Georgia Self-Employed Seamstress Services Contract

Description

How to fill out Self-Employed Seamstress Services Contract?

Have you ever been in a situation where you require documents for both professional or personal purposes almost daily.

There are numerous legitimate document templates available online, but locating ones you can trust is not easy.

US Legal Forms offers a vast array of form templates, including the Georgia Self-Employed Seamstress Services Contract, that are designed to meet federal and state requirements.

Once you find the correct form, simply click Purchase now.

Choose the pricing plan you desire, fill in the required information to create your account, and pay for your order using your PayPal or credit card. Select a convenient file format and download your copy. You can find all the document templates you have purchased in the My documents menu. You can obtain another copy of the Georgia Self-Employed Seamstress Services Contract at any time, if required. Just click on the necessary form to download or print the document template. Use US Legal Forms, the most extensive collection of legal forms, to save time and avoid errors. The service provides professionally crafted legal document templates that you can utilize for various purposes. Create an account on US Legal Forms and start making your life easier.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you can download the Georgia Self-Employed Seamstress Services Contract template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

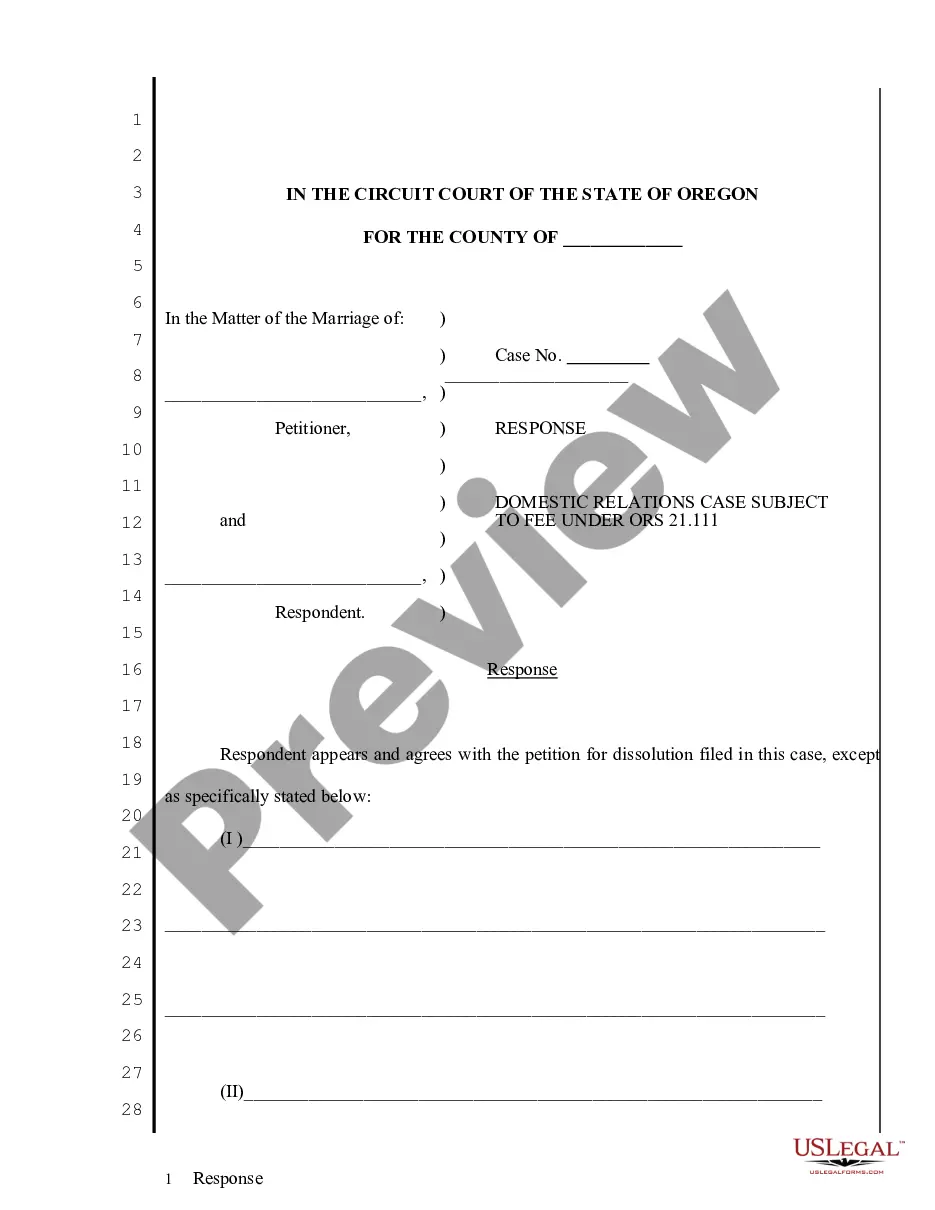

- Use the Preview button to review the form.

- Read the description to confirm that you have selected the right form.

- If the form is not what you are looking for, utilize the Search field to find the form that fits your needs and requirements.

Form popularity

FAQ

Yes, self-employed individuals, including seamstresses, benefit greatly from having a contract. A well-drafted Georgia Self-Employed Seamstress Services Contract protects both you and your clients by defining the scope of work, payment terms, and expectations. This clarity can help prevent disputes and ensure a smooth working relationship. Utilizing resources like US Legal Forms can provide you with the necessary templates to create a professional contract tailored to your needs.

To secure a contract with the state of Georgia, you should start by registering your business with the Georgia Secretary of State. Next, visit the Georgia Procurement Registry to identify available contracts that match your services. It is essential to prepare a Georgia Self-Employed Seamstress Services Contract that outlines your offerings and terms. Additionally, consider using platforms like US Legal Forms to access customizable contract templates that meet state requirements.

