This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement

Description

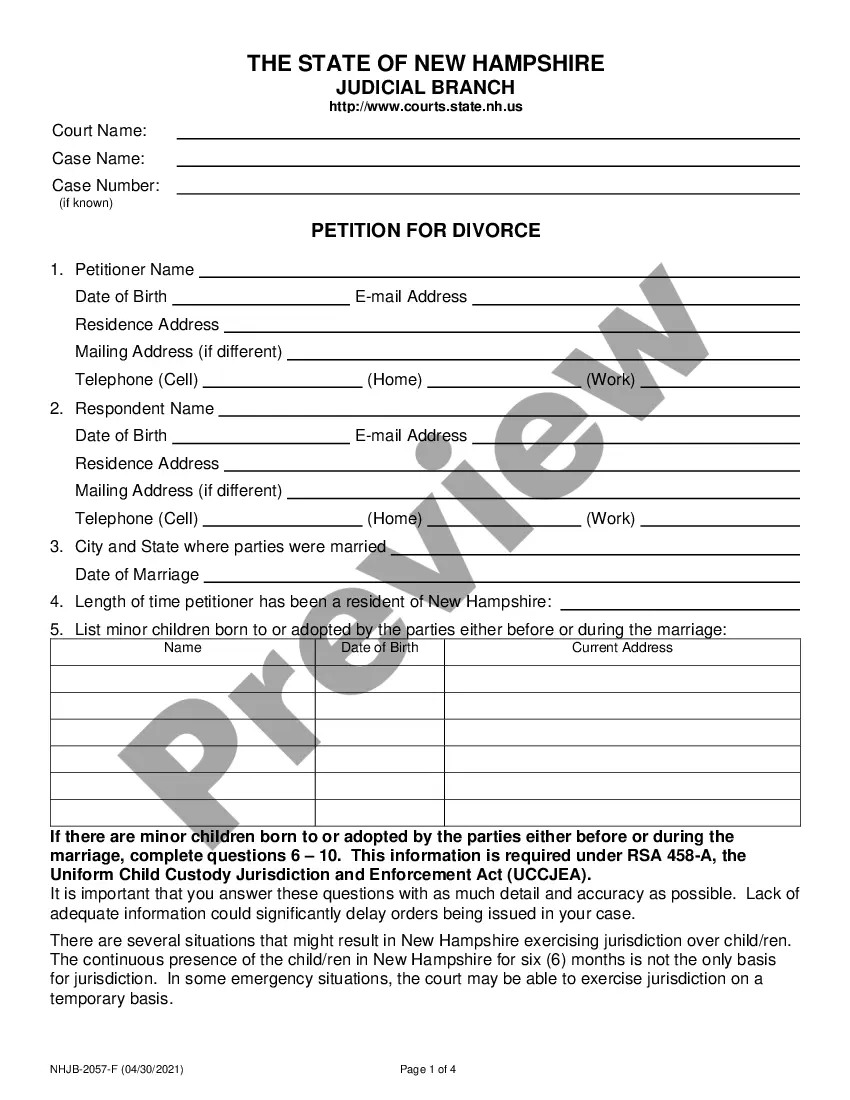

How to fill out Contract To Sell Commercial Property With Commercial Building - Seller Financing Secured By Mortgage And Security Agreement?

Are you presently inside a placement in which you need documents for possibly business or person purposes almost every time? There are a variety of legal papers templates accessible on the Internet, but getting ones you can rely on is not straightforward. US Legal Forms provides a large number of develop templates, just like the Guam Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement, that are composed to satisfy federal and state demands.

In case you are currently acquainted with US Legal Forms internet site and get a merchant account, basically log in. After that, you may obtain the Guam Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement web template.

If you do not come with an bank account and would like to begin using US Legal Forms, adopt these measures:

- Obtain the develop you require and make sure it is for the right metropolis/state.

- Utilize the Review option to examine the form.

- Read the information to actually have chosen the proper develop.

- When the develop is not what you`re looking for, take advantage of the Look for area to find the develop that fits your needs and demands.

- If you find the right develop, simply click Get now.

- Opt for the pricing program you need, fill in the necessary information to create your bank account, and pay for the order using your PayPal or charge card.

- Pick a convenient file formatting and obtain your duplicate.

Find each of the papers templates you have purchased in the My Forms food list. You can get a additional duplicate of Guam Contract to Sell Commercial Property with Commercial Building - Seller Financing Secured by Mortgage and Security Agreement at any time, if possible. Just click on the needed develop to obtain or print the papers web template.

Use US Legal Forms, the most substantial assortment of legal forms, to save some time and steer clear of faults. The service provides expertly produced legal papers templates that you can use for an array of purposes. Create a merchant account on US Legal Forms and begin making your life a little easier.

Form popularity

FAQ

Example: 'X' sold 10 bags of Rice to 'Y' against payment of Rs. 5,000. Example: 'X' agrees to sell 10 bags of Rice to 'Y' for Rs. 5,000 after getting the stock.

