Georgia Sample FCRA Letter to Applicant

Description

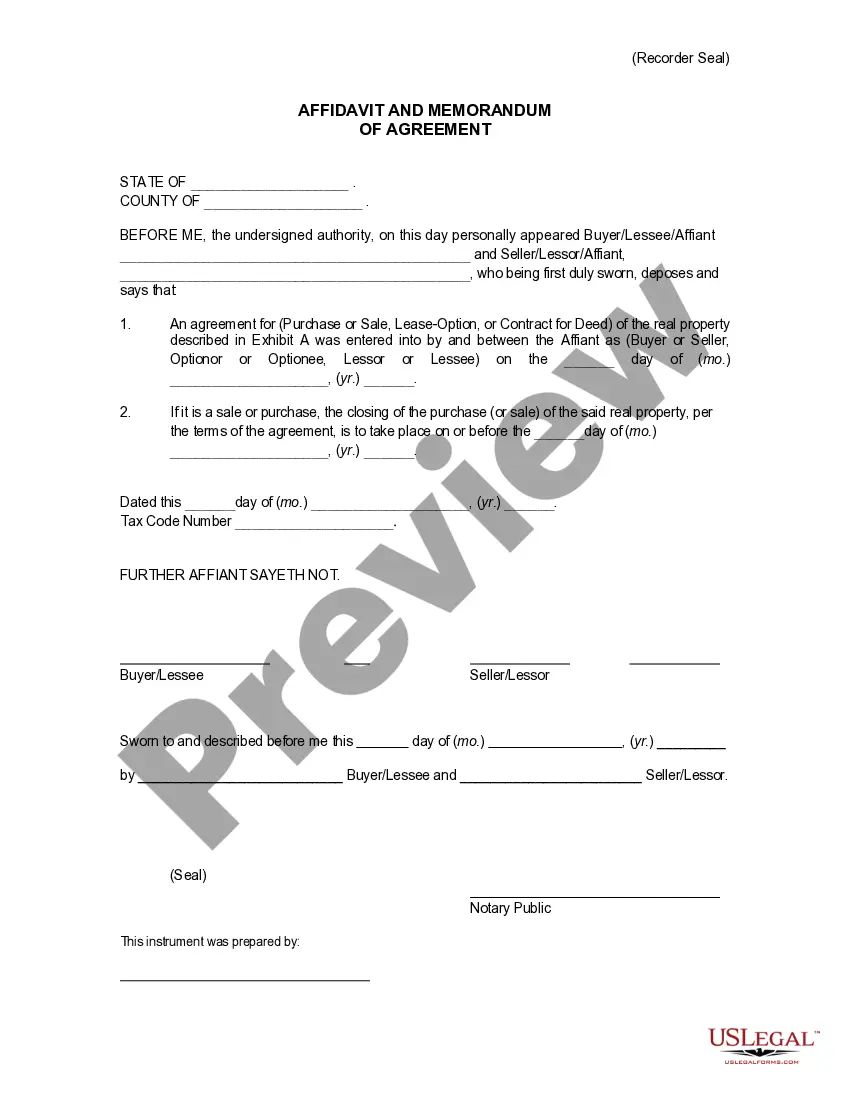

How to fill out Sample FCRA Letter To Applicant?

Are you in a location where you require documentation for potential business or personal purposes almost daily.

There are numerous genuine document templates available online, but finding ones you can trust is not straightforward.

