As most commonly used in legal settings, an audit is an examination of financial records and documents and other evidence by a trained accountant. Audits are conducted of records of a business or governmental entity, with the aim of ensuring proper accounting practices, recommendations for improvements, and a balancing of the books. An audit performed by employees is called "internal audit," and one done by an independent (outside) accountant is an "independent audit." Auditors may refuse to sign the audit to guarantee its accuracy if only limited records are produced.

Guam Report of Independent Accountants after Audit of Financial Statements

Description

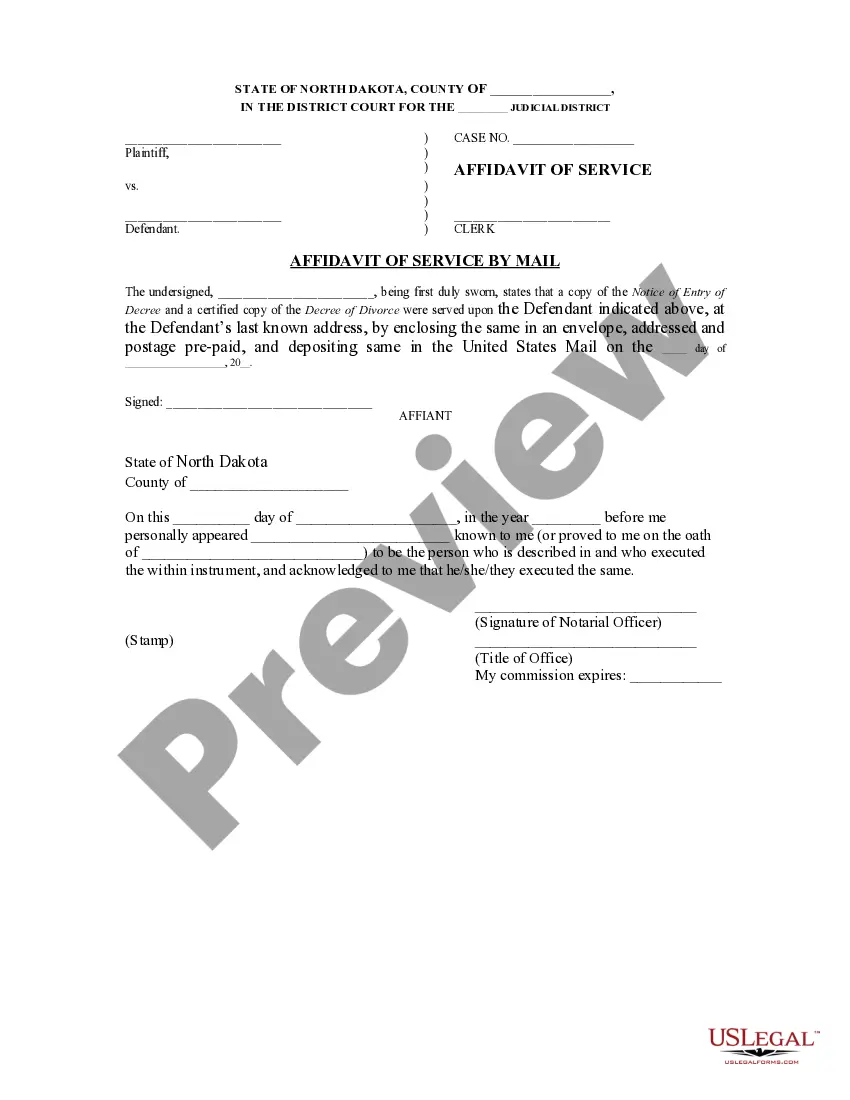

How to fill out Report Of Independent Accountants After Audit Of Financial Statements?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a range of legal document templates available for download or printing.

By using the website, you can access thousands of documents for both business and personal purposes, organized by categories, states, or keywords.

You can obtain the most recent versions of documents like the Guam Report of Independent Accountants post Audit of Financial Statements in just moments.

If the document does not meet your requirements, utilize the Search field at the top of the page to find the one that does.

