Guam General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures

Description

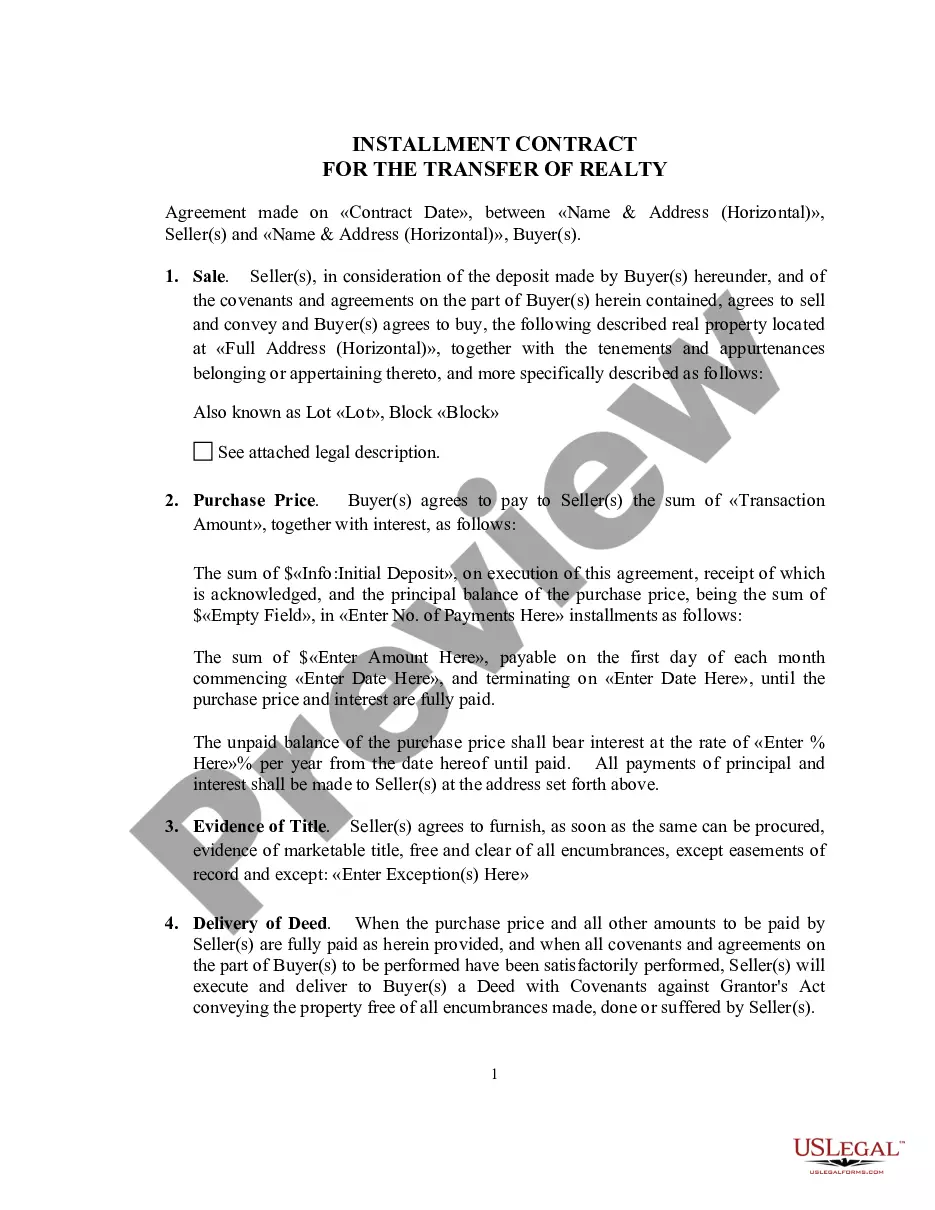

Closed-end transactions involve a fixed amount to be paid back over a period of time such as a note or a retail installment contract.

How to fill out General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures?

Finding the appropriate legal document template can be challenging.

Clearly, there are numerous styles available online, but how can you obtain the legal template you need.

Utilize the US Legal Forms website.

If you are a new user of US Legal Forms, here are simple steps for you to follow: First, ensure you have selected the correct form for your locality. You can check the form using the Review button and read the form description to confirm it is suitable for your needs.

- The service offers a multitude of templates, including the Guam General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, which can be used for both business and personal purposes.

- All of the forms are reviewed by experts and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Download button to acquire the Guam General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

- Use your account to access the legal forms you have previously purchased.

- Go to the My documents section of your account and download another copy of the document you need.

