Georgia Grant Agreement from 501(c)(3) to 501(c)(4)

Description

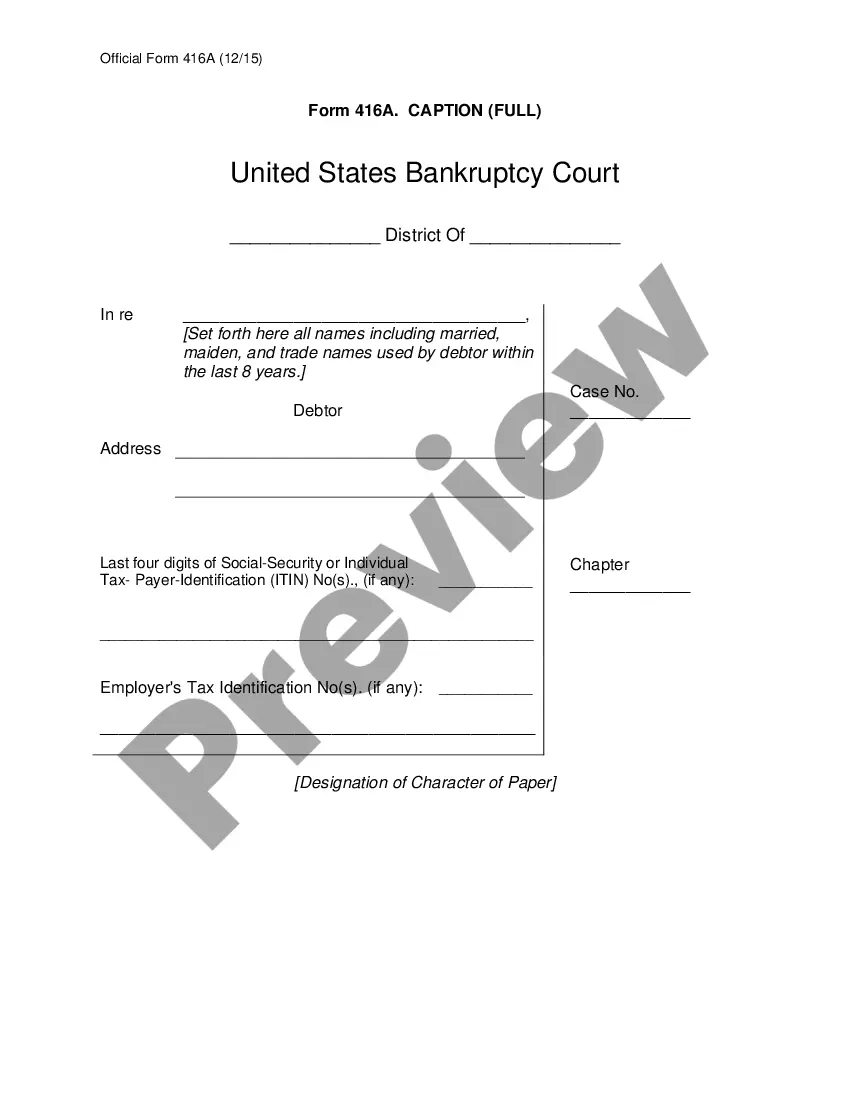

How to fill out Grant Agreement From 501(c)(3) To 501(c)(4)?

If you wish to comprehensive, download, or print authorized record themes, use US Legal Forms, the most important selection of authorized varieties, that can be found on the Internet. Make use of the site`s simple and easy handy look for to obtain the paperwork you require. Numerous themes for company and specific functions are sorted by classes and suggests, or keywords. Use US Legal Forms to obtain the Georgia Grant Agreement from 501(c)(3) to 501(c)(4) within a couple of click throughs.

Should you be currently a US Legal Forms consumer, log in in your account and click the Down load option to have the Georgia Grant Agreement from 501(c)(3) to 501(c)(4). You may also access varieties you in the past saved inside the My Forms tab of the account.

Should you use US Legal Forms for the first time, refer to the instructions listed below:

- Step 1. Be sure you have chosen the form for that correct city/nation.

- Step 2. Make use of the Preview choice to look through the form`s content. Don`t forget to read through the description.

- Step 3. Should you be not happy with all the type, utilize the Lookup area near the top of the monitor to find other types of your authorized type web template.

- Step 4. After you have located the form you require, select the Get now option. Opt for the prices strategy you choose and put your references to sign up to have an account.

- Step 5. Process the deal. You should use your Мisa or Ьastercard or PayPal account to accomplish the deal.

- Step 6. Find the format of your authorized type and download it in your product.

- Step 7. Complete, modify and print or sign the Georgia Grant Agreement from 501(c)(3) to 501(c)(4).

Every authorized record web template you get is yours for a long time. You might have acces to every type you saved within your acccount. Click on the My Forms portion and choose a type to print or download again.

Be competitive and download, and print the Georgia Grant Agreement from 501(c)(3) to 501(c)(4) with US Legal Forms. There are millions of expert and express-specific varieties you can utilize for your company or specific demands.

Form popularity

FAQ

Grants from a 501(c)(3) to a 501(c)(4) should not be made to cover fundraising costs or general support of the 501(c)(4) (this is to protect the 501(c)(3) from the grant being used for impermissible purposes).

Can a 501(c)(3) organization change into a 501(c)(4) organization? A 501(c)(3) organization cannot change into a 501(c)(4) organization. But it can dissolve to create a new 501(c)(4) organization.

If you plan to write a grant proposal, you should familiarize yourself with the following parts: Introduction/Abstract/Executive Summary. ... Organizational Background. ... Problem Statement/Needs Assessment. ... Program Goals and Objectives. ... Methods and Activities. ... Evaluation Plan. ... Budget/Sustainability.

In addition to 501c3 organizations, 501c3 nonprofits can also donate to 501c4 organizations. These contributions must be used for charitable purposes, and no amount can be used for political activities.

Grants to a 501(c)(4) Organization While a 501(c)(3) organization may be prohibited from distributing its remaining assets upon dissolution to a 501(c)(4) organization, it can make a grant to a 501(c)(4) organization.

A 501(c)(4) should only seek funds for a non-lobbying primary purpose activity and should ensure the grant funds are requested for nonpartisan work. For example, a 501(c)(4) that works with immigrants in its community could request grant funds to educate its constituents on new vote by-mail-processes.

Private foundations may make grants to 501(c)(4) organizations (or other non-public charities) as long as the grant is for charitable purposes. Charitable purposes include any permissible 501(c)(3) public charity activity except lobbying and voter registration.

In addition to standard terms describing grant amounts and purposes, agreements also include provisions regarding intellectual property rights, reporting requirements, and indemnification, among other subjects. Special provisions are included that deal with international philanthropy.