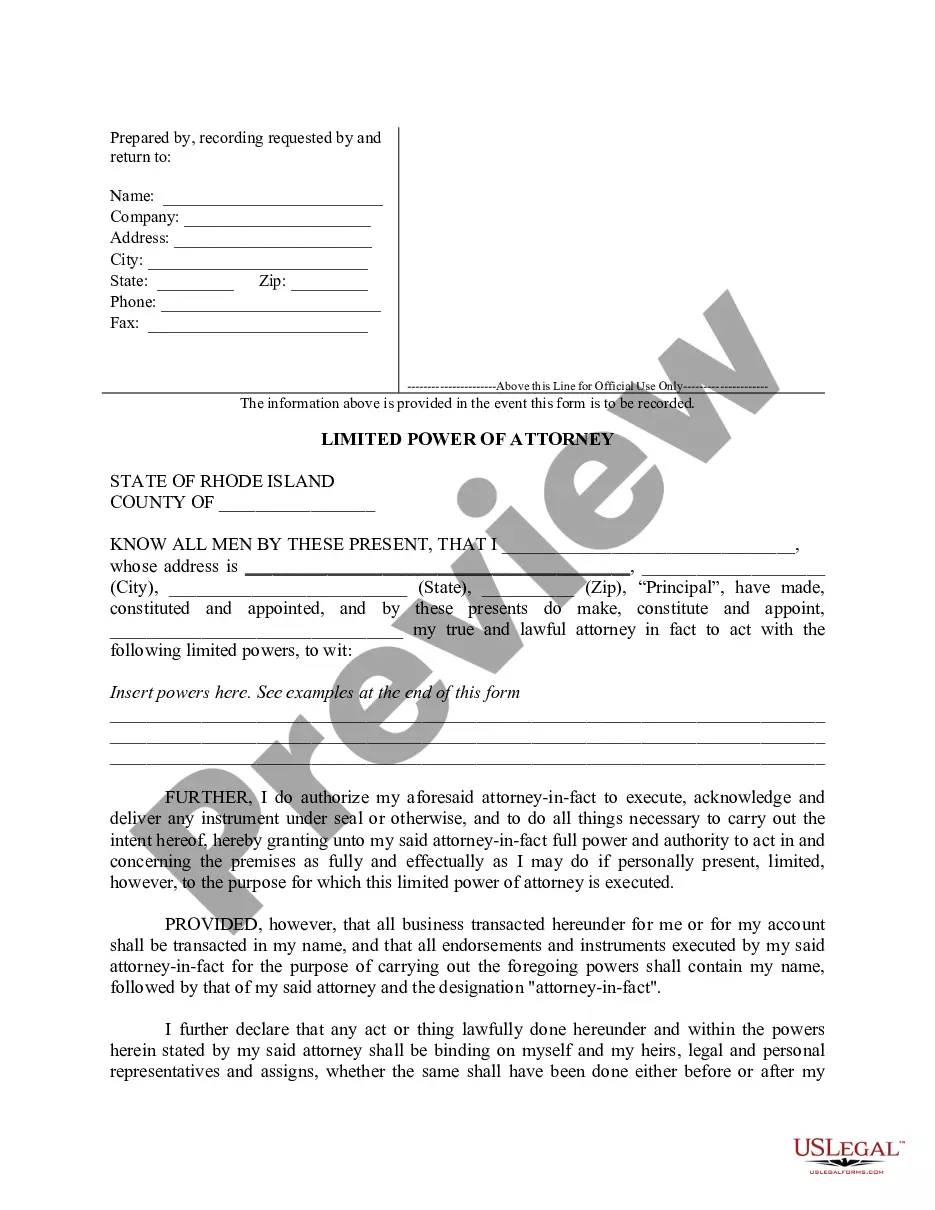

An account is an unsettled claim or demand by one person against another based on a transaction creating a debtor-creditor relationship between the parties. A verified account usually takes the form of an affidavit, in which a statement of an account is verified under oath as to the accuracy of the account. Ordinarily, where an action is based on an itemized account, the correctness of which is verified, the account is taken as true. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Guam Verification of an Account

Description

How to fill out Verification Of An Account?

Finding the right legal papers design can be a have difficulties. Naturally, there are a lot of templates accessible on the Internet, but how do you discover the legal kind you require? Utilize the US Legal Forms internet site. The services offers a huge number of templates, like the Guam Verification of an Account, that you can use for enterprise and personal requirements. Every one of the types are examined by professionals and meet up with federal and state specifications.

When you are currently registered, log in in your bank account and click on the Obtain option to have the Guam Verification of an Account. Utilize your bank account to search from the legal types you possess bought in the past. Go to the My Forms tab of your bank account and acquire another copy in the papers you require.

When you are a brand new customer of US Legal Forms, listed here are straightforward guidelines that you should adhere to:

- First, make sure you have selected the appropriate kind for your metropolis/state. You may check out the shape while using Review option and study the shape outline to ensure this is basically the best for you.

- If the kind is not going to meet up with your expectations, take advantage of the Seach area to get the appropriate kind.

- When you are certain that the shape would work, go through the Get now option to have the kind.

- Select the prices prepare you desire and enter in the essential information. Make your bank account and buy an order with your PayPal bank account or Visa or Mastercard.

- Opt for the document formatting and acquire the legal papers design in your system.

- Complete, edit and print out and indication the acquired Guam Verification of an Account.

US Legal Forms is the greatest library of legal types where you can see different papers templates. Utilize the service to acquire skillfully-made papers that adhere to status specifications.

Form popularity

FAQ

At least 150 semester hours of college education including a baccalaureate or higher degree conferred by a college or university acceptable to the Board, with a minimum of 24 semester hours in accounting or equivalent, a minimum of 24 semester hours in business courses other than accounting including a minimum two (2) ...

The Exam application process is basically the same for U.S. and international candidates. In order to qualify to take the Exam outside the U.S., you will have to establish your eligibility through a jurisdiction participating in the international administration of the Exam.

Guam CPA Exam & Licensing - Cost and Fees The CPA Examination application fee in Guam is $200. Additionally, a fee of $238.15 will be required for each section of the CPA Exam.

CPA Exam Cost Chart Type of FeeAmount Range1.CPA Review Course$1,000 ? $3,0002.CPA Exam Application Fee$50 ? $2003.CPA Examination FeesAbout $200 for each of the four sections of the exam4.Registration FeesAbout $75 for each of the four sections of the exam2 more rows ?

Puerto Rico CPA Exam Fees $210 for the initial application. Candidates can take one or more sections of the exam at a time and must pay the following fees to CPA Examination Services at the time of application: Auditing and Attestation (AUD): $224.99. Business Environment and Concepts (BEC): $224.99.

The only state or jurisdiction that does not require 150 hours of education as a CPA license requirement is the U.S. Virgin Islands.