Guam Business Credit Application: A Detailed Description and Types Introduction: The Guam Business Credit Application is an essential document required by businesses residing in Guam to apply for credit services from financial institutions. This application enables businesses to access various forms of credit, such as loans, lines of credit, trade credit, or credit cards, to support their operations, expansion, or purchase of goods and services. It is vital for businesses in Guam to understand the different types of credit applications available to them to choose the appropriate one as per their specific requirements. Types of Guam Business Credit Applications: 1. Small Business Credit Application: This type of credit application is designed for small businesses, startups, or those with lower credit needs. It allows businesses to apply for credit services with lower credit limits and simplified application procedures, making it suitable for enterprises with limited financial history or lower creditworthiness. Small businesses can leverage this option to access the necessary funds without extensive documentation or collateral requirements. 2. Commercial Credit Application: The commercial credit application is tailored for mid-sized to larger businesses operating in Guam. These applications are usually more comprehensive, requiring detailed financial statements, business plans, and other pertinent documentation. Financial institutions assess the eligibility of applicants based on their financial stability, credit history, and ability to repay larger loan amounts. Commercial credit applications typically offer higher credit limits and more flexible terms for businesses with proven financial stability. 3. Trade Credit Application: Trade credit applications are specific to businesses involved in trade-related activities, such as wholesalers, distributors, or manufacturers. This type of credit application allows businesses to establish credit terms with their suppliers or buyers, enabling them to extend payment periods beyond immediate transactions. By using trade credit, businesses can manage cash flows efficiently and build stronger relationships with partners in the supply chain. 4. Line of Credit Application: A line of credit (LOC) application enables businesses to access a predetermined credit limit to assist with short-term financing needs or unexpected expenses. Rather than providing a lump sum, financial institutions establish a line of credit that can be drawn upon as needed, up to the approved limit. Businesses can repay and reuse the line of credit without requiring a new credit application for each transaction. It offers flexibility, helping businesses address their immediate cash flow gaps efficiently. 5. Credit Card Application: Credit card applications are commonly used for small to medium-sized businesses seeking revolving credit options. These applications allow businesses to obtain credit cards with predetermined credit limits, enabling them to make purchases, pay bills, and manage cash flows conveniently. Credit card applications may have various rewards programs or benefits tailored specifically for business expenses and often come with detailed expense tracking features. In conclusion, the Guam Business Credit Application is a vital tool for businesses in Guam seeking access to credit services. The different types of applications, including small business, commercial, trade credit, line of credit, and credit card applications, cater to the diverse needs of businesses in Guam, ensuring they can receive appropriate funding to support their growth and operations. It is essential for businesses to carefully assess their requirements and choose a credit application that aligns with their needs, financial position, and creditworthiness.

