Guam Letter Tendering Payment

Description

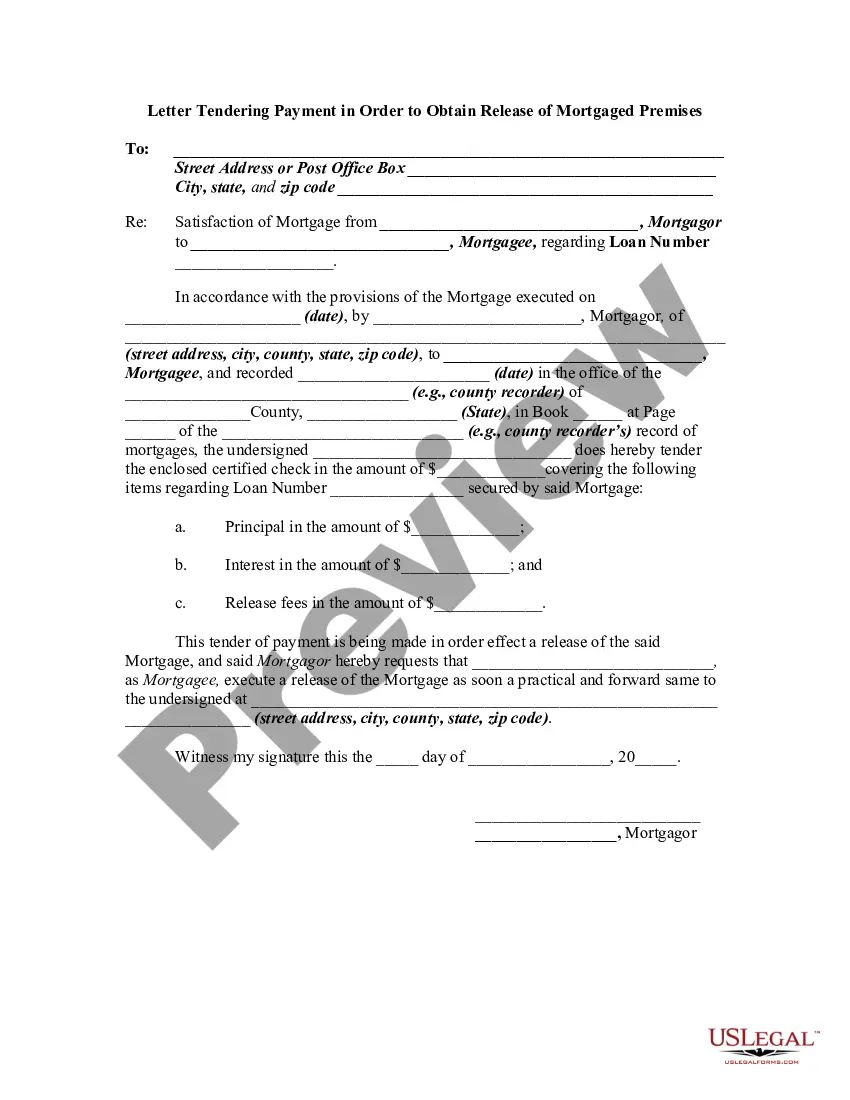

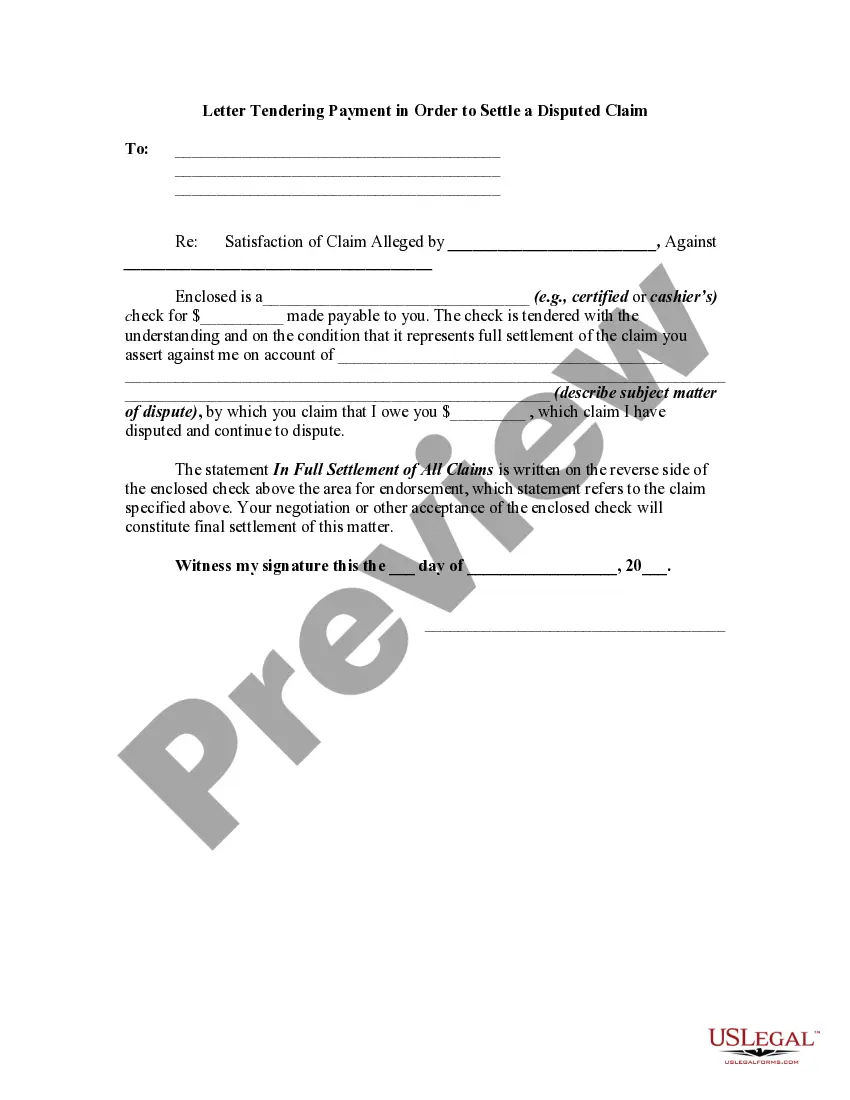

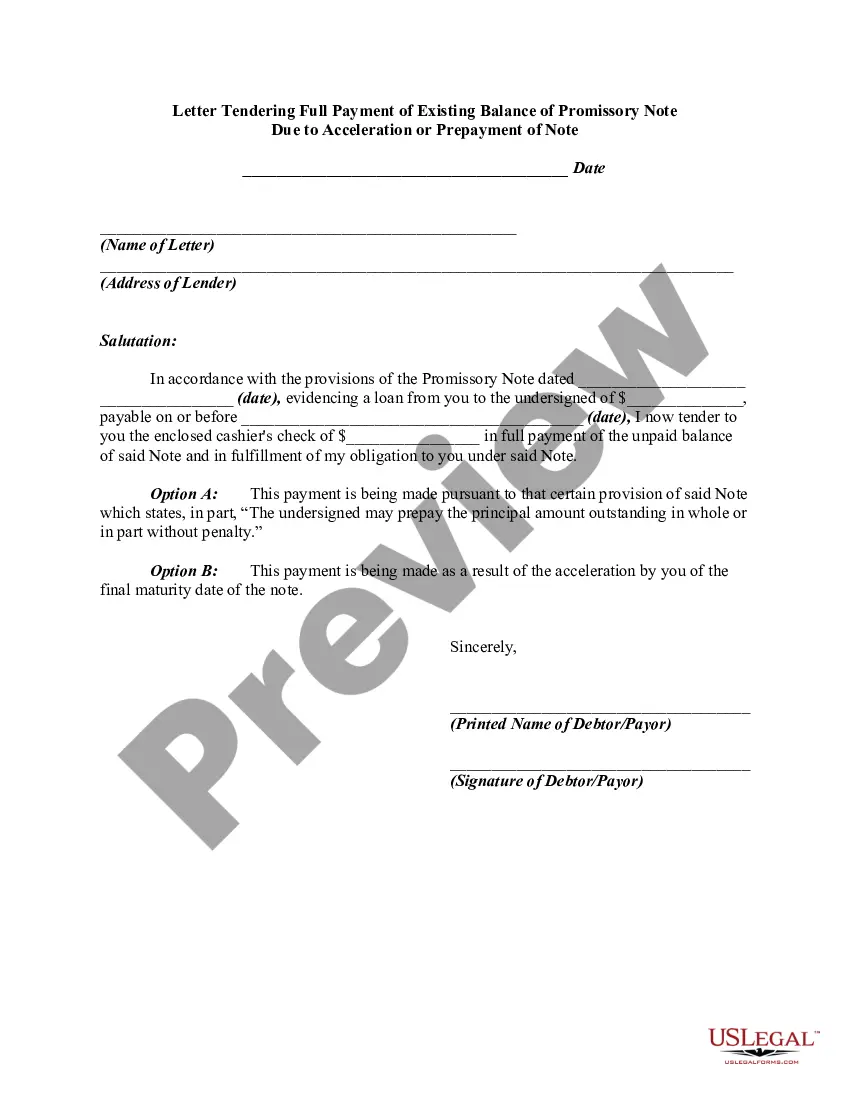

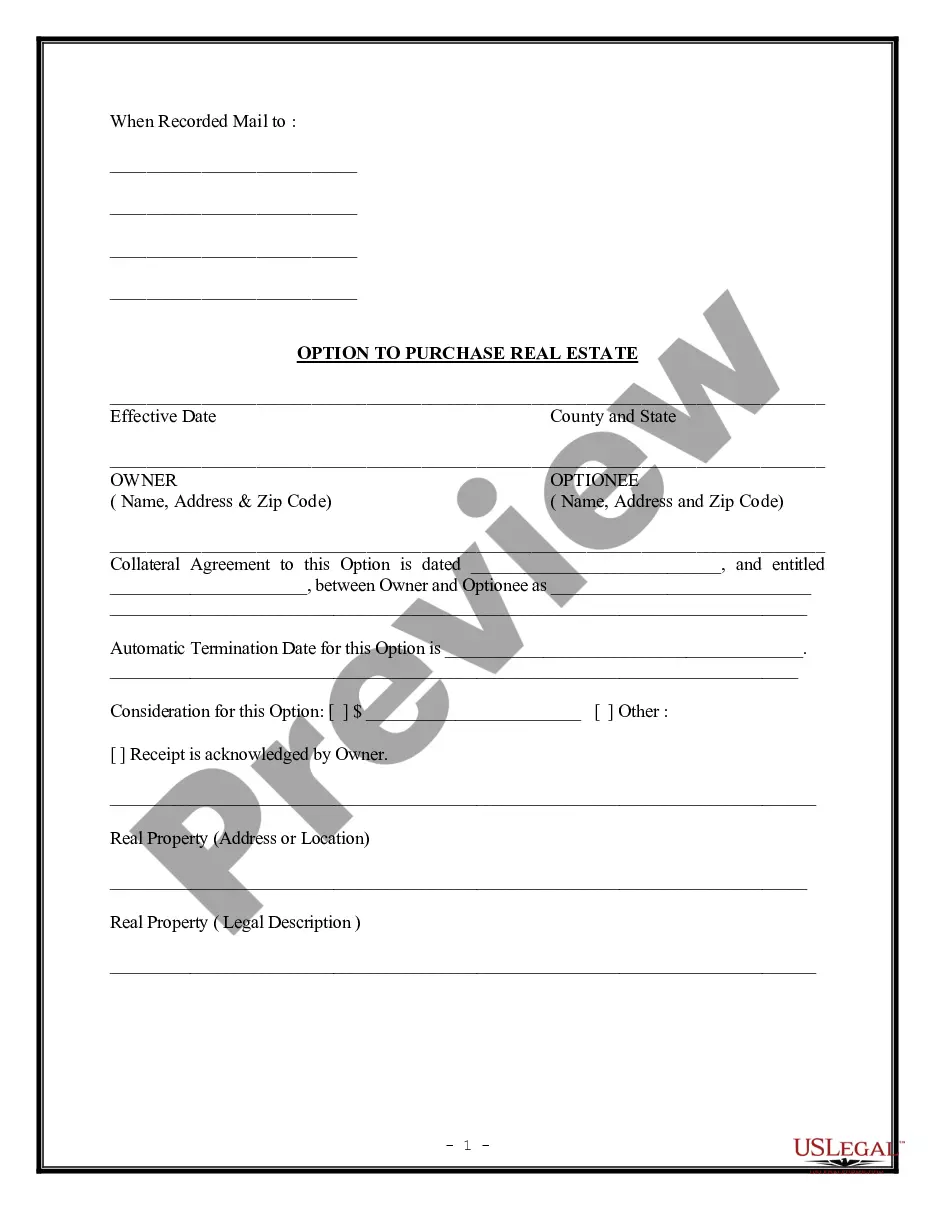

How to fill out Letter Tendering Payment?

If you wish to obtain, acquire, or print legal document templates, utilize US Legal Forms, the foremost selection of legal forms available on the web.

Utilize the website's user-friendly and convenient search to locate the documents you require.

Numerous templates for both business and personal applications are categorized by type and state, or keywords.

Step 4. Once you have located the form you need, click on the Buy now button. Choose the pricing plan you prefer and enter your information to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the payment.

- Utilize US Legal Forms to quickly locate the Guam Letter Tendering Payment.

- If you are already a US Legal Forms member, Log In to your account and click on the Acquire button to find the Guam Letter Tendering Payment.

- You can also access forms you have previously downloaded in the My documents section of your account.

