliate Program Agreement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Identify the form you need and ensure it pertains to the correct city/state.

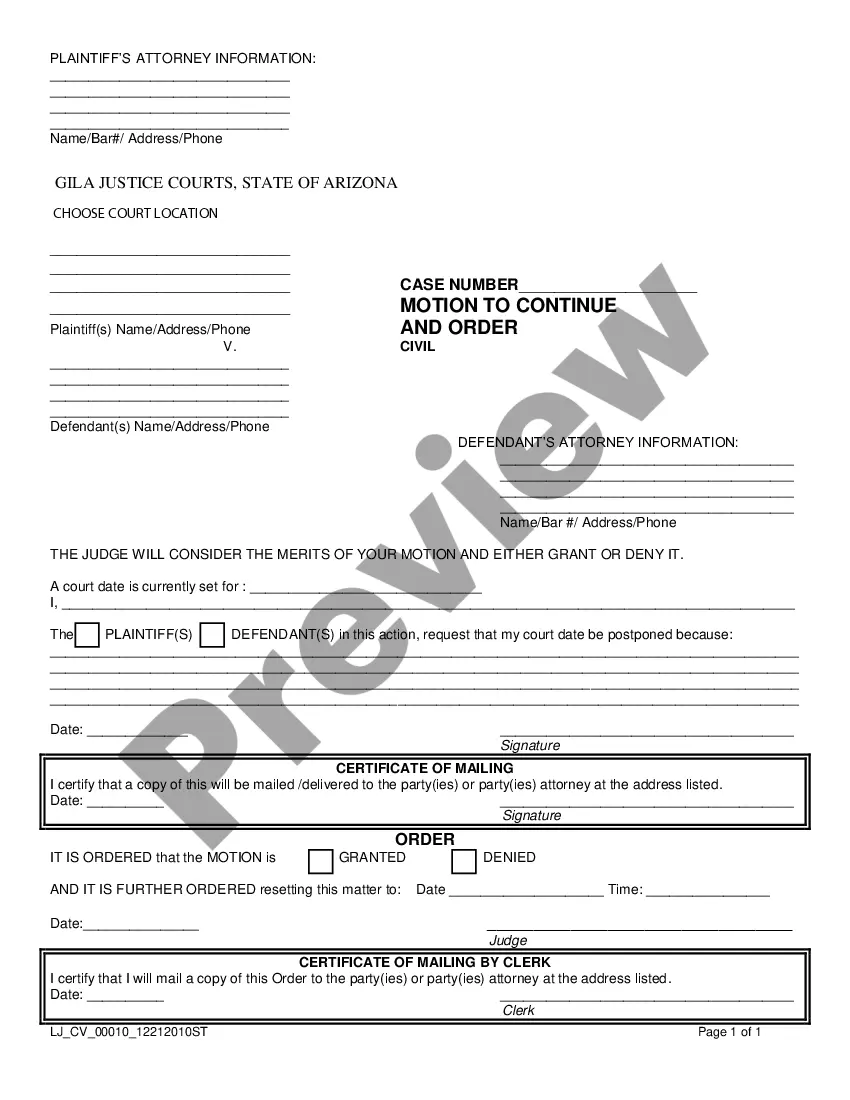

- Use the Review option to inspect the form.

- Examine the information to ensure you have selected the right form.

- If the form isn’t what you need, utilize the Search field to locate the form that meets your needs and requirements.

Form popularity

FAQ

The average commission for affiliate programs varies, but many programs offer around 5% to 30% of the sale value. Specifically, for the Guam Affiliate Program Agreement, commissions can depend on the type of products or services promoted. Generally, higher commission rates tend to attract more affiliates, increasing the program's reach and visibility.

An affiliate agreement is a contract between two parties where one party agrees to promote the other's products or services for a commission. This type of agreement benefits both parties, as it allows businesses to increase their reach while providing affiliates with potential revenue. To better understand the specifics of affiliate agreements, including the Guam Affiliate Program Agreement, explore resources available on the US Legal Forms platform.

Residents of Guam who earn income, including salaries, wages, or self-employment income, are required to file a Guam tax return. Additionally, non-residents earning income from sources within Guam must also file. By reviewing the Guam Affiliate Program Agreement, you can more easily identify your filing requirements and ensure compliance.

Yes, Guam is considered a territory of the United States for tax purposes. However, there are unique tax rules that apply specifically to Guam residents. Referencing documents like the Guam Affiliate Program Agreement can help clarify how these rules affect your tax filing obligations.

Those required to file a tax return include individuals who earn wages, are self-employed, or receive certain types of income. If your income exceeds a specific threshold, you must file a return with the Guam government. Understanding the terms laid out in the Guam Affiliate Program Agreement can help you navigate these responsibilities.

If you are a resident of Guam and receive income, you typically need to file a Guam tax return. You should review the guidelines to determine your specific requirements, which can include various forms and documentation. Familiarizing yourself with the Guam Affiliate Program Agreement can provide clarity on the necessary steps for compliance.

Individuals residing in Guam who earn income are generally obligated to file a tax return. This includes residents, military personnel, and other specific groups. It is important to understand your obligations, as they can be influenced by the Guam Affiliate Program Agreement and other regulations.

Yes, you can file your Guam tax online through various platforms, including the US Legal Forms website. This convenient method allows you to submit your tax returns efficiently, saving you time and effort. Additionally, utilizing online resources, like the Guam Affiliate Program Agreement, keeps you informed about tax requirements and deadlines.

To write an effective affiliate request note, begin by clearly stating your interest in joining the Guam Affiliate Program Agreement. Mention how your audience aligns with their offerings and how you can promote their products effectively. Provide specific examples of your reach, such as website traffic or social media followers, to highlight your potential as a partner. Finally, express your enthusiasm for the partnership and request any additional information they might need to complete the process.

Affiliate marketers' monthly earnings vary widely, ranging from a few dollars to thousands, depending on various factors such as niche, effort, and affiliate programs chosen. Many successful marketers leverage comprehensive agreements like the Guam Affiliate Program Agreement to maximize income potential and solidify partnerships. Your dedication and strategy will ultimately determine your earnings.