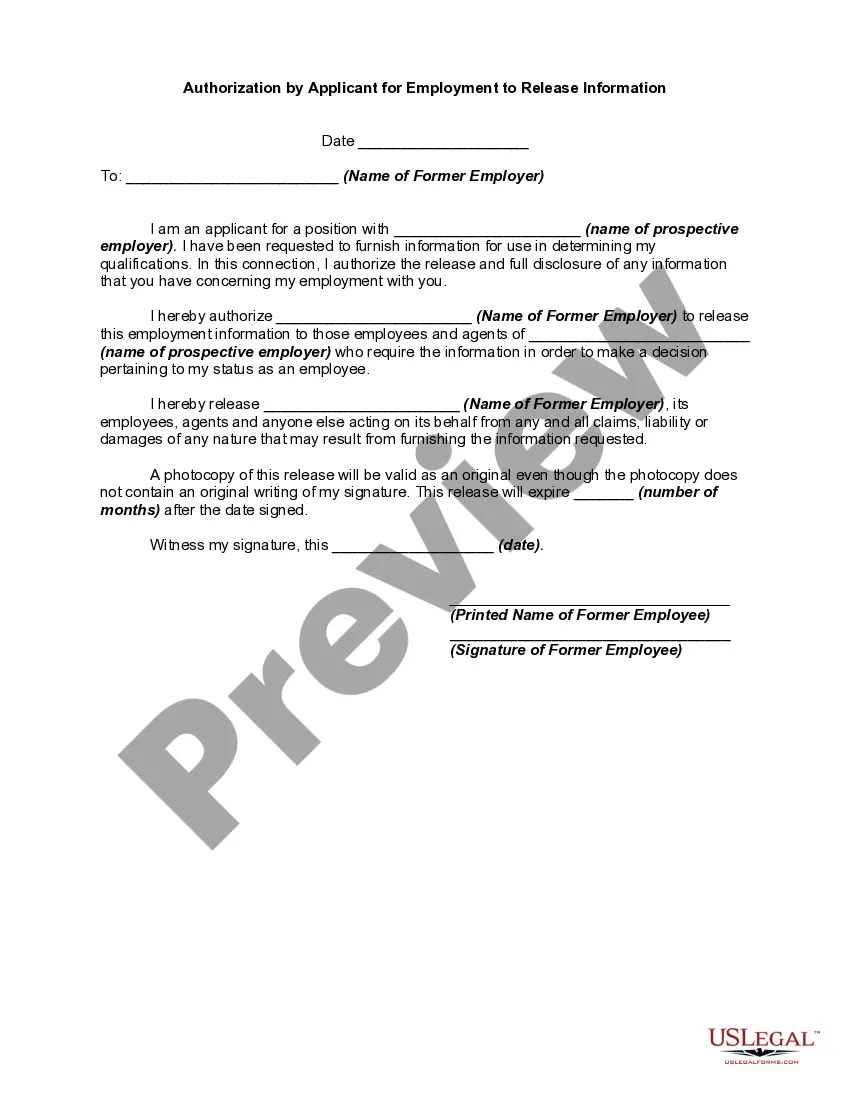

US Legal Forms provides a vast array of document templates, such as the Georgia Sample FCRA Letter to Applicant, designed to meet state and federal requirements.

Once you find the right template, simply click Purchase now.

Choose your payment plan, enter the required information to create your account, and complete the transaction using PayPal, Visa, or Mastercard.

- If you are already acquainted with the US Legal Forms website and have your account, just Log In.

- Subsequently, you can download the Georgia Sample FCRA Letter to Applicant template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Select the form you need and ensure it is for the correct city/state.

- Utilize the Review button to evaluate the form.

- Check the description to confirm that you have selected the right template.

- If the form does not meet your needs, use the Search field to find the form that fits your requirements.

Form popularity

FAQ

Common violations of the FCRA include:Creditors give reporting agencies inaccurate financial information about you. Reporting agencies mixing up one person's information with another's because of similar (or same) name or social security number. Agencies fail to follow guidelines for handling disputes.