- If this is your first time using US Legal Forms, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Review option to check the form's details. Don't forget to read the information.

- Step 3. If you are unsatisfied with the form, use the Search box at the top of the screen to find alternative forms of the legal document template.

Form popularity

FAQ

To mail your Guam tax return, you should send it to the Department of Revenue and Taxation in Guam. Be sure to follow all specific guidelines to ensure proper processing. Utilizing tools like Guam Letter Tendering Payment can help track your submissions and manage your tax filings smoothly.

Privilege tax in the USA generally refers to taxes imposed on businesses for the privilege of conducting business within a jurisdiction. This tax can vary significantly from state to state. For Guam, this aligns closely with the business privilege tax and GRT. Managing these taxes through the Guam Letter Tendering Payment can provide clarity and guidance.

Yes, Guam implements a business privilege tax at a rate of 5% on a business's gross receipts. This applies to many business activities within the territory. Using Guam Letter Tendering Payment can assist you in managing your obligations effectively, ensuring you meet all tax requirements.

The business tax rate in Guam typically varies depending on the type of business and its gross earnings. Most businesses face a combined rate that includes the GRT and BPT. For those navigating these tax landscapes, utilizing Guam Letter Tendering Payment can simplify the financial obligations associated with taxes.

The business privilege tax in Guam is categorized under the business privilege tax (BPT), which runs at a rate of 5%. This tax is an essential aspect for businesses operating in the territory. Using the Guam Letter Tendering Payment process can help streamline your tax management and ensure timely compliance.

The Gross Receipts Tax (GRT) in Guam is set at 4%. This tax applies to all business income generated in the region. Understanding GRT is vital when you handle Guam Letter Tendering Payment, ensuring you comply with local tax laws while managing your finances effectively.

Yes, Guam is classified as a U.S. possession. This status influences various legal and tax obligations, including those related to Guam Letter Tendering Payment. Being aware of your rights and obligations as a resident can help you manage your tax responsibilities more effectively.

The Business Privilege Tax (BPT) in Guam is a tax on businesses operating within the territory. This tax is essential for revenue generation and must be accurately calculated and reported. Using U.S. Legal Forms can assist you in understanding your obligations regarding the BPT tax and the process of Guam Letter Tendering Payment to ensure compliance.

Yes, Guam is a U.S. territory, and it has its own tax laws that may differ from those on the mainland. As a resident, you must comply with these laws, which includes considerations for Guam Letter Tendering Payment. Familiarizing yourself with these regulations can save you time and potential penalties.

The easiest way to file your taxes is to use a reliable online tax service. Platforms like U.S. Legal Forms simplify the filing process, offering templates and guidance tailored for Guam residents. This includes assistance with Guam Letter Tendering Payment, ensuring that you complete your filing correctly and efficiently.