Under the Equal Credit Opportunity Act, a creditor may design its own application forms, use forms prepared by another person, or use the appropriate model application forms contained in 12 C.F.R. Part 202, Appendix B. If a creditor chooses to use an Appendix B form, it may change the form by: (1) asking for additional information not prohibited by 12 C.F.R. § 202.5; (2) by deleting any information request; or (3) by rearranging the format without modifying the substance of the inquiries; provided that in each of these three instances the appropriate notices regarding the optional nature of courtesy titles, the option to disclose alimony, child support, or separate maintenance, and the limitation concerning marital status inquiries are included in the appropriate places if the items to which they relate appear on the creditor's form.

Guam Application for Open End Unsecured Credit - Signature Loan

Description

How to fill out Application For Open End Unsecured Credit - Signature Loan?

US Legal Forms - one of the biggest libraries of lawful forms in the USA - provides a wide range of lawful document web templates you can download or produce. While using site, you will get a large number of forms for organization and personal functions, sorted by groups, says, or search phrases.You can get the newest variations of forms just like the Guam Application for Open End Unsecured Credit - Signature Loan within minutes.

If you have a subscription, log in and download Guam Application for Open End Unsecured Credit - Signature Loan in the US Legal Forms library. The Obtain option can look on each and every develop you perspective. You get access to all in the past acquired forms inside the My Forms tab of the bank account.

In order to use US Legal Forms initially, here are basic instructions to help you get started out:

