This handbook describes the Fair Debt Collection Practices Act (FDCPA) and discusses how to negotiate with debt collectors and creditors. The handbook is divided into 4 sections. Section 1 briefly describes how consumer credit got started. Section 2 describes how to deal with debt collectors. Section 3 provides a detailed overview of the FDCPA. Finally, Section 4 is a journal for you to use to document your communicatioins with debt collectors.

Georgia Fair Debt Collection Practices Act Handbook

Description

How to fill out Fair Debt Collection Practices Act Handbook?

Are you presently in the situation where you require documentation for potential business or particular purposes almost every day.

There are numerous authentic document templates available online, but finding reliable ones can be challenging.

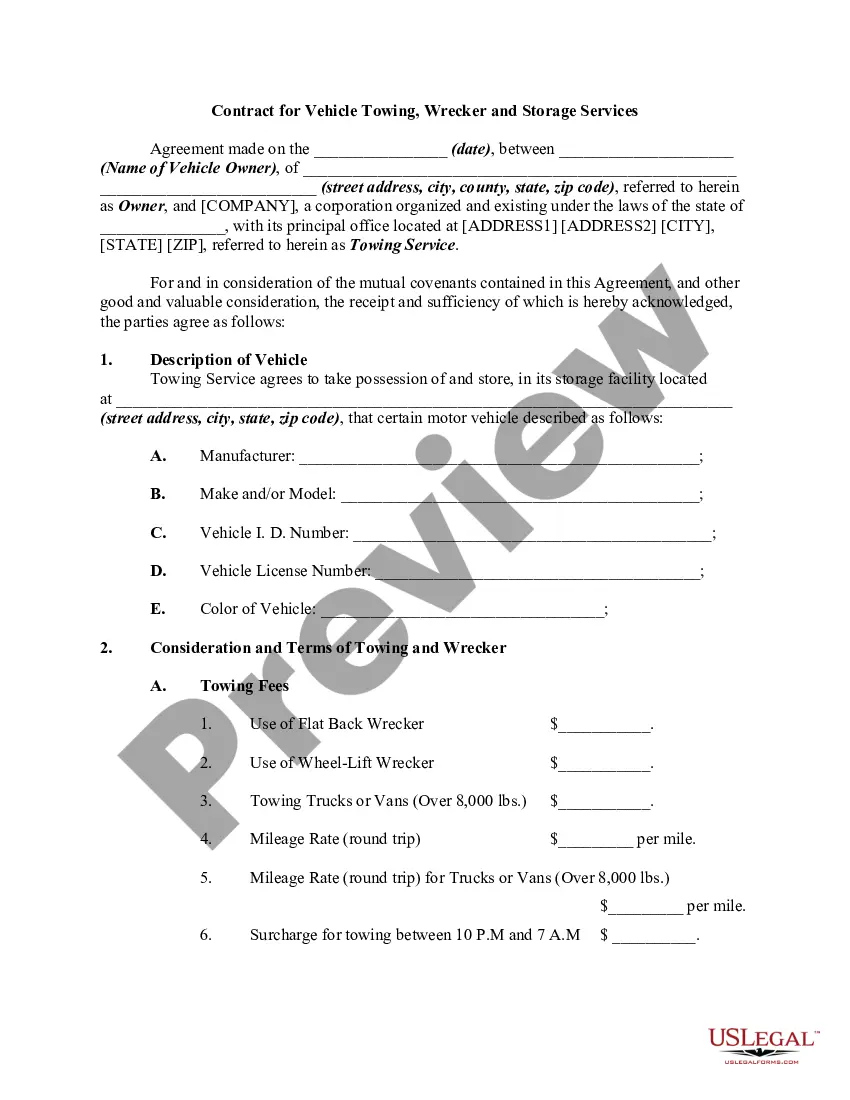

US Legal Forms offers thousands of document templates, similar to the Georgia Fair Debt Collection Practices Act Handbook, which can be customized to comply with state and federal regulations.

If you have found the appropriate document, click on Purchase now.