If you are satisfied with the document, confirm your selection by clicking the Get now button. Then, choose your preferred pricing plan and provide your details to register for an account.

- If you already possess a registration, Log In and download the Guam Report of Independent Accountants post Audit of Financial Statements from the US Legal Forms collection.

- The Download button will appear on every document you view.

- You have access to all previously saved documents in the My documents section of your account.

- If you are using US Legal Forms for the first time, here are simple instructions to get started.

- Ensure you have selected the correct document for your locality. Click the Preview button to review the document’s content.

- Examine the document summary to make sure that you have selected the appropriate form.

Form popularity

FAQ

The SA 700 audit report is an international standard that outlines the requirements for obtaining and reporting on an audit opinion. This standard dictates how auditors present their findings, ensuring the integrity of audit reports like the Guam Report of Independent Accountants after Audit of Financial Statements. Adherence to SA 700 increases the credibility of the audit process. Understanding this standard helps businesses maintain compliance and transparency in their financial reporting.

An independent auditor is a professional tasked with examining a company's financial statements to ensure accuracy and compliance with standards. This role is critical in providing transparency and maintaining public confidence, often culminating in the Guam Report of Independent Accountants after Audit of Financial Statements. Independent auditors operate without biases or conflicts of interest, which enhances the reliability of their findings. They provide a crucial service that benefits all stakeholders involved.

An independent auditor's report generally includes the auditor's opinion, basis for the opinion, management's responsibility, and the audit's scope. The report effectively conveys the auditor's conclusion on the financial statements, like the Guam Report of Independent Accountants after Audit of Financial Statements. It serves as a formal declaration of integrity to stakeholders. Clarity and precision in these elements bolster trust in the financial statements being presented.

Yes, financial accounting reports are typically audited by Certified Public Accountants (CPAs). These professionals possess the expertise and qualifications necessary to conduct thorough audits. The Guam Report of Independent Accountants after Audit of Financial Statements is often prepared by CPAs, ensuring compliance with established accounting standards. Engaging a CPA can enhance your organization's credibility and improve financial accuracy.

Auditors issue a report that provides an opinion on the truthfulness and fairness of a company's financial statements. This report, often known as the Guam Report of Independent Accountants after Audit of Financial Statements, highlights whether the financial statements adhere to accepted accounting principles. The report serves as a critical validation for investors, creditors, and other interested parties. It reflects the auditor's conclusion on the reliability of the financial information presented.

Entities such as publicly traded companies, nonprofits with substantial funding, and businesses that meet specific asset thresholds must file audited financial statements. These filings often include the Guam Report of Independent Accountants after Audit of Financial Statements, which provides a credible overview of the firm's financial status. Compliance is essential for maintaining transparency with stakeholders and regulatory bodies. Filing audited financial statements ensures you meet both state and federal requirements.

Yes, audited financial statements are generally considered public documents. This means that interested parties, such as investors or regulatory bodies, can access them to review the financial health of a business. Specifically, the Guam Report of Independent Accountants after Audit of Financial Statements offers detailed insights into an organization’s financial operations. By utilizing platforms like USLegalForms, you can easily obtain these reports and ensure compliance with any necessary regulations.

An audit report typically contains five key components: the title, the addressee, the opinion paragraph, the basis for the opinion, and any additional explanatory paragraphs. Among these, the opinion paragraph is crucial as it conveys the conclusions derived from the Guam Report of Independent Accountants after Audit of Financial Statements. Understanding these components can help you better comprehend the overall findings and implications of the audit.

An accountant's review report offers a middle ground between an audit and a compilation. It provides a certain level of assurance about the financial statements, but not as thorough as the Guam Report of Independent Accountants after Audit of Financial Statements. Companies often use this report type for internal decision-making and to enhance credibility with external parties.

An independent accountant's report is prepared by a certified accountant who assesses and provides an opinion on the financial statements. This report can take various forms, including the Guam Report of Independent Accountants after Audit of Financial Statements, depending on the level of assurance required. It plays an essential role in building trust with investors and stakeholders by validating the integrity of financial reporting.