Georgia Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V.

Description

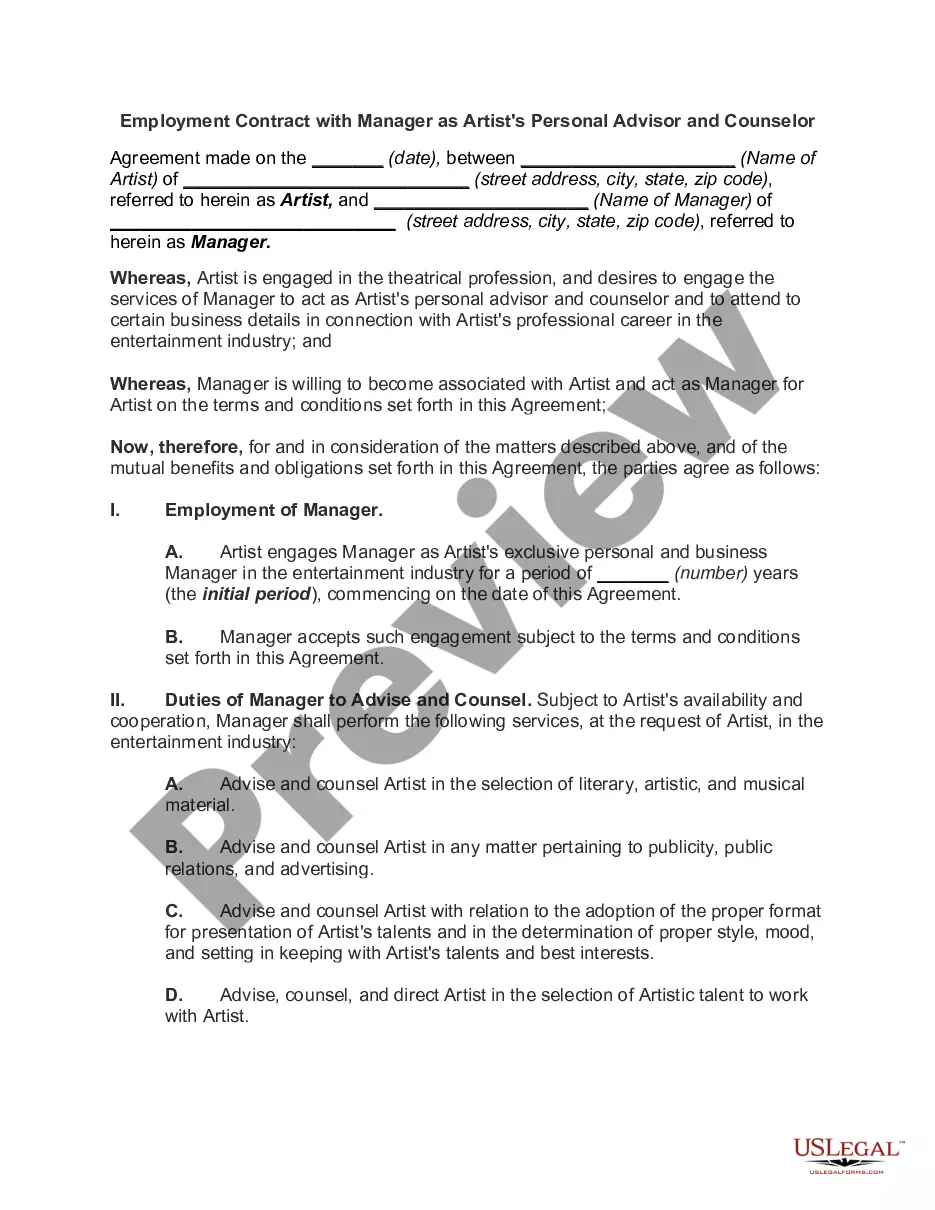

How to fill out Pledge Agreement Between ADAC Laboratories And ABN AMRO Bank, N.V.?

If you want to comprehensive, download, or printing authorized document themes, use US Legal Forms, the most important variety of authorized types, which can be found online. Use the site`s simple and handy lookup to discover the documents you will need. Various themes for company and individual purposes are sorted by groups and claims, or key phrases. Use US Legal Forms to discover the Georgia Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V. in just a few mouse clicks.

In case you are presently a US Legal Forms customer, log in in your account and click on the Acquire button to have the Georgia Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V.. You can even entry types you in the past delivered electronically inside the My Forms tab of the account.

If you work with US Legal Forms for the first time, refer to the instructions beneath:

- Step 1. Make sure you have chosen the form for the right area/country.

- Step 2. Make use of the Preview solution to examine the form`s content. Never neglect to see the outline.

- Step 3. In case you are not satisfied with the type, take advantage of the Research area near the top of the display to discover other models of your authorized type template.

- Step 4. When you have found the form you will need, go through the Buy now button. Choose the rates program you like and add your credentials to sign up to have an account.

- Step 5. Procedure the transaction. You can utilize your Мisa or Ьastercard or PayPal account to complete the transaction.

- Step 6. Pick the file format of your authorized type and download it in your gadget.

- Step 7. Complete, modify and printing or indicator the Georgia Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V..

Every authorized document template you buy is your own property for a long time. You possess acces to each type you delivered electronically within your acccount. Select the My Forms portion and pick a type to printing or download yet again.

Remain competitive and download, and printing the Georgia Pledge Agreement between ADAC Laboratories and ABN AMRO Bank, N.V. with US Legal Forms. There are thousands of skilled and express-specific types you may use for your personal company or individual needs.