Form popularity

FAQ

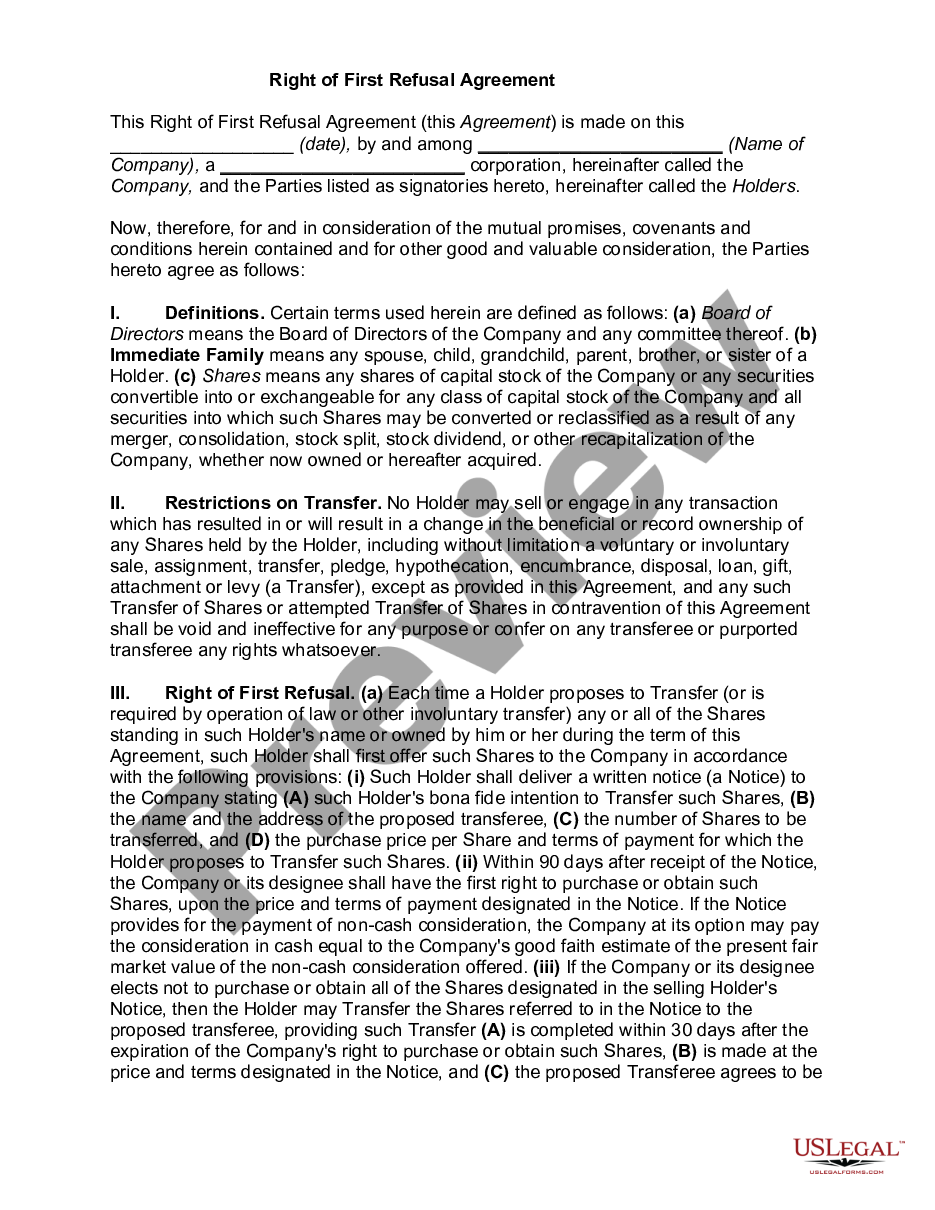

The Truth in Lending Act, or TILA, mandates that retail businesses provide clear and understandable financing information. Specifically, this includes disclosing terms such as the annual percentage rate, the total finance charges, and the amount financed. For compliance, Guam General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures must be applied. By adhering to these rules, businesses can ensure transparency, helping customers make informed decisions about their financing options.

According to Reg Z, all material closed-end credit disclosures must be presented in a clear and conspicuous manner. This means they should be easy to read and understand, usually in a standardized format. By ensuring compliance with the Guam general disclosures required by the Federal Truth in Lending Act, lenders affirm their commitment to transparency, helping consumers to make well-informed financial choices.

Regulation Z is a federal law that outlines how lenders must disclose the terms and conditions of closed-end credit products. This regulation specifically applies to loans where the total amount is fixed, such as auto loans and mortgages. Understanding these rules helps consumers comprehend their obligations and rights under the Guam general disclosures required by the Federal Truth in Lending Act - retail installment contract - closed-end disclosures.

The Truth in Lending Act applies to most types of consumer credit, including loans for automobiles, mortgages, and credit cards. It is designed to protect consumers by ensuring they receive clear and comprehensive information about the terms of credit. With the Guam General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures, you can expect transparency in your borrowing experience.

Regulation Z mandates several consumer disclosures that aim to inform and protect borrowers. These include information on payment schedules, prepayment penalties, and the consequences of missed payments. Understanding these disclosures is essential for borrowers to navigate their financial obligations effectively and is part of the Guam General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

Regulation Z requires specific disclosures for installment loans to ensure consumers understand the terms of their financing. These disclosures include the total amount financed, finance charges, and the annual percentage rate (APR). It's crucial for borrowers to receive this information before they commit to an obligation, as it aligns with the Guam General Disclosures Required By The Federal Truth In Lending Act - Retail Installment Contract - Closed End Disclosures.

Regulation Z also requires mortgage lenders to provide borrowers with a written disclosure of rates, fees and other finance charges. Plus, if you have an adjustable-rate mortgage, they're required to let you know in advance if your rate will be changing.

Created to protect consumers from predatory lending practices, Regulation Z, also known as the Truth in Lending Act, requires that lenders disclose borrowing costs upfront and in clear terminology so consumers can make informed decisions.

The Truth in Lending Act (TILA) protects you against inaccurate and unfair credit billing and credit card practices. It requires lenders to provide you with loan cost information so that you can comparison shop for certain types of loans.

Sample disclosures required under TILA include:Annual percentage rate.Finance charges.Payment schedule.Total amount to be financed.Total amount made in payments over the life of the loan.13-Nov-2020