Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate

Description

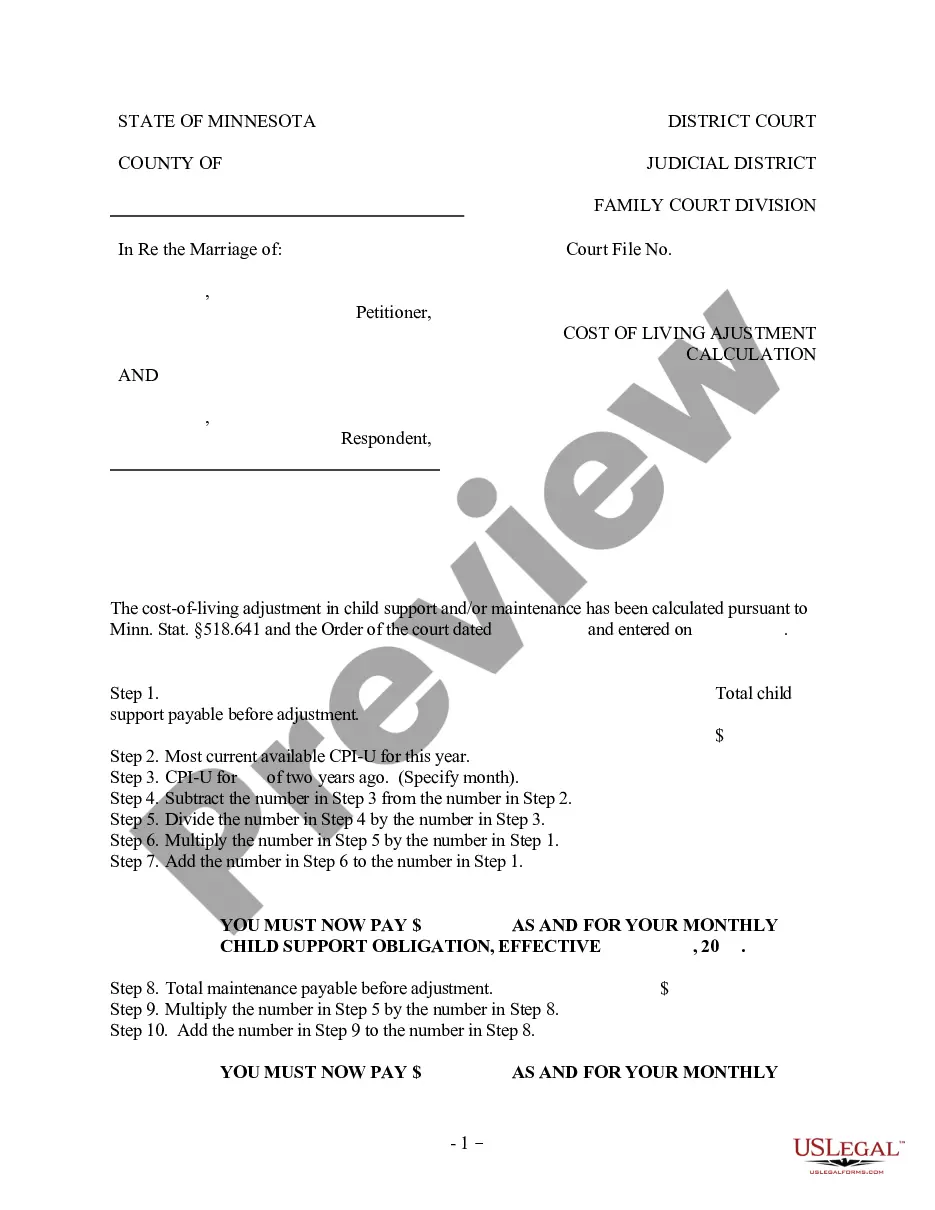

How to fill out Personal Guaranty - Guarantee Of Contract For The Lease And Purchase Of Real Estate?

If you want to compile, acquire, or produce legal document templates, utilize US Legal Forms, the most extensive collection of legal forms available online. Take advantage of the site's straightforward and user-friendly search feature to locate the documents you need.

Various templates for business and personal purposes are sorted by types and states, or keywords. Use US Legal Forms to locate the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate with just a few clicks.

If you are already a US Legal Forms user, Log In to your account and click the Download button to access the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. You can also retrieve forms you previously saved in the My documents section of your account.

Every legal document template you obtain is yours indefinitely. You will have access to all forms you saved in your account. Go to the My documents section and select a form to print or download again.

Compete and acquire, and print the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate with US Legal Forms. There are numerous professional and state-specific forms available for your business or personal needs.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Do not forget to read the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal form template.

- Step 4. Once you’ve found the form you need, click the Get now button. Choose the pricing plan you prefer and enter your details to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Form popularity

FAQ

To fill out a personal guarantee, begin by carefully reading the document to understand the obligations involved. Provide your name and relevant details about the financial obligations or lease terms you are guaranteeing. It's essential to ensure all necessary information is accurate and clearly presented. By doing so, you protect both yourself and the parties involved in the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

While a personal guarantee does not always require notarization, having it notarized adds an extra layer of protection. Notarization verifies the identity of the signer and confirms their intention to commit to the agreement. This practice can be especially beneficial in formal agreements, such as those involving the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Filling out a personal guaranty involves several key steps. First, you will need to provide your personal information, including name and address, alongside the details of the primary obligor. Next, specify the obligations being guaranteed, such as lease payments or purchase terms. A well-completed personal guaranty maintains clarity, supporting the integrity of the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Yes, a contract of guarantee generally must be in writing to be enforceable. This requirement helps clarify the terms and prevents misunderstandings between the involved parties. By documenting the agreement in writing, you establish a clear record of the obligations and responsibilities outlined in the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate. Ensure you keep a signed copy for your records.

A residential lease contract in Georgia establishes the tenant's rights and responsibilities, including the duration of the lease, rent payment terms, and maintenance obligations. It provides a framework that helps protect both the tenant and landlord. By understanding this agreement, tenants can ensure compliance with the terms, especially regarding the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

In Georgia, a real estate contract is binding once it is signed by all parties involved. This includes buyers, sellers, and any real estate agents who may be acting on behalf of the parties. Knowing who binds a contract is crucial under the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, as it ensures all parties are legally committed to the agreement.

In Georgia, a valid contract requires mutual consent, a legal purpose, consideration, and the capacity to contract. While verbal agreements may hold some weight, it is advisable to have written contracts for real estate transactions. This approach aligns with the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, ensuring robust legal backing.

In Georgia, the most common real estate contracts include purchase agreements, lease agreements, and option agreements. Each of these contracts has its own unique terms and conditions, typically governed by state laws. Understanding these contracts helps ensure clarity and legal compliance, especially under the Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate.

Exiting a personal guaranty can be complex, but it's certainly possible. One common method is seeking a release from the creditor, which may involve negotiating terms or finding a substitute guarantor. Utilizing services like USLegalForms can streamline this process, providing you with templates and guidance to help you navigate the terms of your Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate effectively.

While the terms 'guarantee' and 'guaranty' are often used interchangeably, 'guarantee' refers to the act of providing assurance, while 'guaranty' specifically denotes the formal agreement itself. In the realm of Georgia Personal Guaranty - Guarantee of Contract for the Lease and Purchase of Real Estate, understanding this distinction can help you grasp the legal implications of your responsibilities. A clear comprehension of these terms can aid in effective decision-making when entering contracts.