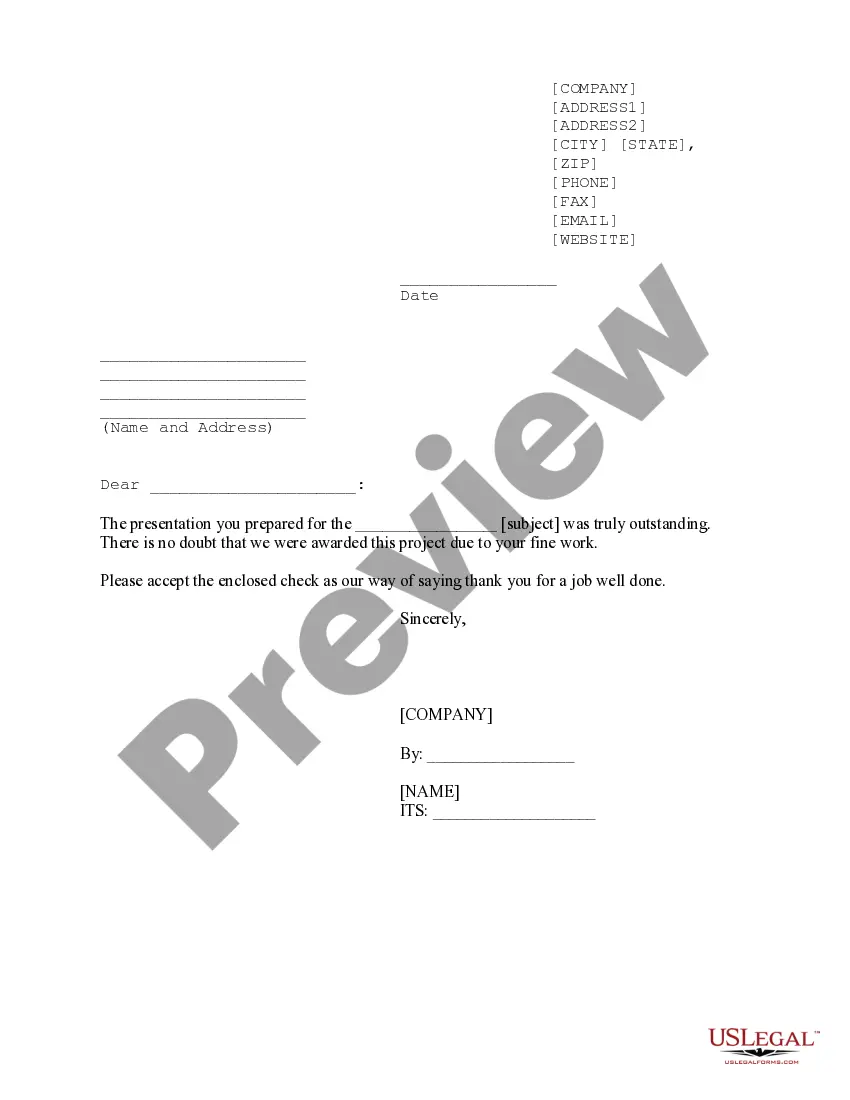

Guam Sample Letter for Corporate Annual Report

Description

How to fill out Sample Letter For Corporate Annual Report?

Choosing the right authorized papers design can be a have a problem. Naturally, there are plenty of web templates available on the Internet, but how would you obtain the authorized kind you require? Take advantage of the US Legal Forms internet site. The services provides a huge number of web templates, such as the Guam Sample Letter for Corporate Annual Report, that you can use for organization and personal requires. Every one of the types are checked out by professionals and fulfill state and federal demands.

In case you are already authorized, log in to your profile and click on the Download option to get the Guam Sample Letter for Corporate Annual Report. Utilize your profile to look through the authorized types you might have ordered previously. Go to the My Forms tab of your respective profile and acquire an additional duplicate of your papers you require.

In case you are a fresh user of US Legal Forms, here are easy recommendations so that you can adhere to:

- First, make certain you have selected the appropriate kind for your city/region. You may examine the form while using Preview option and browse the form explanation to ensure this is basically the best for you.

- If the kind fails to fulfill your expectations, make use of the Seach industry to get the proper kind.

- When you are positive that the form is proper, click on the Purchase now option to get the kind.

- Choose the prices plan you would like and enter the needed details. Make your profile and pay money for the order with your PayPal profile or bank card.

- Pick the data file format and down load the authorized papers design to your product.

- Complete, revise and print out and indication the obtained Guam Sample Letter for Corporate Annual Report.

US Legal Forms will be the biggest library of authorized types for which you can see numerous papers web templates. Take advantage of the company to down load appropriately-produced documents that adhere to state demands.

Form popularity

FAQ

The income tax is the major tax in Guam, providing 60 percent of its locally collected tax revenues. These revenues are supplemented by the transfer from the Federal treasury to the Guam treasury of Federal income taxes withheld from U.S. military and civilian personnel stationed in Guam.

Guam also has a Business Privilege Tax, which is 5% of gross sales.

If your corporation fails to properly file its annual report within sixty days after the due date, there will be a $50 late fee which will be paid in addition to the regular $100 annual report fee (a nonprofit annual report only costs $10 to file), if the report is received by the Director of the Department of Revenue ...

STEPS ON HOW TO START A CORPORATION IN GUAM STEP 1: CHOOSING A NAME. ... STEP 2: DIRECTORS, SHAREHOLDERS, AND OFFICERS. ... STEP 3: FILING YOUR ARTICLES. ... STEP 4: ORGANIZATION AND BYLAWS. ... STEP 5: GET A GUAM GENERAL BUSINESS LICENSE. ... STEP 6: GUAM MANAGING AGENT / GUAM REGISTERED AGENT. ... STEP 7: BUSINESS PRIVILEGE TAX REQUIREMENTS.

Guam Sworn Annual Report Fee: $100 You can file your annual report by mail or in person.

To form an LLC on the island of Guam, you will need to name your LLC, appoint a registered agent, file Articles of Organization with the Department of Revenue and Taxation, and pay a $250 registration fee. We'll walk you through entire process of forming an LLC in Guam and getting it ready to do business.

Guam corporations are subject to income tax on their income from all sources. Other corporations doing business on Guam incur income tax liabilities to Guam on all Guam source income. Corporations not engaged in business on Guam are liable to a 30% tax on certain types of income from Guam sources.