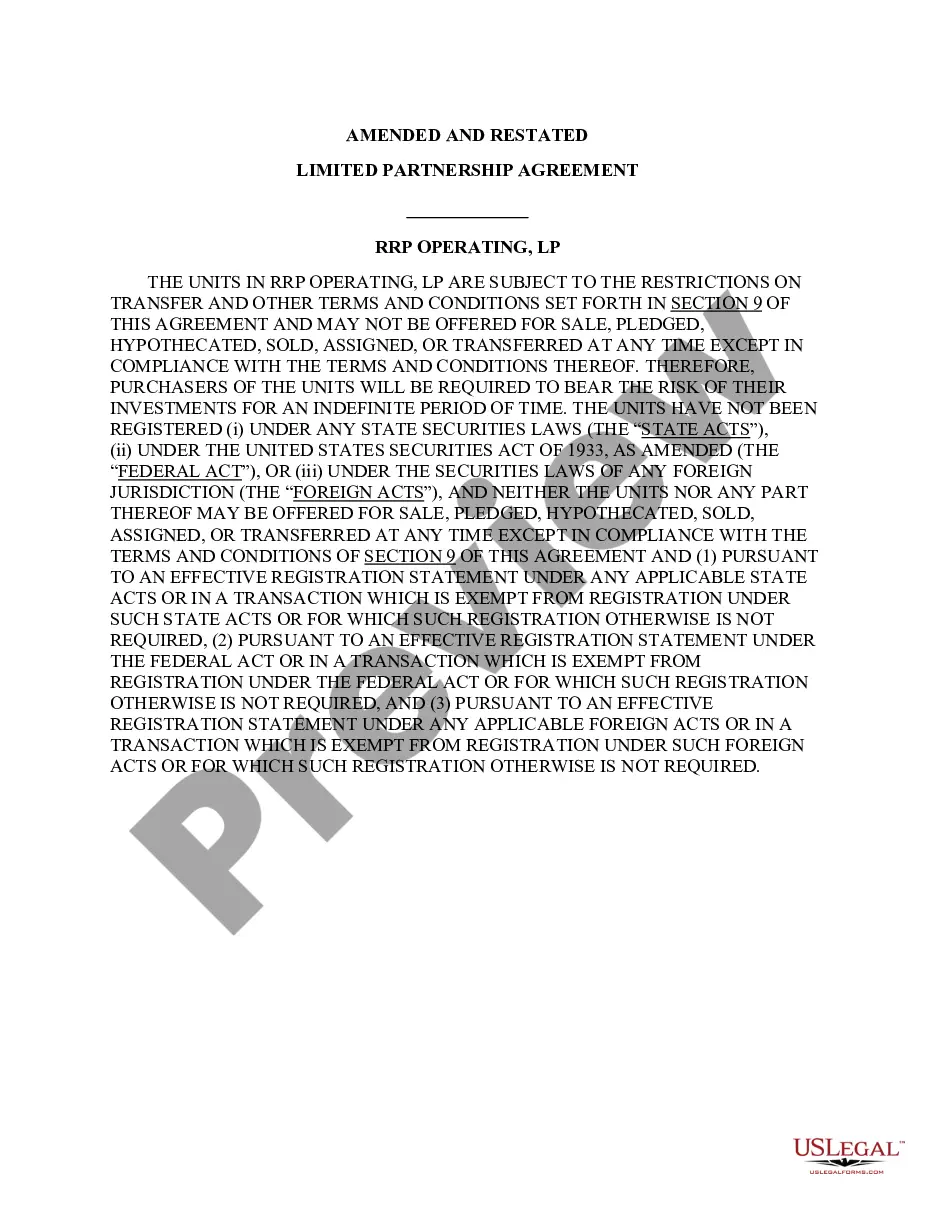

CONDITIONAL SALE CONTRACT ? A contract for the sale of property stating that delivery is to be made to the buyer, title to remain vested in the seller until the conditions of the contract have been fulfilled.

Examples of seller financing are all-inclusive mortgages, rent-to-own agreements, second mortgages or junior mortgages, wrap-around agreements, and land contracts.

In real estate, seller financing is also called ?owner financing? or ?bond-for-title.? In such cases, the buyer signs a mortgage agreement with the seller, and the seller handles the process.

There are two parties in a contract: the promisee and the promisor. A promisor refers to the party that makes the promise, while a promisee is a party that receives the promise. The other party set to benefit from a contract is referred to as a third-party beneficiary.

Holding mortgage: Under a holding mortgage agreement, a homeowner agrees to serve as a lender for the home buyer, and provides a loan for the purchase, which the buyer repays by making monthly payments to the seller. The seller continues to hold the property's title until full loan repayment has been made by the buyer.

?Seller/Owner Will Carry? or ?Seller/Owner Financing? is when the owner of the property is financing the loan for the buyer to purchase the property. This means the current owner of the home owes no money on the property and becomes the lender for the home's buyer.

An agreement to sell is a contract between a seller and a buyer where the seller agrees to sell an asset or property to the buyer at a specified price. The agreement to sell is also known as a sale agreement. It is generally used to sell immovable property such as land or buildings.