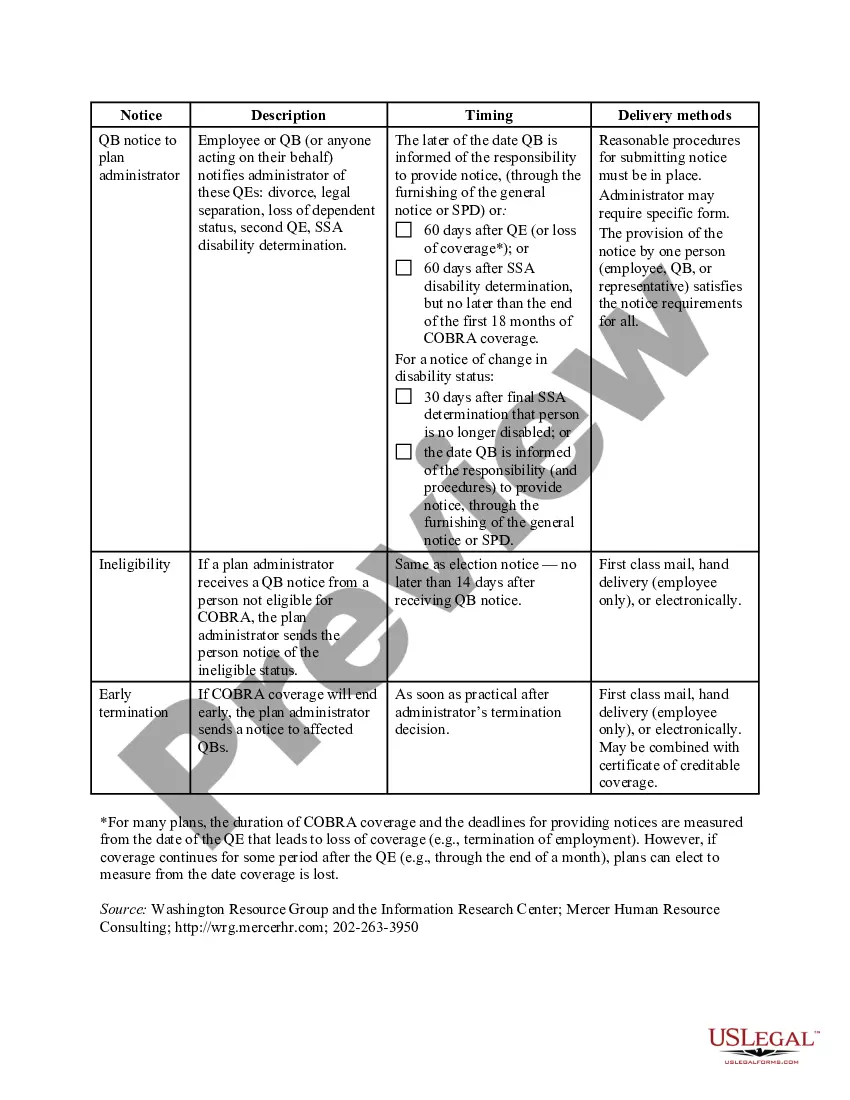

Georgia COBRA Notice Timing Delivery Chart

Description

How to fill out COBRA Notice Timing Delivery Chart?

US Legal Forms - one of the most prominent collections of legal documents in the United States - offers a variety of legal form templates that you can download or print.

Using the site, you can discover thousands of forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest editions of forms such as the Georgia COBRA Notice Timing Delivery Chart in mere seconds.

If you already possess a membership, Log In and obtain the Georgia COBRA Notice Timing Delivery Chart from the US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms within the My documents tab of your account.

Complete the transaction. Use your Visa or Mastercard or PayPal account to finalize the purchase.

Select the format and download the document to your device. Make adjustments. Fill out, amend, and print the downloaded Georgia COBRA Notice Timing Delivery Chart. Each template you include in your account has no expiration date and is yours indefinitely. So, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Georgia COBRA Notice Timing Delivery Chart with US Legal Forms, one of the largest collections of legal document templates. Utilize thousands of professional and state-specific templates that cater to your business or personal requirements.

- Ensure you have selected the correct form for your city/state.

- Click the Preview button to examine the form's content.

- Review the form description to confirm you've chosen the right form.

- If the form does not suit your needs, utilize the Search bar at the top of the screen to find one that does.

- Once satisfied with the form, affirm your choice by clicking the Buy now button.

- Then, select the payment plan you desire and provide your details to register for an account.

Form popularity

FAQ

New York State law requires small employers (less than 20 employees) to provide the equivalent of COBRA benefits. You are entitled to 36 months of continued health coverage at a monthly cost to you of 102% of the actual cost to the employer which may be different from the amount deducted from your paychecks.

Employers who fail to comply with the COBRA requirements can be required to pay a steep price. Failure to provide the COBRA election notice within this time period can subject employers to a penalty of up to $110 per day, as well as the cost of medical expenses incurred by the qualified beneficiary.

In most cases, COBRA provides for continuation of health plan coverage for up to 18 months following the work separation. COBRA rights accrue once a "qualifying event" occurs - basically, a qualifying event is any change in the employment relationship that results in loss of health plan benefits.

The initial notice, also referred to as the general notice, communicates general COBRA rights and obligations to each covered employee (and his or her spouse) who becomes covered under the group health plan.

If You Do Not Receive Your COBRA PaperworkReach out to the Human Resources Department and ask for the COBRA Administrator. They may use a third-party administrator to handle your enrollment. If the employer still does not comply you can call the Department of Labor at 1-866-487-2365.

COBRA coverage follows a "qualifying event". An example of a qualifying event would be if your hours were reduced or you lost your job (as long as there was no gross misconduct). Your employer must mail you the COBRA information and forms within 14 days after receiving notification of the qualifying event.

COBRA allows a 30-day grace period. If your premium payment is not received within the 30-day grace period, your coverage will automatically be terminated without advance warning. You will receive a termination letter at that time to notify you of a lapse in your coverage due to non-payment of premiums.

Are there penalties for failing to provide a COBRA notice? Yes, and the penalties can be substantial. Under the Employment Retirement Income Security Act of 1974 (ERISA), a penalty of up to $110 per day may be imposed for failing to provide a COBRA notice.

COBRA continuation coverage may be terminated if we don't receive timely payment of the premium. What is the grace period for monthly COBRA premiums? After election and initial payment, qualified beneficiaries have a 30-day grace period to make monthly payments (that is, 30 days from the due date).

Initial COBRA notices must generally be provided within 14 days of the employer notifying the third-party administrator (TPA) of a qualifying event.