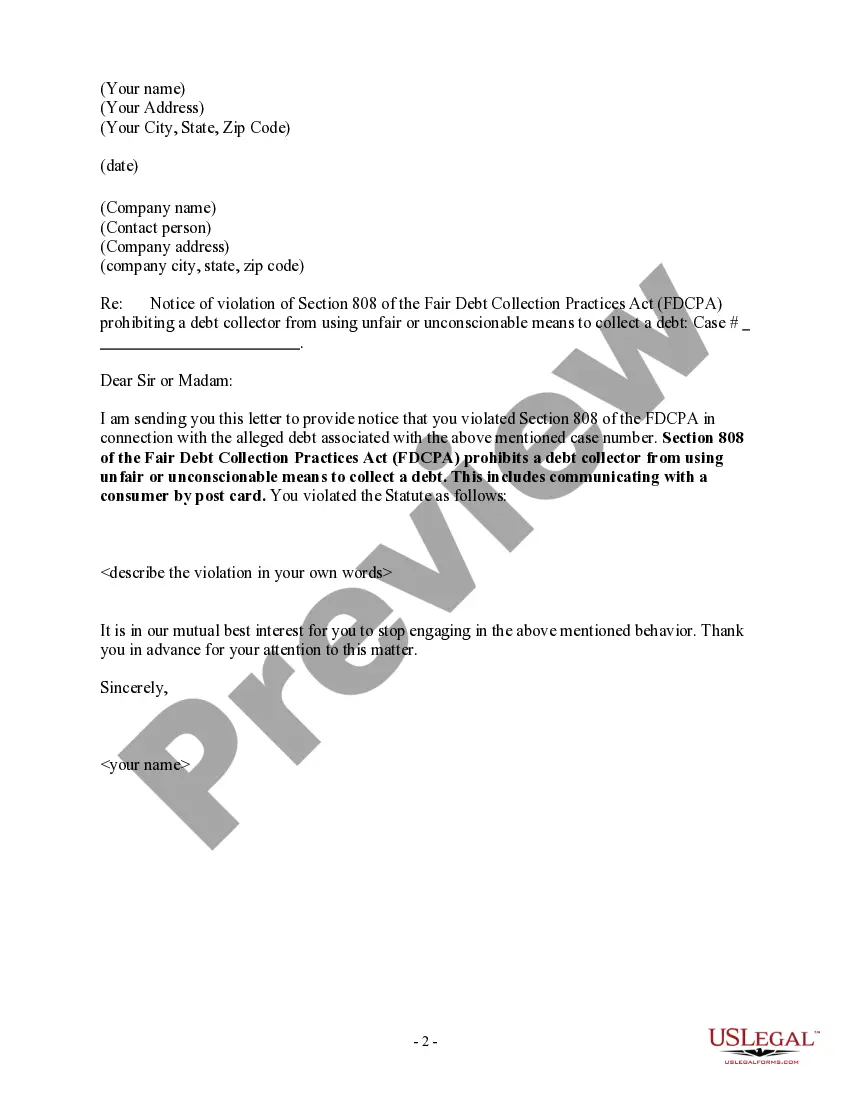

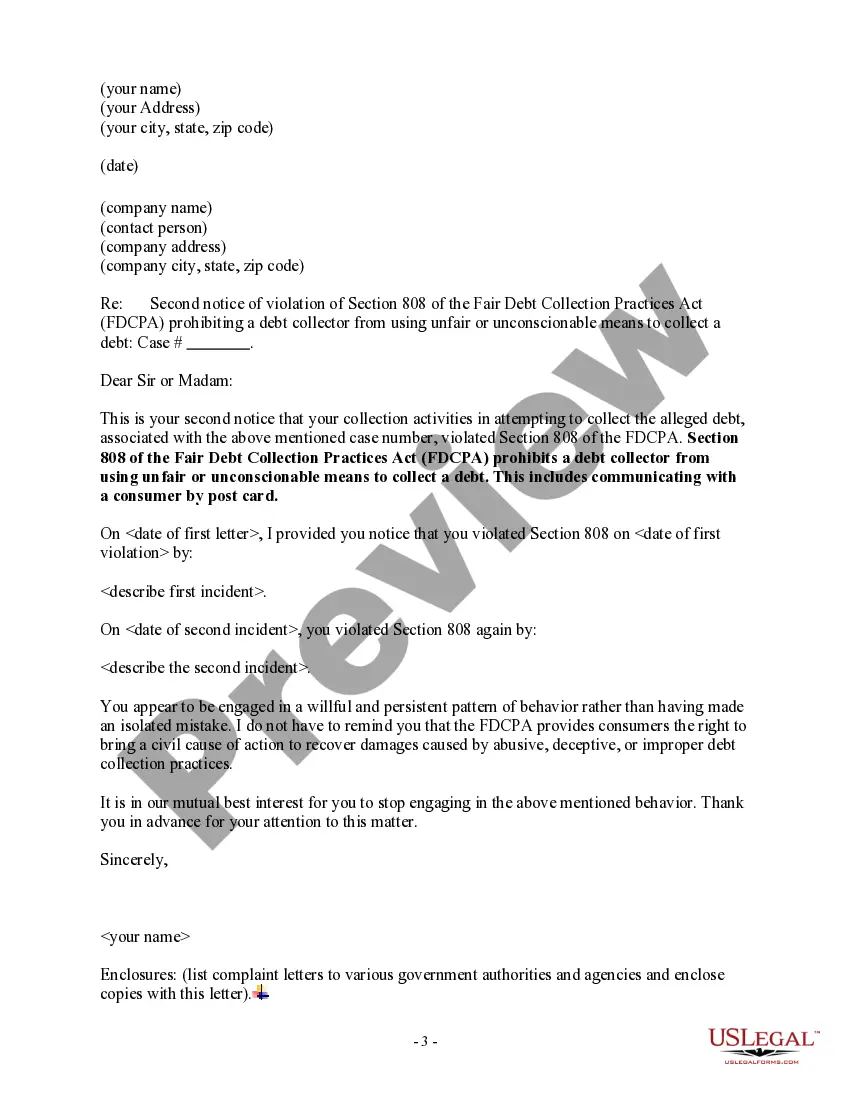

Georgia Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard

Description

How to fill out Notice Of Violation Of Fair Debt Act - Unlawful Contact By Postcard?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a diverse selection of legal document templates that you can download or print.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Georgia Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard in no time.

If you have a monthly subscription, Log In and retrieve the Georgia Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard from the US Legal Forms library. The Download button will be visible on each form you view. You can access all previously downloaded forms in the My documents section of your account.

Make alterations. Fill out, edit, print, and sign the downloaded Georgia Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard.

Every template you add to your account has no expiration date and is yours indefinitely. So, if you want to download or print an additional copy, simply visit the My documents section and click on the form you require. Access the Georgia Notice of Violation of Fair Debt Act - Unlawful Contact by Postcard with US Legal Forms, the most extensive collection of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- If you are using US Legal Forms for the first time, here are simple instructions to help you get started.

- Ensure you have selected the correct form for your city/state. Click on the Preview button to review the content of the form. Check the form summary to make sure you have chosen the appropriate form.

- If the form does not meet your requirements, use the Search field at the top of the screen to find the one that does.

- When you are satisfied with the form, confirm your choice by clicking the Get now button. Then, select your preferred pricing plan and provide your information to register an account.

- Process the transaction. Use your credit card or PayPal account to complete the transaction.

- Choose the file format and download the form to your device.

Form popularity

FAQ

