Although no definite rule exists for determining whether one is an independent contractor or an employee, certain indicia of the status of an independent contractor are recognized, and the insertion of provisions embodying these indicia in the contract will help to insure that the relationship reflects the intention of the parties. These indicia generally relate to the basic issue of control. The general test of what constitutes an independent contractor relationship involves which party has the right to direct what is to be done, and how and when. Another important test involves the method of payment of the contractor.

Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor

Description

How to fill out Agreement By Accounting Firm To Employ Auditor As Self-Employed Independent Contractor?

You can dedicate numerous hours online searching for the valid document template that meets the state and federal requirements you need.

US Legal Forms offers thousands of valid forms that are evaluated by professionals.

You can download or print the Georgia Agreement by Accounting Firm to Hire Auditor as Self-Employed Independent Contractor from their service.

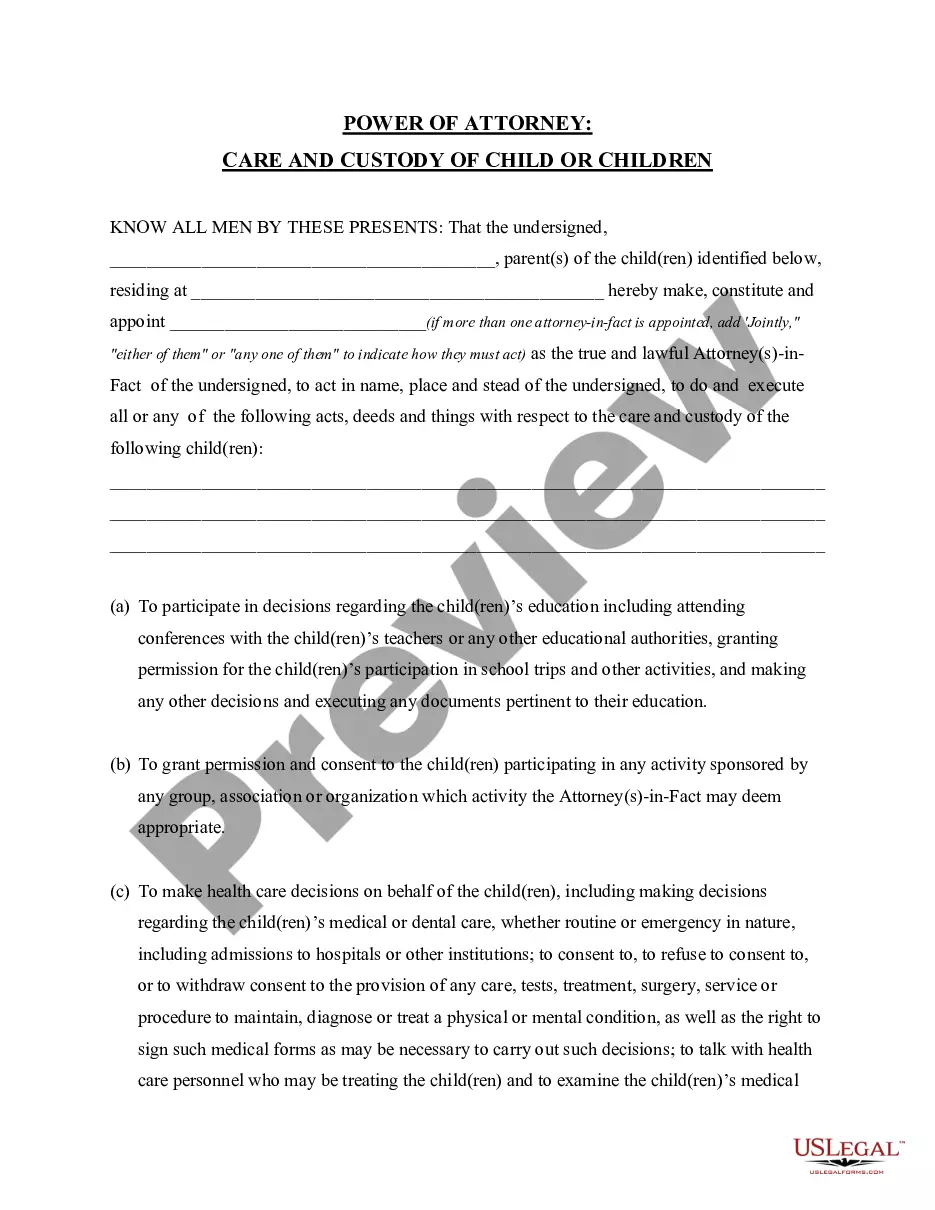

If available, use the Review button to preview the document template simultaneously.

- If you have a US Legal Forms account, you can sign in and click the Download button.

- After that, you can complete, modify, print, or sign the Georgia Agreement by Accounting Firm to Hire Auditor as Self-Employed Independent Contractor.

- Each valid document template you obtain is yours permanently.

- To get another copy of any downloaded form, visit the My documents tab and click the relevant button.

- If you are using the US Legal Forms website for the first time, adhere to the simple instructions below.

- Firstly, ensure you have chosen the correct document template for the state/city you select.

- Review the form information to ensure you have selected the appropriate form.

Form popularity

FAQ

Yes, Georgia uses the ABC test to determine the status of independent contractors. This test assesses the degree of control and independence an individual has in their work. Understanding the nuances of the Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor can ensure compliance with this evaluation process.

Yes, you can be self-employed as an accountant. This arrangement gives you the autonomy to choose your clients and manage your work schedule. By using a Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, you can define your role and responsibilities, ensuring a solid business foundation.

Yes, accountants can serve as independent contractors. This setup allows accountants to provide their expertise without the restrictions of traditional employment. A Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor can clarify the terms of this relationship and protect both parties.

Yes, accountants can work independently. This means they can offer their services directly to clients without being tied to an employer. By engaging in a Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, accountants can ensure they meet legal requirements while enjoying the benefits of independent work.

Certainly, an accountant can have their own business. Many accountants operate independent firms, providing specialized services to clients. When you establish a Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, it gives you the legal framework to operate successfully.

Yes, you can become an independent accountant. This path offers the freedom to manage your own client base and set your own fees. By establishing a Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, you can specify the nature of your services while maintaining compliance with applicable laws.

Yes, a company can hire you as an independent contractor. This arrangement allows for flexibility in employment, where you are not considered an employee but rather a self-employed individual. Under a Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor, you can structure your work terms while complying with state regulations.

Writing a simple business agreement involves outlining the terms mutually agreed upon by the parties. Include the names, dates, and detailed descriptions of the services or products exchanged. Define payment terms, obligations, and any relevant timelines. Utilizing resources from USLegalForms can help you create a Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor that is both clear and legally binding.

To write an independent contractor agreement, begin by defining the roles and responsibilities of both the contractor and the hiring firm. Specify payment terms, project duration, and any required deliverables. It is advisable to include clauses on confidentiality and dispute resolution to protect your interests. A Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor can simplify this process with appropriate guidelines and customizable templates available on USLegalForms.

To write a simple contract agreement, start by clearly stating the purpose of the contract. Include the names and contact information of all parties involved, as well as the specific terms and conditions. Make sure to detail the scope of work, payment terms, and any deadlines. Consider using a template from USLegalForms for a Georgia Agreement by Accounting Firm to Employ Auditor as Self-Employed Independent Contractor to ensure accuracy and compliance.