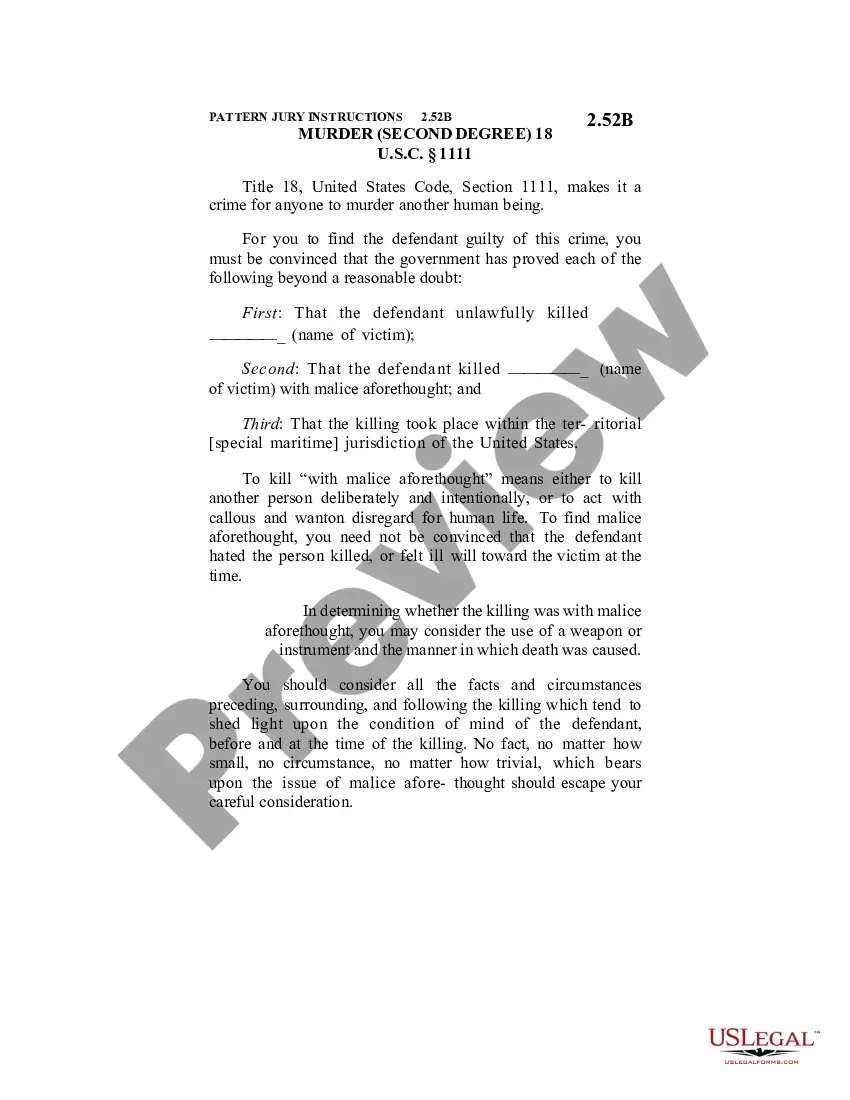

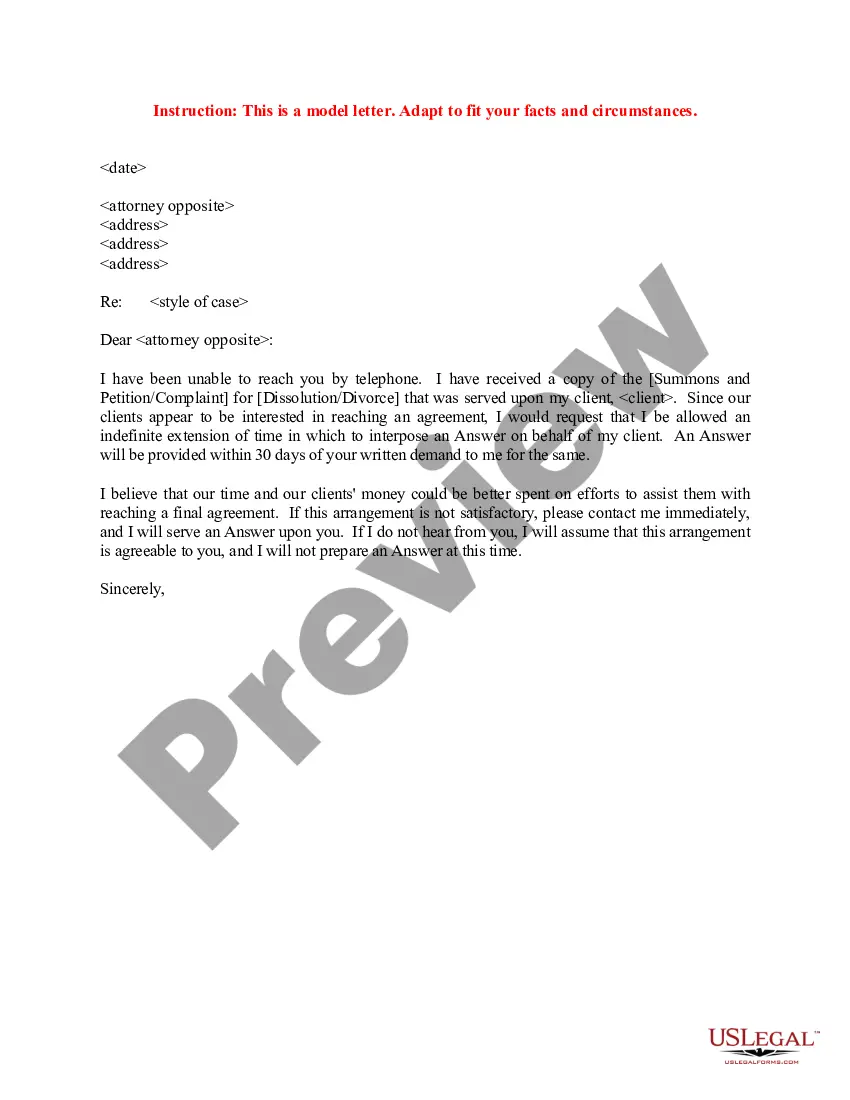

Before you take adverse action, you will provide the applicant or employee a notice that includes a copy of the background check/consumer report you used to make your decision and provide them with a summary of their rights under the FCRA. This is commonly referred to as a Pre-Adverse Action Notice.

An adverse action notice is to inform you that you have been denied credit, employment, insurance, or other benefits based on information in a credit report. The notice should indicate which credit reporting agency was used, and how to contact them.

Four Basic Steps to FCRA ComplianceStep 1: Disclosure & Written Consent. Before requesting a consumer or investigative report, an employer must:Step 2: Certification To The Consumer Reporting Agency.Step 3: Provide Applicant With Pre-Adverse Action Documents.Step 4: Notify Applicant Of Adverse Action.

Properly inform the applicant of adverse action: In your final adverse action letter, you must explain your choice and tell the applicant that they have the right to dispute your decision. Provide the necessary information for them to get another copy of their report.

