This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness

Description

How to fill out Assignment Of All Of Expected Interest In Estate In Order To Pay Indebtedness?

Discovering the right legal file format might be a have difficulties. Of course, there are tons of web templates accessible on the Internet, but how do you get the legal type you will need? Use the US Legal Forms site. The service delivers a huge number of web templates, like the Guam Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness, which can be used for organization and private requires. Each of the forms are checked out by professionals and satisfy federal and state needs.

In case you are previously registered, log in for your account and then click the Down load option to have the Guam Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness. Use your account to search through the legal forms you have purchased in the past. Visit the My Forms tab of your respective account and get an additional backup in the file you will need.

In case you are a fresh user of US Legal Forms, listed here are simple instructions that you should follow:

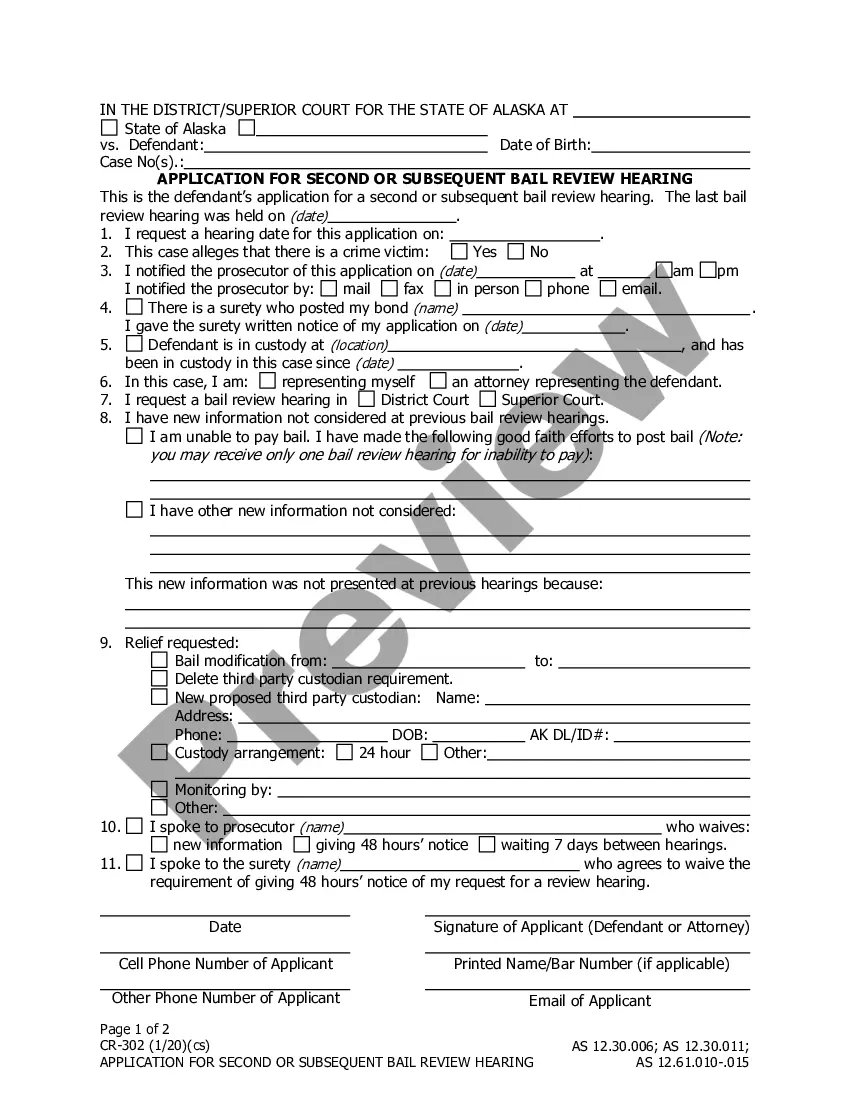

- Initially, ensure you have chosen the appropriate type for your area/state. You are able to look through the form using the Review option and study the form description to ensure this is the best for you.

- In the event the type will not satisfy your requirements, take advantage of the Seach industry to discover the right type.

- Once you are certain that the form would work, go through the Buy now option to have the type.

- Pick the rates strategy you would like and enter the needed information. Make your account and purchase the transaction using your PayPal account or charge card.

- Choose the document file format and acquire the legal file format for your device.

- Comprehensive, revise and printing and signal the attained Guam Assignment of All of Expected Interest in Estate in Order to Pay Indebtedness.

US Legal Forms will be the greatest collection of legal forms for which you can see a variety of file web templates. Use the service to acquire appropriately-made papers that follow condition needs.

Form popularity

FAQ

A common misconception among Canadians is that they can be taxed on money they inherit. The truth is, there is no inheritance tax in Canada. Instead, after a person is deceased, a final tax return must be prepared on income they earned up to the date of death.

Earnings after the date of death are taxable to the beneficiary of the account or to the estate. Money you inherit is generally not subject to ?federal income taxes. Only interest on it from the time you become the owner is taxed. Money in traditional IRAs, 401(k)s, 403(b)s, and annuities is taxed to the heir.

Estates are taxed as separate entities by the IRS so income taxes must be filed for the estate. In some cases, the estate will owe taxes on any income earned through its assets. If the estate pays the appropriate amount in taxes, the beneficiary shouldn't be responsible for taxes.

The personal representative of an estate is an executor, administrator, or anyone else in charge of the decedent's property. The personal representative is responsible for filing any final individual income tax return(s) and the estate tax return of the decedent when due.

Generally, any income or capital gains that are made after the person's death will usually be considered to be the income of the person's estate. The personal representative will be responsible for paying taxes on such income with money from the estate.

Under the Act, as the legal representative, it is your responsibility to: file all required returns for the deceased. ensure that all taxes owing are paid. let the beneficiaries know which of the amounts they receive from the estate are taxable.

Payment of Outstanding Taxes The settlement of outstanding taxes hinges upon utilizing the estate's assets to discharge the debt effectively. This process can encompass a range of strategies, including the potential liquidation of assets, the sale of properties, and the allocation of funds from various bank accounts.

If there is unpaid tax, the estate's executor has to repay it with the decedent's available cash and any proceeds from their liquidated property, per Solomon. This must be completed before any kind of property is transferred.