Georgia Account Executive Agreement - Self-Employed Independent Contractor

Description

How to fill out Account Executive Agreement - Self-Employed Independent Contractor?

Are you in a position where you frequently require documents for business or specific purposes almost every day? There are numerous legal document templates accessible online, but finding reliable versions isn’t easy. US Legal Forms offers thousands of form templates, such as the Georgia Account Executive Agreement - Self-Employed Independent Contractor, designed to meet federal and state requirements.

If you are already acquainted with the US Legal Forms website and have an account, just Log In. After that, you can download the Georgia Account Executive Agreement - Self-Employed Independent Contractor template.

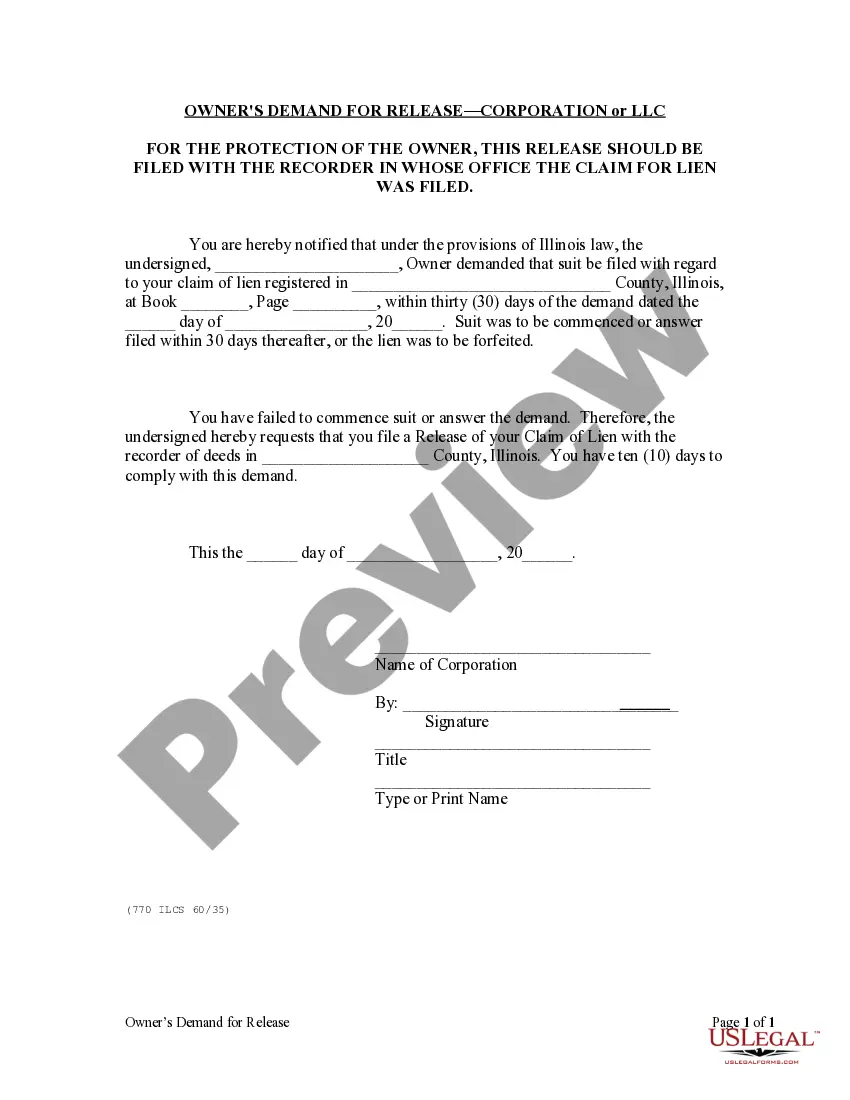

If you do not possess an account and wish to start utilizing US Legal Forms, follow these steps: Obtain the form you need and ensure it is for the correct city/area. Use the Preview button to examine the form. Review the description to confirm you have selected the correct form. If the form isn’t what you're looking for, use the Search field to find the form that meets your needs. Once you locate the right form, simply click Get now. Choose the pricing plan you desire, enter the required information to create your account, and complete the purchase using your PayPal or credit card. Select a convenient document format and download your version. Access all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Georgia Account Executive Agreement - Self-Employed Independent Contractor whenever needed. Click on the necessary form to download or print the document template.

- Utilize US Legal Forms, one of the most extensive collections of legal forms, to save time and prevent errors.

- The service provides well-crafted legal document templates that can be utilized for various purposes.

- Create an account on US Legal Forms and start making your life a bit easier.

Form popularity

FAQ

The ABC rule for independent contractors provides a clear framework to identify whether a worker should be classified as an independent contractor. It emphasizes that a contractor must maintain independence from the employer, conduct work distinctly from the employer's core operations, and possess an established trade or business of their own. This rule is essential for anyone drafting or entering into a Georgia Account Executive Agreement - Self-Employed Independent Contractor.

Several states, including California, Massachusetts, and New Jersey, utilize the ABC test to determine independent contractor status. This test assesses whether a worker operates independently of the company, is engaged in an occupation distinct from the employer, and performs work that is not central to the employer's business. Understanding this test is essential for anyone considering a Georgia Account Executive Agreement - Self-Employed Independent Contractor.

Independent contractors in Georgia must adhere to specific rules governing their work relationships. They are not entitled to many of the benefits provided to employees, such as health insurance or unemployment benefits. In addition, they should operate under their brand, manage their schedules, and maintain control over how to fulfill their tasks, as outlined in a Georgia Account Executive Agreement - Self-Employed Independent Contractor.

The independent contractor agreement in Georgia outlines the terms of the working relationship between a client and a contractor. This agreement specifies that the contractor operates independently, meaning they control how tasks are completed and are responsible for their own taxes. By using a Georgia Account Executive Agreement - Self-Employed Independent Contractor, both parties can clearly define expectations and avoid misunderstandings.

Filling out an independent contractor form starts with entering your basic information, such as name and address. Next, describe the services you offer and specify the payment structure that aligns with the Georgia Account Executive Agreement - Self-Employed Independent Contractor. You can find easy-to-use forms on USLegalForms that guide you through the process, ensuring compliance with relevant laws.

Writing an independent contractor agreement involves outlining the terms and conditions of the working relationship. Begin with the introduction of both parties and describe the services to be provided. Be sure to incorporate critical aspects like payment details and the duration of the partnership, focusing on the Georgia Account Executive Agreement - Self-Employed Independent Contractor. Utilize templates from USLegalForms to streamline the writing process.

To fill out an independent contractor agreement, start by including the names and contact information of both parties. Clearly define the scope of work, payment terms, and deadlines. Ensure you detail any specific responsibilities related to the Georgia Account Executive Agreement - Self-Employed Independent Contractor. Finally, both parties should sign and date the agreement to make it legally binding.

A basic independent contractor agreement outlines the relationship between a client and a contractor. This document typically includes details such as scope of work, payment terms, and responsibilities of both parties. Specifically, a Georgia Account Executive Agreement - Self-Employed Independent Contractor formalizes these terms, providing clarity and legal protection. By using a structured agreement, both the client and the contractor can minimize misunderstandings and focus on achieving their goals.

The independent contractor law in Georgia defines the legal relationship between a worker and a business. Under this law, an independent contractor operates autonomously and is not subject to the same control as an employee. This means that independent contractors, including those under a Georgia Account Executive Agreement - Self-Employed Independent Contractor, manage their own tax responsibilities and work hours. It is essential for both parties to understand these regulations to ensure compliance and protect their interests.