Georgia Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on Transfer

Description

How to fill out Notice Concerning Introduction Of Remuneration Plan For Shares With Restriction On Transfer?

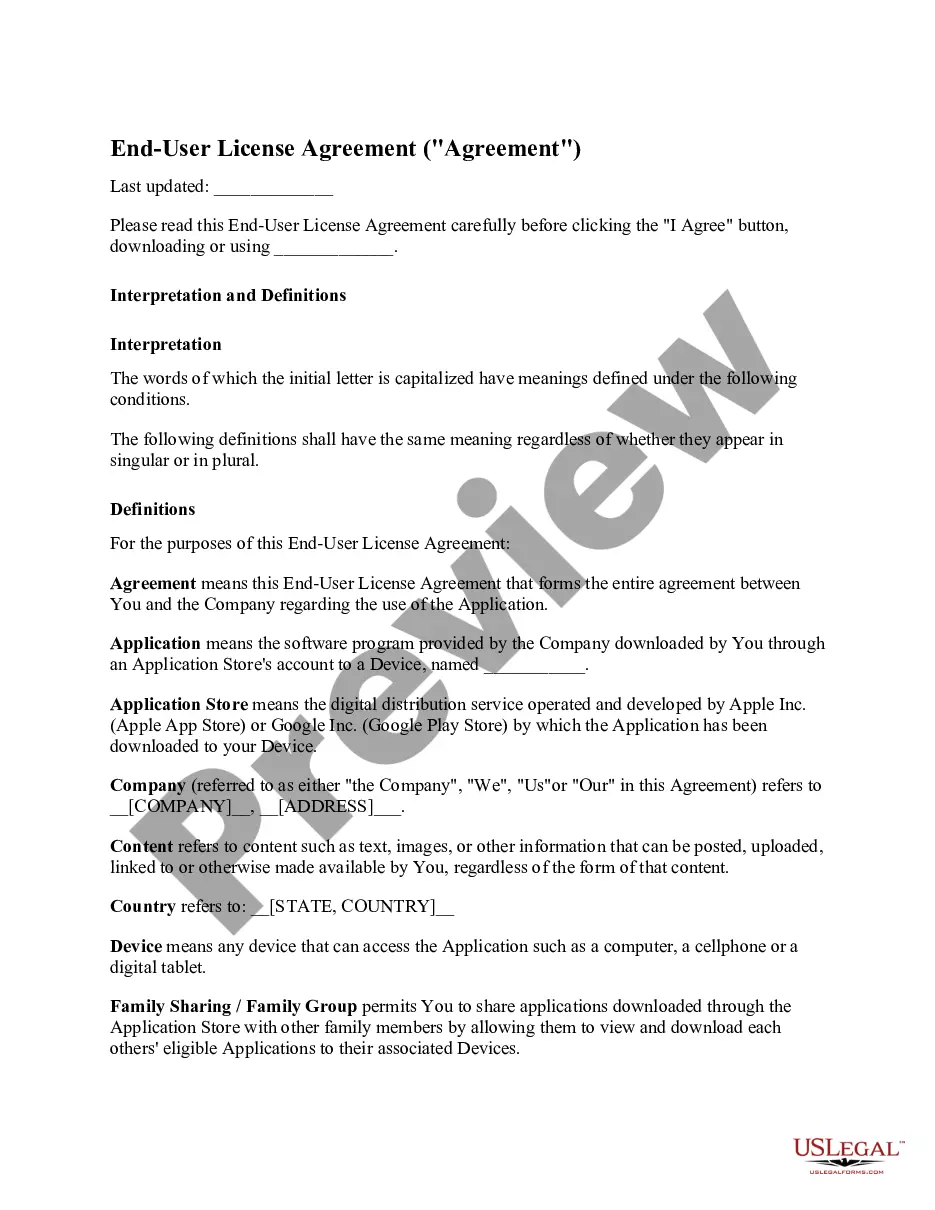

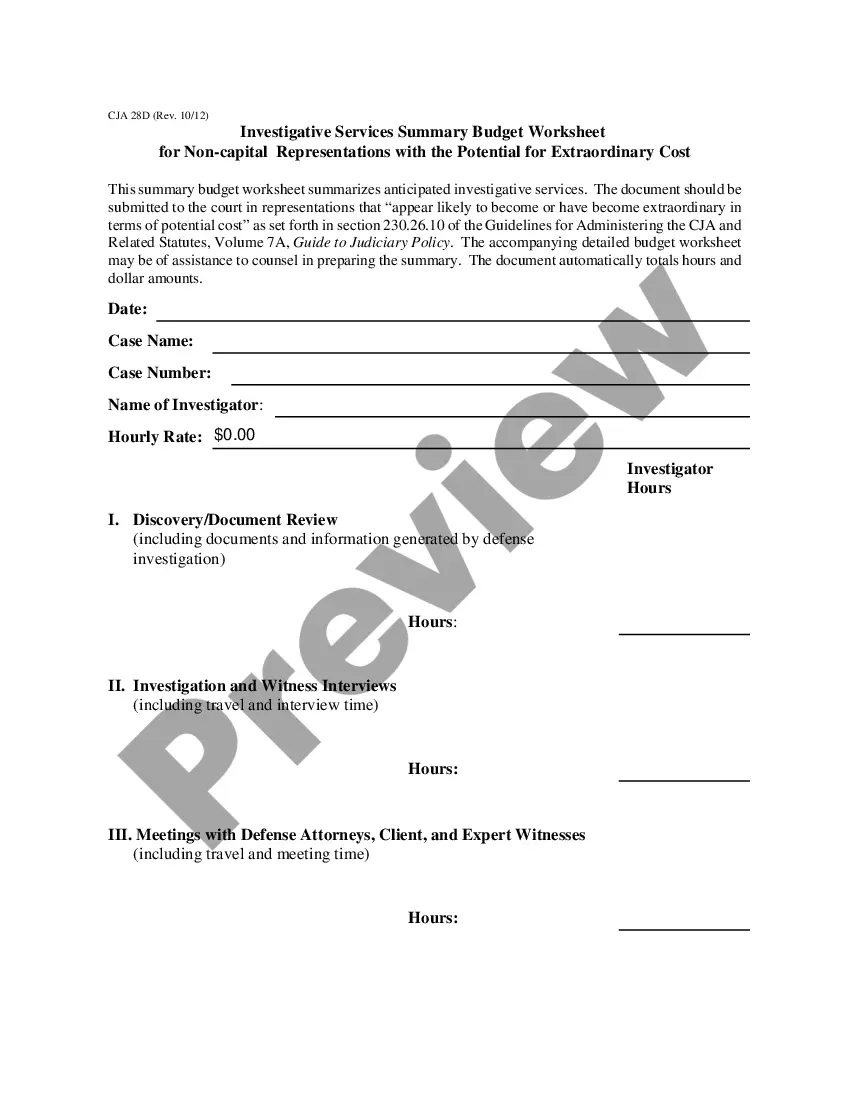

If you wish to complete, obtain, or printing authorized document web templates, use US Legal Forms, the most important collection of authorized varieties, which can be found on the web. Utilize the site`s simple and hassle-free search to find the documents you need. Different web templates for company and person functions are categorized by groups and suggests, or keywords and phrases. Use US Legal Forms to find the Georgia Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on in just a number of mouse clicks.

When you are currently a US Legal Forms buyer, log in for your bank account and click on the Download key to have the Georgia Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on. You may also entry varieties you in the past saved from the My Forms tab of your own bank account.

If you are using US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Make sure you have selected the shape for your correct area/nation.

- Step 2. Take advantage of the Preview option to look over the form`s content. Do not neglect to read the outline.

- Step 3. When you are unsatisfied with the form, take advantage of the Lookup industry towards the top of the display screen to get other types of your authorized form web template.

- Step 4. After you have located the shape you need, select the Purchase now key. Select the prices plan you choose and put your references to register on an bank account.

- Step 5. Method the financial transaction. You can utilize your Мisa or Ьastercard or PayPal bank account to perform the financial transaction.

- Step 6. Pick the formatting of your authorized form and obtain it on your product.

- Step 7. Complete, modify and printing or signal the Georgia Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on.

Every single authorized document web template you acquire is yours forever. You possess acces to every single form you saved inside your acccount. Click the My Forms section and decide on a form to printing or obtain yet again.

Contend and obtain, and printing the Georgia Notice Concerning Introduction of Remuneration Plan for Shares with Restriction on with US Legal Forms. There are millions of skilled and status-certain varieties you can utilize to your company or person requirements.

Form popularity

FAQ

