Guam General Form for Bill of Sale of Personal Property

Description

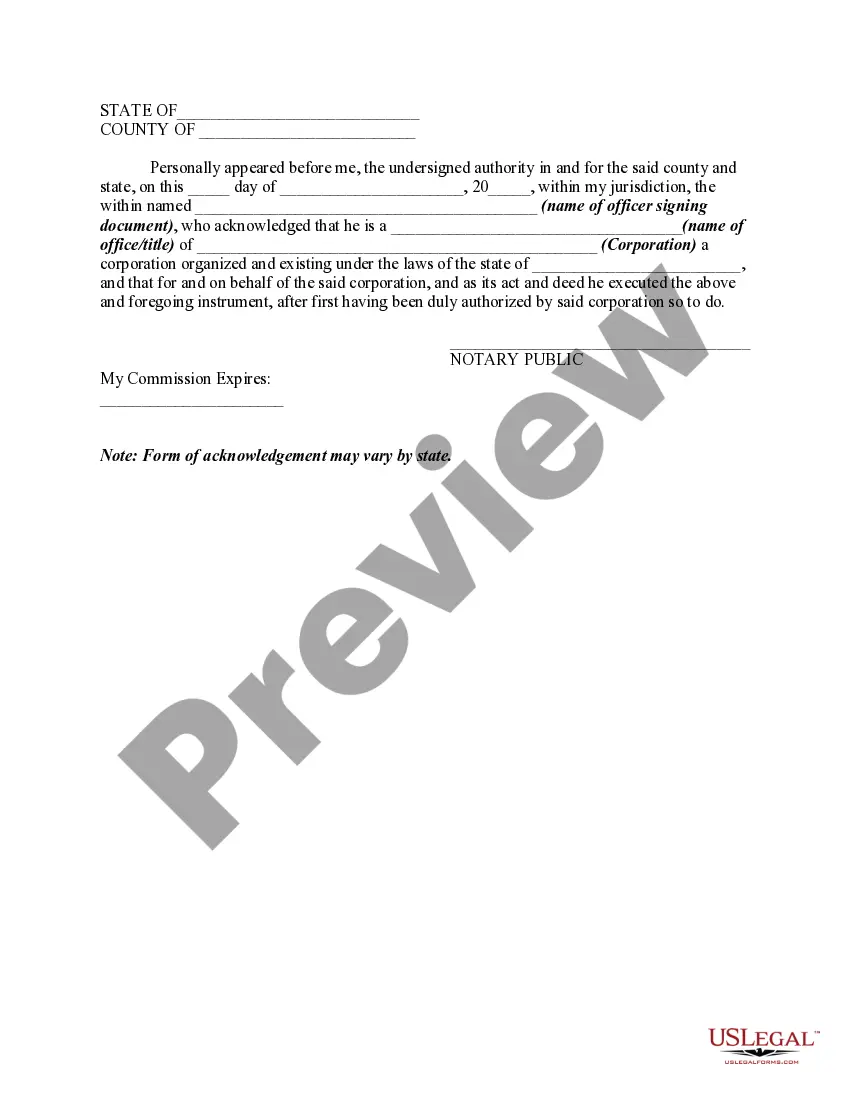

How to fill out General Form For Bill Of Sale Of Personal Property?

US Legal Forms - one of the largest collections of legal documents in the USA - offers a vast selection of legal templates that you can download or print.

By using the website, you'll find thousands of forms for business and personal needs, organized by categories, states, or keywords. You can access the latest iterations of forms like the Guam General Form for Bill of Sale of Personal Property within moments.

If you have a monthly membership, Log In and retrieve the Guam General Form for Bill of Sale of Personal Property from the US Legal Forms collection. The Download button will be visible on every form you encounter. You can access all previously downloaded forms from the My documents section of your account.

Complete the payment. Use your credit card or PayPal account to finalize the transaction.

Find the format and download the form to your device. Edit. Complete, modify, print, and sign the downloaded Guam General Form for Bill of Sale of Personal Property. Every template you add to your account does not have an expiration date and is your permanent property. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you desire. Access the Guam General Form for Bill of Sale of Personal Property with US Legal Forms, the most comprehensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the appropriate form for your specific city or county.

- Click the Review button to examine the form’s content.

- Check the form description to confirm you have chosen the correct one.

- If the form does not meet your needs, utilize the Search field at the top of the page to find the one that does.

- If you are satisfied with the form, confirm your choice by clicking the Get now button.

- Then, select the payment plan you wish and provide your information to register for an account.

Form popularity

FAQ

The sales tax rate in Guam is currently 11%. This tax applies to most purchases made on the island, contributing to local revenue. When creating transactions with the Guam General Form for Bill of Sale of Personal Property, understanding the sales tax implications can help avoid unexpected costs. Utilizing legal platforms like USLegalForms can simplify your preparation of documents, ensuring you account for all financial considerations.

Yes, Guam is a U.S. possession located in the western Pacific Ocean. It has been under U.S. control since 1898 and serves as an important strategic military base. Understanding Guam's status is vital when dealing with legal documents, such as the Guam General Form for Bill of Sale of Personal Property. This form helps ensure your transaction complies with local laws.

Yes, if you earn income in Guam or are a resident, filing Guam taxes is required. This includes both individuals and businesses. Failing to file can result in penalties and interest on any unpaid taxes. For tailored assistance, you may consider utilizing platforms like uslegalforms, which offer resources such as the Guam General Form for Bill of Sale of Personal Property to help streamline your paperwork.

Guam property tax rates vary depending on the type and use of the property. Typically, residential property tax rates are set at a rate of 1% of the assessed value. For commercial properties, the rate can be higher, depending on local regulations. It’s important to check with the Guam Department of Revenue and Taxation for the most accurate and current information regarding property tax assessments and rates.

To obtain a Guam Gross Receipts Tax (GRT) account number, you need to complete a registration form from the Guam Department of Revenue and Taxation. This step is crucial for businesses that wish to comply with local tax laws. After submitting your application, the department will process your request and issue your GRT account number. This number is essential for maintaining proper records and filing taxes accurately.

Yes, you can file your Guam taxes online using the official Guam Department of Revenue and Taxation website. This option allows you to manage your tax obligations conveniently and securely. By filing online, you save time and can easily keep track of your submissions. Remember to have all necessary documents and information ready to ensure a smooth process.

The bill of sale should contain:name and address of the buyer;name, address and signature of the seller;complete vehicle description, including the Vehicle Identification Number (VIN);description of trade-in, if any;purchase price of the vehicle;trade-in allowance, if applicable; and.net purchase price.

Create a Receipt for a Used Car SaleAcquire a medium for creating your receipt.State the names of those involved in the sale, along with the date, at the top of the receipt.State the make, model, year and VIN (vehicle identification number) number of the car.State the agreed-upon total price for the vehicle.More items...

Mail in your payment. Mail your check payable to "Treasurer of Guam" to the Department of Revenue and Taxation, P.O. Box 23607, GMF, Guam 96921.

The consideration is the value that the buyer transfers to the seller. Or, simply put and in most cases, the consideration reflects how much (or the dollar amount) the buyer spent to purchase the item. For instance, if the buyer purchases a car for $20,000 from the seller, the consideration is $20,000.