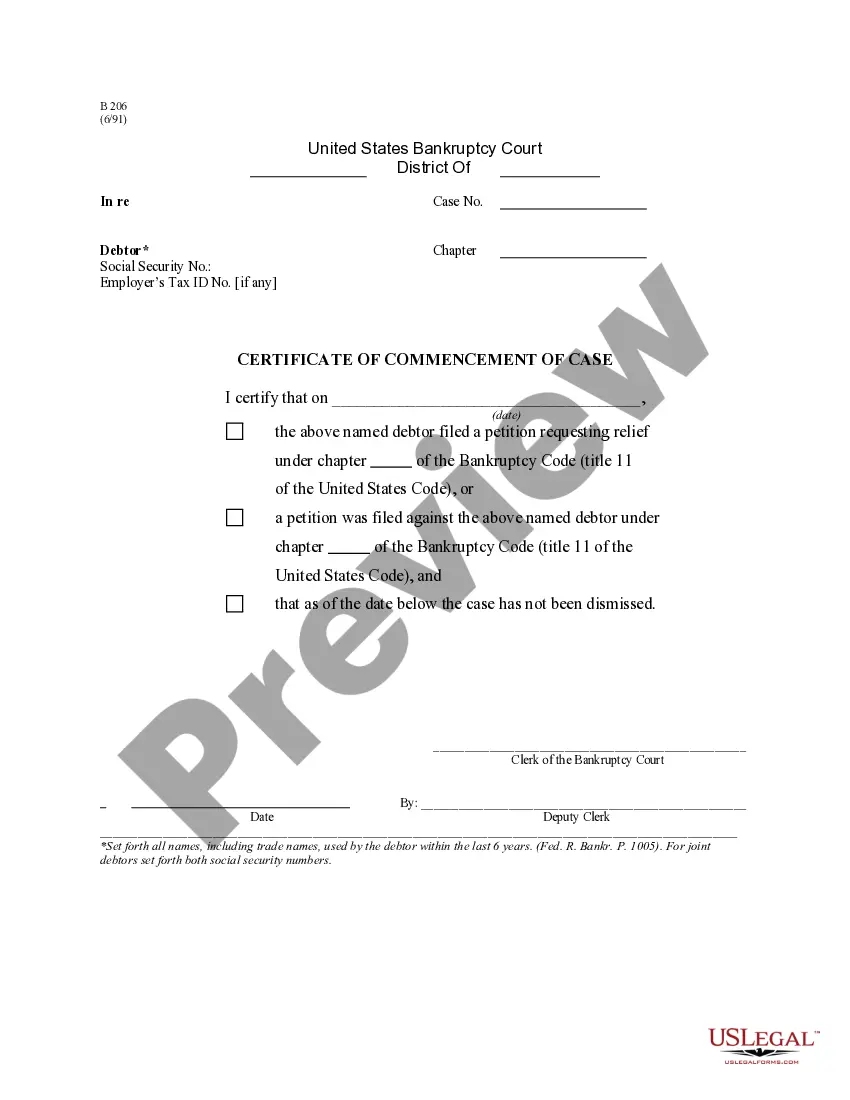

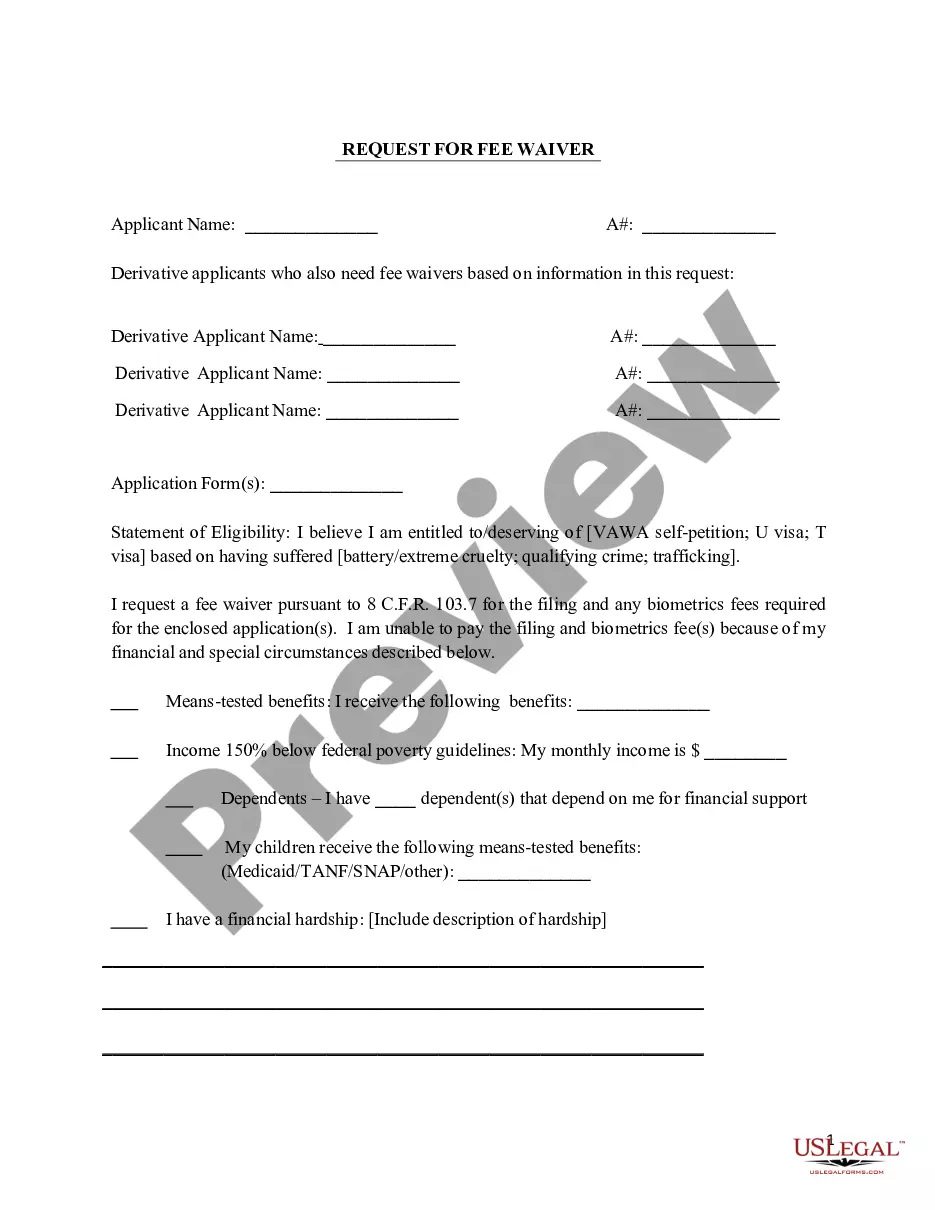

- Make sure you have selected the correct develop to your metropolis/county. Click the Preview option to examine the form`s information. Read the develop outline to actually have chosen the right develop.

- When the develop doesn`t satisfy your specifications, take advantage of the Research area on top of the display screen to find the one who does.

- In case you are content with the shape, validate your option by clicking the Get now option. Then, opt for the prices prepare you like and supply your accreditations to register on an bank account.

- Procedure the deal. Make use of your credit card or PayPal bank account to perform the deal.

- Find the format and download the shape on the device.

- Make changes. Load, modify and produce and indicator the acquired Guam Application for Open End Unsecured Credit - Signature Loan.

Each web template you included with your bank account does not have an expiry time and it is yours forever. So, in order to download or produce yet another version, just check out the My Forms area and click in the develop you need.

Get access to the Guam Application for Open End Unsecured Credit - Signature Loan with US Legal Forms, one of the most substantial library of lawful document web templates. Use a large number of skilled and express-distinct web templates that meet up with your organization or personal requirements and specifications.

Form popularity

FAQ

Of course as with any form of credit, irresponsible use of a personal loan can have a negative impact on your credit score. And much like with any other loan, mortgage, or credit card application, applying for a personal loan can cause a slight dip in your credit score.

A signature loan is basically just an unsecured loan. This means that you can get one with proof of steady income, bank statements, a credit check, and your signature. Since it's an unsecured loan you won't be required to offer any collateral.

A signature loan is an unsecured personal loan. Unlike a secured loan, this type of loan doesn't require you to pledge collateral ? something of value, like a bank account or house ? a lender can seize if you fail to repay the loan.

A signature loan is offered as a lump sum, whereas a line of credit is a source of funds that you can draw from whenever you choose. With a line of credit, the money that is repaid becomes available again. There are advantages to both, depending upon your needs and circumstances.

Banks: While these types of lenders typically offer competitive APRs, terms, loan amounts and perks, they tend to have stricter eligibility requirements. To get a signature loan from a bank, you'll likely need a good credit score and a positive credit history. You may also need to be a current customer of the bank.

Open-end credit is a loan from a bank or other financial institution that the borrower can draw on repeatedly, up to a certain pre-approved amount, and that has no fixed end date for full repayment.

Loan Requirements Two valid picture National Identification* (Valid Passport or National Identification Card) Job Letter ? Not older than 3-months old. Payslip ? Most Recent. Proof of Address ? Bank Statement, Credit Card Statement, Utility Bill, Rental Agreement etc.

Because signature loans rely heavily on your credit score, it will likely be difficult to qualify for a loan with a bad credit score. While there are signature loans for bad credit, if you do qualify, you'll likely get matched with APRs as high as 36%.