Guam Business Credit Application

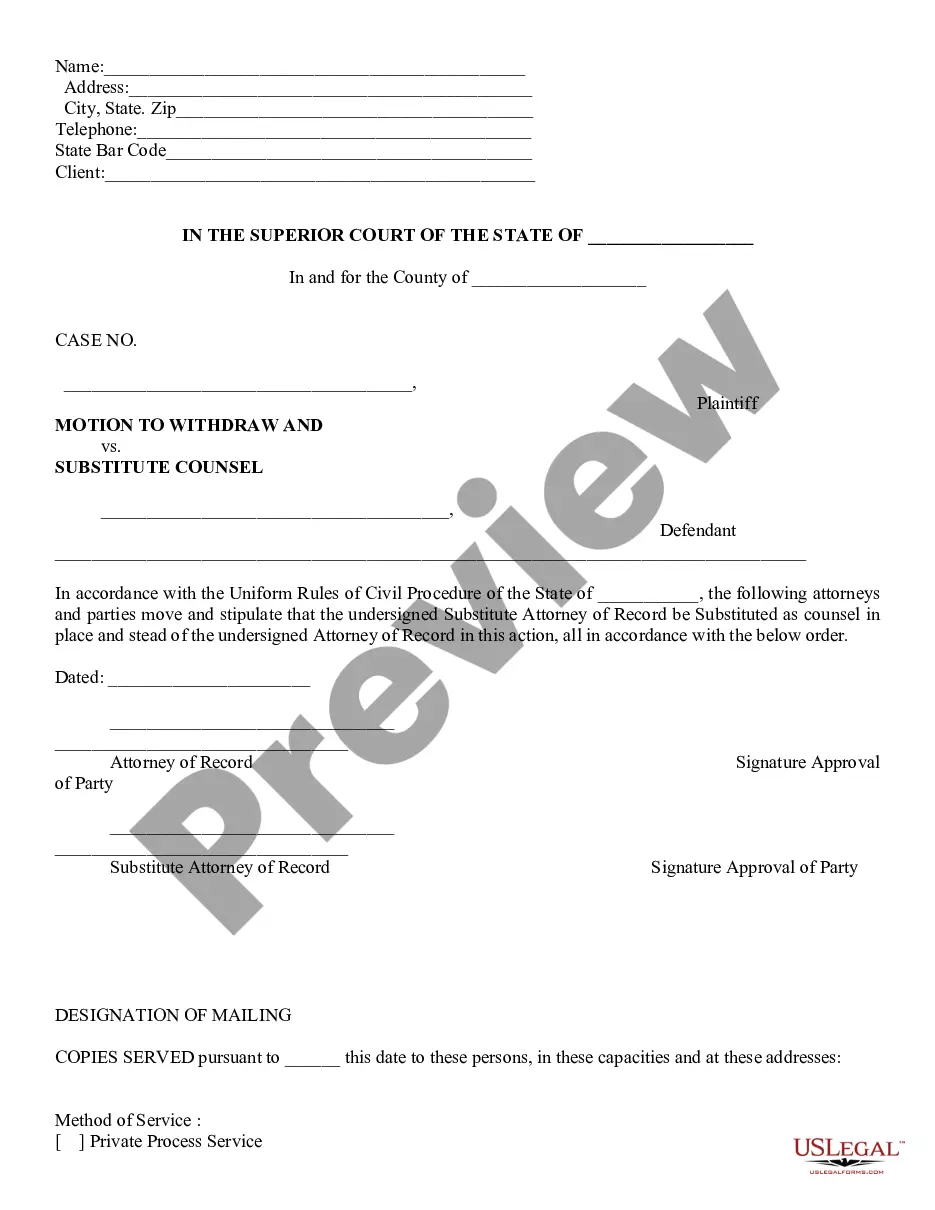

Description

How to fill out Guam Business Credit Application?

Finding the right legal document template might be a have a problem. Naturally, there are tons of layouts accessible on the Internet, but how will you find the legal form you need? Take advantage of the US Legal Forms website. The service gives thousands of layouts, such as the Guam Business Credit Application, that you can use for enterprise and personal demands. Every one of the forms are examined by pros and meet up with federal and state requirements.

In case you are currently signed up, log in to your profile and click on the Acquire button to obtain the Guam Business Credit Application. Make use of profile to check with the legal forms you have bought earlier. Check out the My Forms tab of your profile and have yet another backup from the document you need.

In case you are a fresh consumer of US Legal Forms, listed here are basic guidelines so that you can comply with:

- Initially, make certain you have selected the appropriate form for the metropolis/county. You may check out the form utilizing the Preview button and study the form explanation to ensure this is basically the right one for you.

- In the event the form does not meet up with your requirements, take advantage of the Seach industry to find the proper form.

- When you are positive that the form would work, go through the Get now button to obtain the form.

- Opt for the prices prepare you need and enter the needed info. Design your profile and buy an order with your PayPal profile or Visa or Mastercard.

- Opt for the file format and acquire the legal document template to your system.

- Complete, modify and print and indication the acquired Guam Business Credit Application.

US Legal Forms is the largest local library of legal forms for which you will find various document layouts. Take advantage of the company to acquire skillfully-manufactured documents that comply with state requirements.

Form popularity

FAQ

You can use credit to add to your working capital, lease equipment or vehicles, or acquire another business.

Answer : A Doing Business As (DBA) filing is the official way of registering a business name with either a state or a local jurisdiction (such as a county). Often a DBA name is commonly referred to as an assumed name, trade name or fictitious business name.

WHAT TO INCLUDE IN A BUSINESS CREDIT APPLICATION Name of the business, address, phone and fax number. Names, addresses, Social Security numbers of principals. Type of business (corporation, partnership, proprietorship) Industry. Number of employees. Bank references. Trade payment references.

Even without a separate legal entity, you can build a business credit history as a sole proprietorship, and a business credit card can help. Start by registering your business with your state and requesting a D-U-N-S number from Dun & Bradstreet, one of the major commercial credit bureaus.

4. Gather required application information Business name and contact information. You'll need to provide important identifying information about your business, such as your business name, address and phone number. ... Your role in the company. ... Your annual business income. ... Business details. ... Supporting documentation.

Can I Get a Business Credit Card with a DBA? When you have a business, no matter how small or big it is, you can apply for a business credit card. The legal name of your business will appear on your card, so if you have already registered a DBA you can include this in your credit card application.

Most card issuers require you to provide your Social Security number when applying for a business credit card. Corporate cards are the exception. You can typically get these cards using just your business's employer identification number, or EIN.

Yes, you can get a credit card for an LLC, as long as you're an officer or authorized representative of the LLC. You can apply for a business credit card for an LLC the same way you would for a partnership, corporation, or sole proprietorship. Work on your personal credit to improve your approval odds.