Writing a contract for a 1099 employee involves outlining the nature of the work, payment rate, and any deadlines. It is also important to clarify that the worker is not an employee but an independent contractor. For a reliable Georgia Self-Employed Seamstress Services Contract, you can utilize the templates available on US Legal Forms, which make it easy to create compliant agreements.

To write a self-employed contract, start by detailing the services you will provide, payment amounts, and deadlines. Clearly state both parties' responsibilities and any provisions for changes to the agreement. A well-structured Georgia Self-Employed Seamstress Services Contract can help define expectations, and using US Legal Forms can guide you in drafting an effective document.

You can write your own legally binding contract as long as it meets the legal requirements, such as mutual consent and a lawful purpose. It is crucial to clearly outline the terms and conditions to avoid any potential disputes. To create a solid Georgia Self-Employed Seamstress Services Contract, consider using US Legal Forms for reliable templates and legal language.

Writing a simple employment contract involves specifying the job duties, compensation, and duration of employment. Additionally, include any relevant policies, such as vacation days and notice periods. A straightforward Georgia Self-Employed Seamstress Services Contract can streamline your agreements, and platforms like US Legal Forms provide user-friendly templates to simplify this process.

To write a self-employment contract, start by outlining the key elements, such as the services you will provide, payment terms, and the duration of the agreement. Make sure to include clauses that address confidentiality and termination conditions. For a comprehensive Georgia Self-Employed Seamstress Services Contract, you can find helpful resources on US Legal Forms, which offer templates tailored to your needs.

Yes, you can write your own service agreement. It is essential, however, to ensure that the contract clearly defines the scope of work, payment terms, and any other important conditions. A well-drafted Georgia Self-Employed Seamstress Services Contract can help prevent misunderstandings and protect your interests. If you need assistance, consider using platforms like US Legal Forms for templates and guidance.

The purpose of an independent contractor agreement is to clearly define the terms of the working relationship. This agreement protects both parties by establishing expectations, payment terms, and responsibilities. For those in the Georgia Self-Employed Seamstress Services arena, having a solid agreement can prevent disputes and ensure smooth collaboration.

The independent contractor law in Georgia defines the legal framework for classifying workers as independent contractors. This law establishes criteria that help determine whether a worker is engaged in an independent business or is an employee. For seamstresses offering Georgia Self-Employed Seamstress Services, understanding these laws is important for compliance and maintaining your status.