Select the payment plan you prefer, fill in the necessary details to create your account, and complete your order using PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Georgia Fair Debt Collection Practices Act Handbook template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for your specific city/county.

- Utilize the Preview button to review the document.

- Check the description to confirm you have selected the correct document.

- If the document does not match what you're looking for, use the Search bar to find the document that suits your requirements.

Form popularity

FAQ

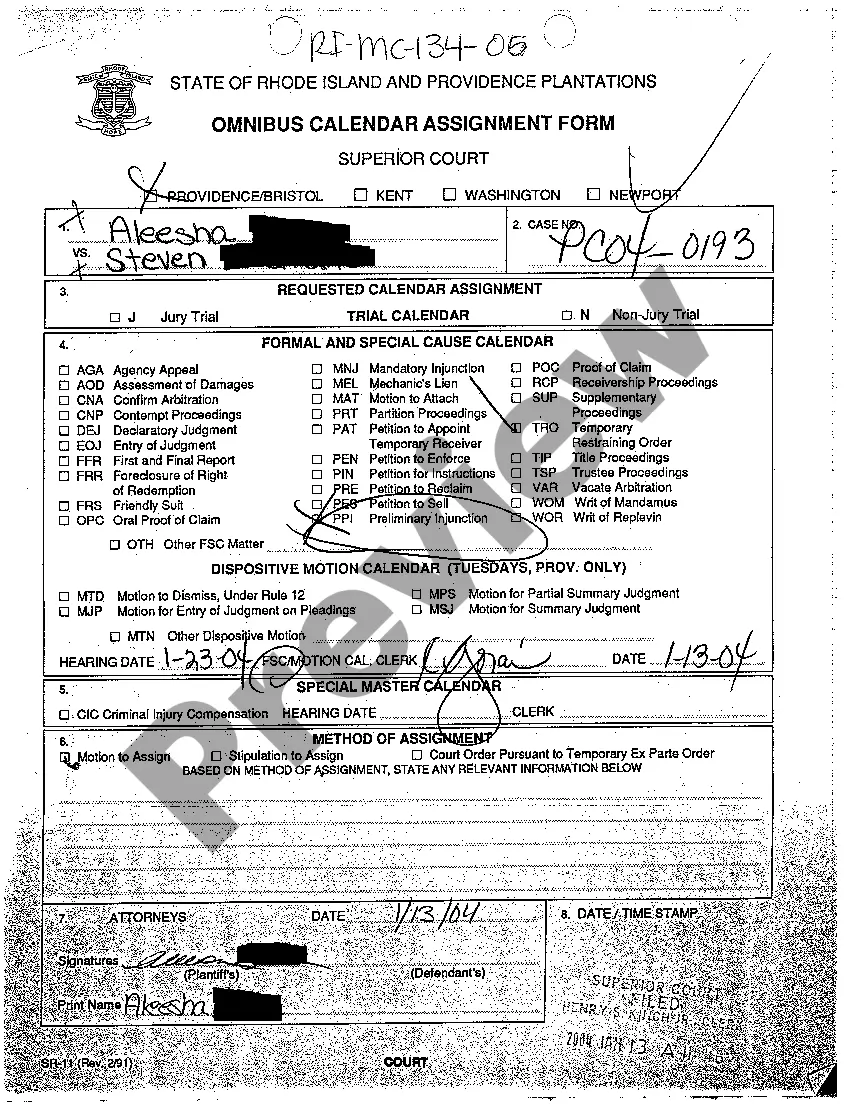

The most common violation of the Fair Debt Collection Practices Act involves using abusive or threatening language during communication with consumers. Many debt collectors do not adhere to the respectful communication standards set by the Georgia Fair Debt Collection Practices Act Handbook. Knowing these rights can help individuals stand firm against harassment and seek remedies through appropriate channels.

What are the provisions of the FDCPA?Call Time Restrictions.Honoring Workplace Opt-Outs.Honoring Home Phone Opt-Outs.Restrictions Against Harassment.Restrictions Against Unfair Practices.Restrictions Against False Lawsuit Threats.

