Georgia Retainer Agreement

Description

How to fill out Retainer Agreement?

Have you been in a situation the place you will need paperwork for either company or specific uses almost every working day? There are tons of lawful record templates available online, but finding types you can depend on isn`t straightforward. US Legal Forms delivers 1000s of kind templates, such as the Georgia Retainer Agreement, which are composed to meet federal and state demands.

Should you be currently knowledgeable about US Legal Forms website and also have your account, merely log in. Next, you can obtain the Georgia Retainer Agreement template.

Should you not provide an bank account and need to begin to use US Legal Forms, follow these steps:

- Obtain the kind you require and ensure it is to the right city/region.

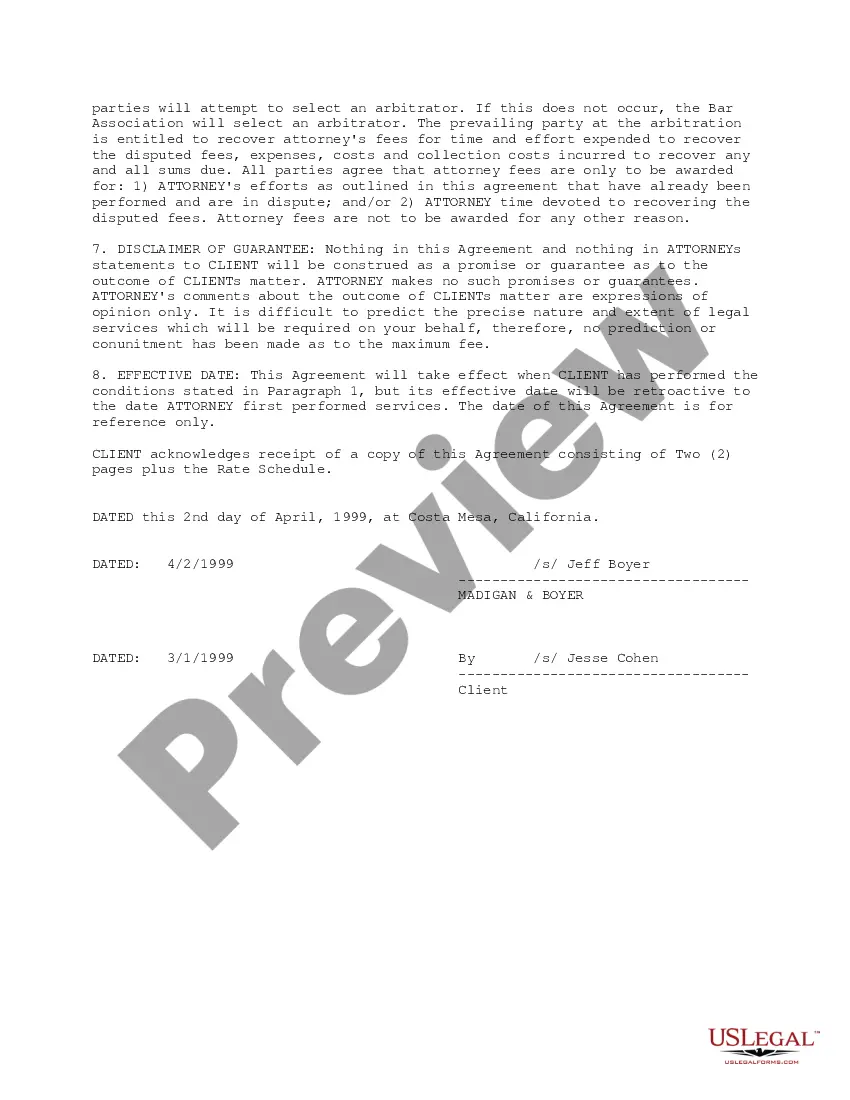

- Make use of the Review option to analyze the form.

- Browse the description to ensure that you have selected the proper kind.

- In case the kind isn`t what you are trying to find, use the Look for area to get the kind that meets your needs and demands.

- If you get the right kind, click on Purchase now.

- Opt for the costs plan you want, fill in the necessary details to generate your money, and pay for an order using your PayPal or credit card.

- Decide on a handy data file format and obtain your duplicate.

Locate all the record templates you might have purchased in the My Forms menu. You can aquire a additional duplicate of Georgia Retainer Agreement at any time, if necessary. Just click the needed kind to obtain or print the record template.

Use US Legal Forms, one of the most extensive assortment of lawful varieties, in order to save efforts and avoid blunders. The support delivers expertly created lawful record templates that you can use for a range of uses. Generate your account on US Legal Forms and initiate generating your way of life a little easier.

Form popularity

FAQ

A retainer is a fee paid to a lawyer or law firm in advance of services being rendered, and the law firm should hold it in a trust account until the services are provided. It gets booked to the balance sheet as a prepaid expense (which is an asset).

The essential parts of the agreement include: Scope and nature of the work. What is the attorney expected to do for the client? ... Retainer fee. The retainer fee is the amount charged to the client. ... Client expenses. The client typically pays for some expenses, especially filing-related expenses, and travel costs.

The agreement should clearly outline the payment schedule, the hourly rate or flat fee, and any additional expenses or fees. Clients should ensure that they understand the payment terms and are comfortable with the payment structure before signing the agreement.

A retainer is a fee paid to a lawyer or law firm in advance of services being rendered, and the law firm should hold it in a trust account until the services are provided. It gets booked to the balance sheet as a prepaid expense (which is an asset).

The retainer or deposit is treated as a liability to show that, although your business is holding the money from a deposit or retainer, it doesn't belong to you until it's used to pay for services. When you invoice the customer and receive payment against it, you'll turn that liability into income.

This agreement should cover elements like the services you'll provide, how long the working relationship will last, fees, pricing, confidentiality, and more. This sounds like a lot, but it's important to create a comprehensive agreement that protects your agency should anything go wrong.

Accounting for a Retainer Fee If the firm is using the accrual basis of accounting, retainers are recognized as a liability upon receipt of the cash, and are recognized as revenue only after the associated work has been performed.

A retainer fee is an advance payment a client makes to a professional, and it is considered a down payment on the future services rendered by that professional. Regardless of occupation, the retainer fee funds the initial expenses of the working relationship.