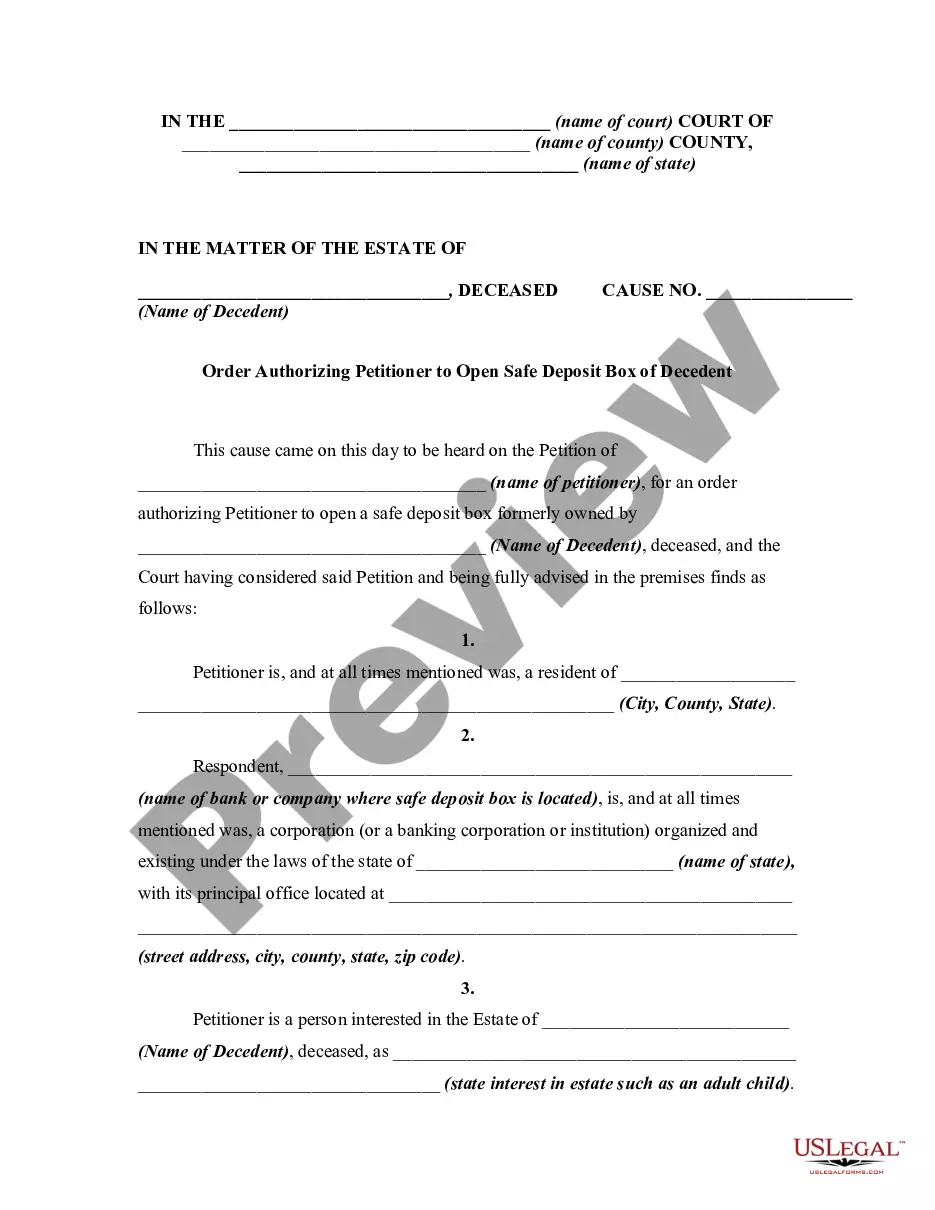

The Fair and Accurate Credit Transaction Act (FACT Act) of 2003 that amended the Fair Credit Reporting Act (FCRA), provides the ability for consumers to obtain a free copy of his or her consumer file from certain consumer reporting agencies once during a 12 month period.

FACTA (Fair and Accurate Credit Transactions Act) is an amendment to FCRA (Fair Credit Reporting Act ) that was added, primarily, to protect consumers from identity theft. The Act stipulates requirements for information privacy, accuracy and disposal and limits the ways consumer information can be shared.

The Fair Credit Reporting Act (FCRA) is a federal law that helps to ensure the accuracy, fairness and privacy of the information in consumer credit bureau files. The law regulates the way credit reporting agencies can collect, access, use and share the data they collect in your consumer reports.

613a Letter FCRA Purpose A 613 Letter serves as a notification that derogatory information was found in a criminal database background check that could influence their ability to be hired. Normally it is used to save time and money in verifying a record at the county court.

Credit Report Adverse Action Letter A post-decision form sent by entities to consumers after deciding to deny/reject them due to their credit score and/or other information found in a consumer credit report.