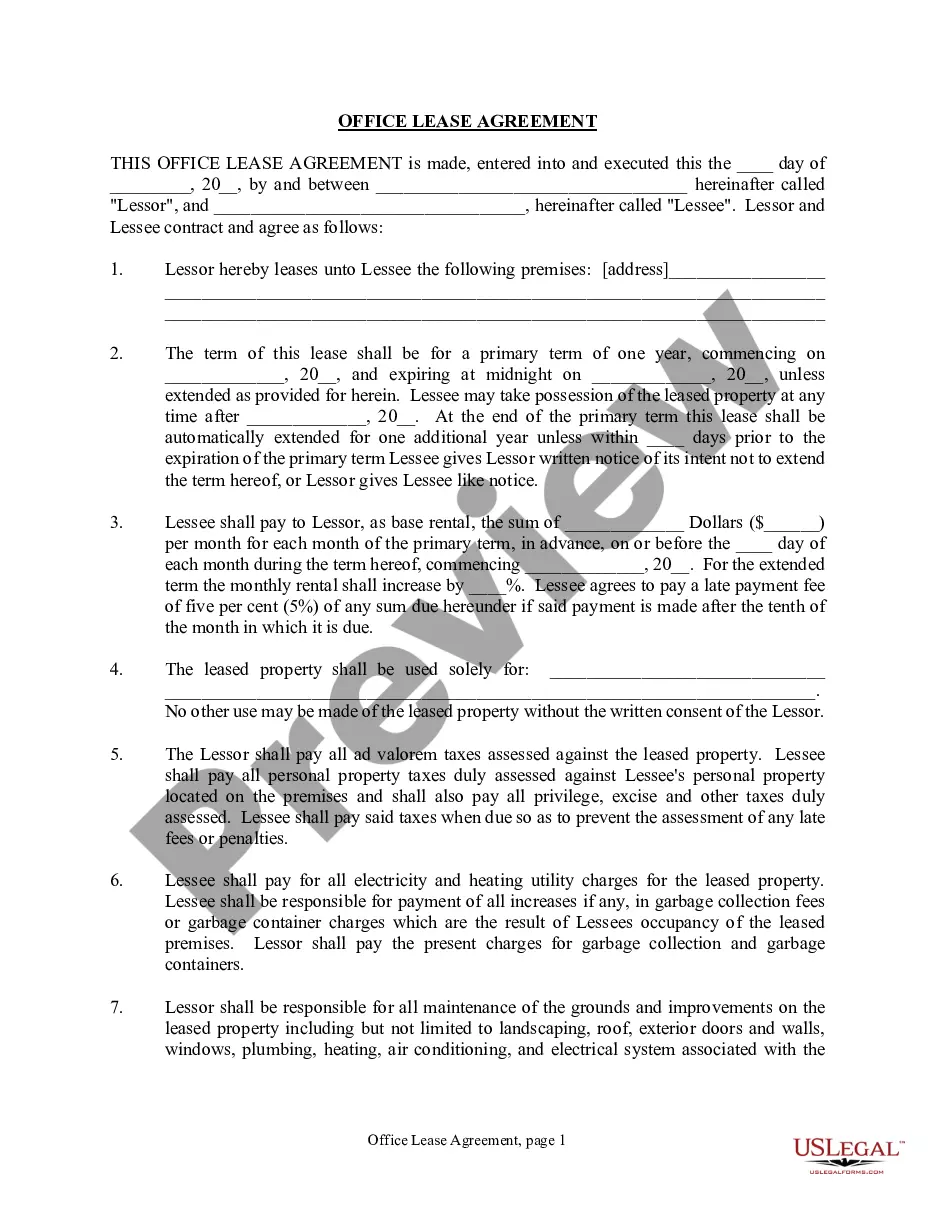

This form is a Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. Adapt to your specific circumstances. Don't reinvent the wheel, save time and money.

Guam Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage

Description

How to fill out Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage?

Are you in a circumstance where you require documents for either business or personal purposes nearly every day? There are numerous legal document templates available online, but locating forms you can trust is challenging.

US Legal Forms provides thousands of form templates, such as the Guam Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, which are designed to meet state and federal requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Guam Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage template.

Choose a convenient file format and download your copy.

Access all the document templates you have purchased in the My documents section. You can get another copy of the Guam Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage whenever needed. Just click on the required form to download or print the document template. Use US Legal Forms, the largest selection of legal forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for a variety of purposes. Create an account on US Legal Forms and start simplifying your life.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the form you need and ensure it is for the correct city/state.

- Use the Review button to examine the form.

- Check the details to make sure you have selected the correct form.

- If the form is not what you are looking for, use the Search field to find the form that meets your needs and requirements.

- Once you locate the correct form, click Acquire now.

- Select the pricing plan you want, provide the necessary information to create your account, and process the payment using your PayPal or credit card.

Form popularity

FAQ

The burden of proof for a declaratory judgment generally falls on the party seeking the declaration. In the case of a Guam Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, this party must establish their claims by a preponderance of the evidence. This standard requires that the evidence presented tips the scales in their favor, reflecting that their interpretation of the policy is more credible.

The requirements for a declaratory judgment include a clear statement of the legal issue, the existence of a legal relationship between the parties, and the need for a court’s determination. In the context of a Guam Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, it is crucial to establish that the court's ruling will resolve the uncertainty regarding policy coverage. This helps both parties understand their rights and obligations.

To initiate a declaratory judgment action, the plaintiff must demonstrate an actual controversy that requires resolution. The Guam Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage must involve parties with a legal interest in the policy in question. Additionally, the court must have jurisdiction over the matter and the parties involved.

The three burdens of proof include the preponderance of the evidence, clear and convincing evidence, and beyond a reasonable doubt. In a Guam Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage, the most commonly applied standard is the preponderance of the evidence. This means that one party must show that their claims are more likely true than not.

An insurance company may seek a declaratory judgment when there is uncertainty regarding the terms of a policy or the obligations of the parties. This typically occurs when the insurer believes there may be a dispute over coverage, such as in the case of a Guam Complaint For Declaratory Judgment To Determine Credit Life Policy Coverage. By obtaining a court's ruling, the insurer aims to clarify its responsibilities and avoid potential litigation.