If a debt collector violates the FDCPA, you may sue that collector in state or federal court. You can even sue in small claims court. You must do this within one year from the date on which the violation occurred.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.16 Sept 2020

The law makes it illegal for debt collectors to harass debtors in other ways, including threats of bodily harm or arrest. They also cannot lie or use profane or obscene language. Additionally, debt collectors cannot threaten to sue a debtor unless they truly intend to take that debtor to court.

Deceptive And Unfair Practices Calling you collect so that you have to pay to accept the call is an example of an unfair practice. Engaging in any practice that forces you to pay additional money other than the debt you owe is considered an FDCPA violation.

Your credit card debt, auto loans, medical bills, student loans, mortgage, and other household debts are covered under the FDCPA.

Among the insider tips, Ulzheimer shared with the audience was this: if you are being pursued by debt collectors, you can stop them from calling you ever again by telling them '11-word phrase'. This simple idea was later advertised as an '11-word phrase to stop debt collectors'.

7 Most Common FDCPA ViolationsContinued attempts to collect debt not owed.Illegal or unethical communication tactics.Disclosure verification of debt.Taking or threatening illegal action.False statements or false representation.Improper contact or sharing of info.Excessive phone calls.

Debt collectors cannot harass or abuse you. They cannot swear, threaten to illegally harm you or your property, threaten you with illegal actions, or falsely threaten you with actions they do not intend to take. They also cannot make repeated calls over a short period to annoy or harass you.

The FDCPA forbids harassing, oppressive, and abusive conductno matter what kind of communication media the debt collector uses. So, this prohibition applies to in-person interactions, telephone calls, audio recordings, paper documents, mail, email, text messages, social media, and other electronic media.

The Fair Debt Collection Practices Act (FDCPA) The FDCPA prohibits debt collection companies from using abusive, unfair or deceptive practices to collect debts from you.