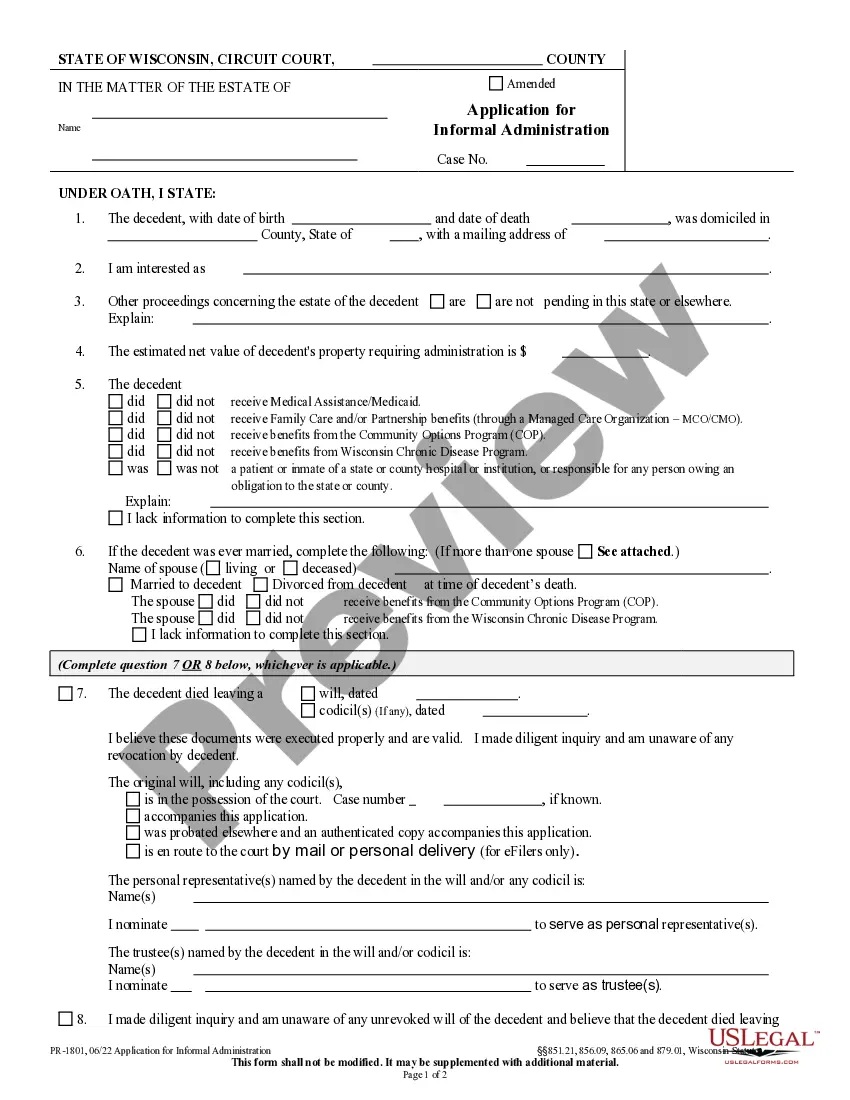

Original Creditors and Debt BuyersGeorgia does not have any special licensing or bonding requirements for collection agencies, nor does Georgia require licensing or bonding requirements for debt buyers.

The Fair Debt Collection Practices Act (FDCPA) (15 USC 1692 et seq.), which became effective in March 1978, was designed to eliminate abusive, deceptive, and unfair debt collection practices.

Statute of Limitations and Your Credit ReportCollection accounts can remain on your report for seven years and 180 days from the original delinquency. Depending on the type of account and your location, this can be more than or less than the statute of limitations.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Here are five ways the Fair Debt Collection Practices Act protects you and what to do if your rights are violated:You control communication with debt collectors.You're protected from harassing or abusive practices.Debt collectors must be truthful.Unfair practices are prohibited.Collectors must validate your debt.More items...

Most debts in Georgia have a statute of limitations of four years, like medical debt, credit card debt and auto loans. Mortgages have a slightly longer statute of limitations of six years, and any debt you may owe to your state for tax purposes has a statute of limitations of seven years.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.