The accounting for restricted stock awards can be quite technical. For example, if actual shares are delivered to the employee, then journal entries would impact equity. If the value of the shares is paid in cash, then the company would most likely record a liability. Restricted Stock - Overview, Transition, Unit, Award corporatefinanceinstitute.com ? accounting ? restri... corporatefinanceinstitute.com ? accounting ? restri...

A grant date is established when the following criteria are met: The employer and its employees have reached a mutual understanding of the award's key terms and conditions. The company is contingently obligated to issue shares or transfer assets to employees who fulfill vesting conditions. 2.6 Grant date, requisite service period and expense attribution PwC ? 26_grant_date_requis_US PwC ? 26_grant_date_requis_US

When an employee exercises stock options, you'll credit Common Stock for the number of shares x par value, debit Cash for the number of shares x the exercise price, then debit Additional Paid-In Capital for the difference, representing the increase in value of the shares during the service period.

Under US GAAP, stock based compensation (SBC) is recognized as a non-cash expense on the income statement. Specifically, SBC expense is an operating expense (just like wages) and is allocated to the relevant operating line items: SBC issued to direct labor is allocated to cost of goods sold. Stock Based Compensation (SBC) | Journal Entry Examples wallstreetprep.com ? knowledge ? stock-bas... wallstreetprep.com ? knowledge ? stock-bas...

The RSUs are assigned a fair market value (FMV) when they vest. Restricted stock units are considered income once vested, and a portion of the shares is withheld to pay income taxes. The employee then receives the remaining shares and has the right to sell them.

Restricted shares are unregistered, non-transferable shares issued to a company's employees. They give employees incentives to help companies attain success. They are most common in established companies that want to motivate people with an equity stake. Their sale is usually restricted by a vesting schedule. Restricted Shares vs. Stock Options: What's the Difference? - Investopedia investopedia.com ? ask ? answers ? what-are... investopedia.com ? ask ? answers ? what-are...

Stock Compensation Is an Expense For many companies, compensation is their most significant expense. Most forms of stock compensation are compensatory in nature; as such, they result in expense that the company recognizes in its P&L. Occasionally stock compensation is not considered compensatory.

2 Income statement. Stock-based compensation expense should be included in the same income statement line or lines as the cash compensation paid to the employees receiving the stock-based awards (for example, cost of sales, research and development costs, or general and administrative costs).