Georgia New Company Benefit Notice

Description

How to fill out New Company Benefit Notice?

Finding the appropriate valid document format can be quite challenging.

Of course, there are numerous templates accessible online, but how will you locate the valid template you need.

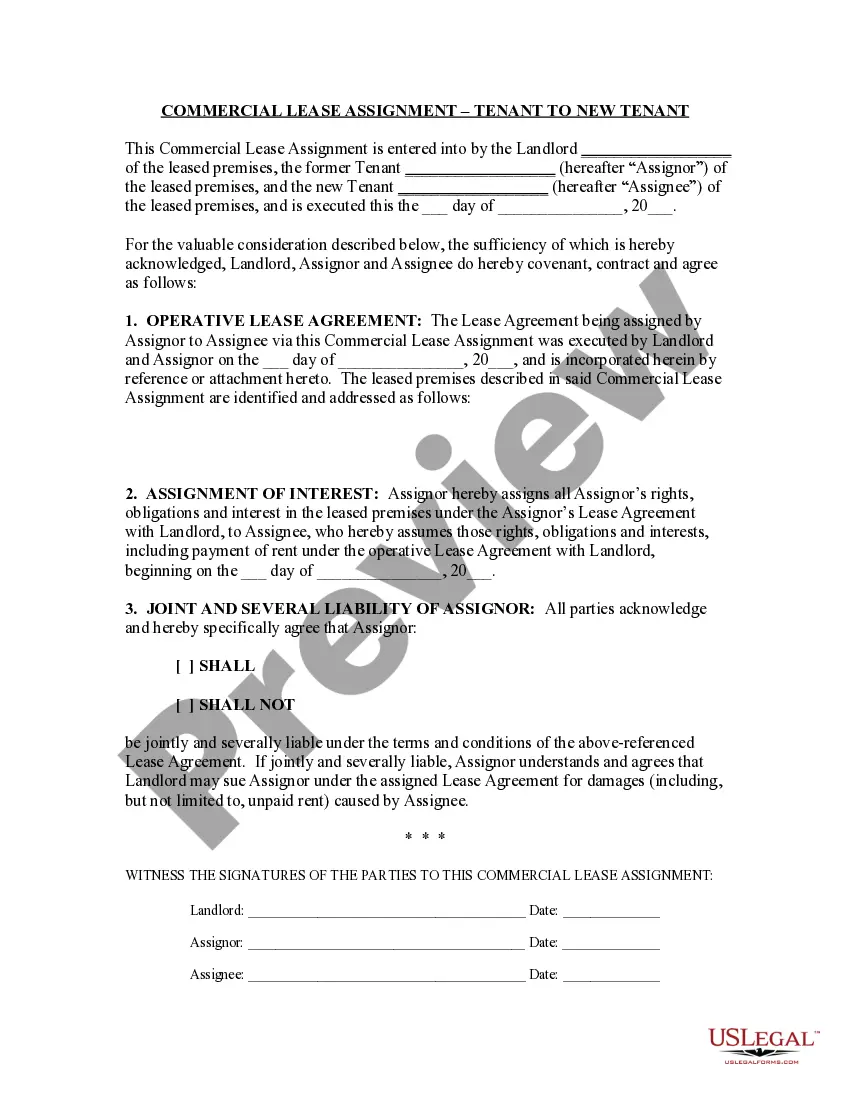

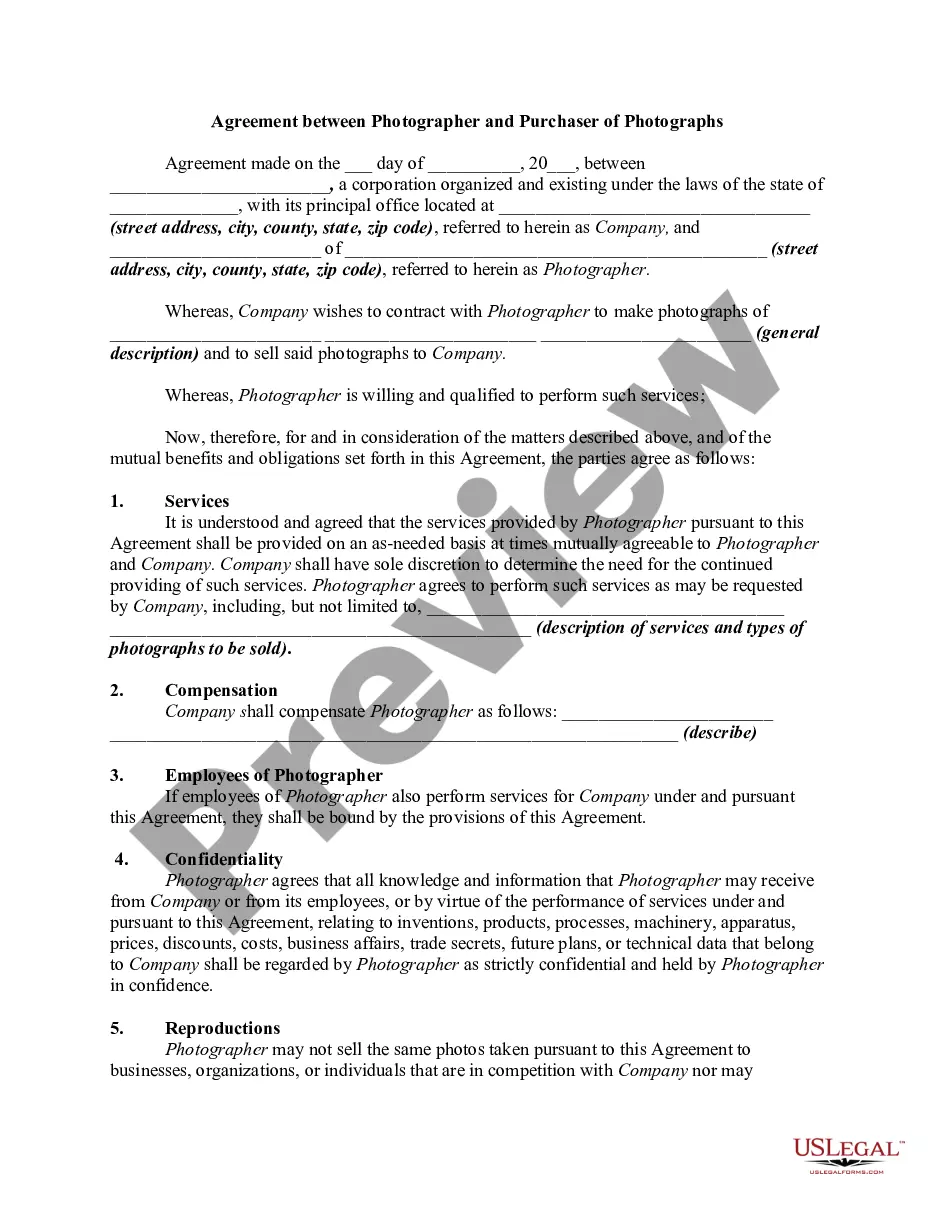

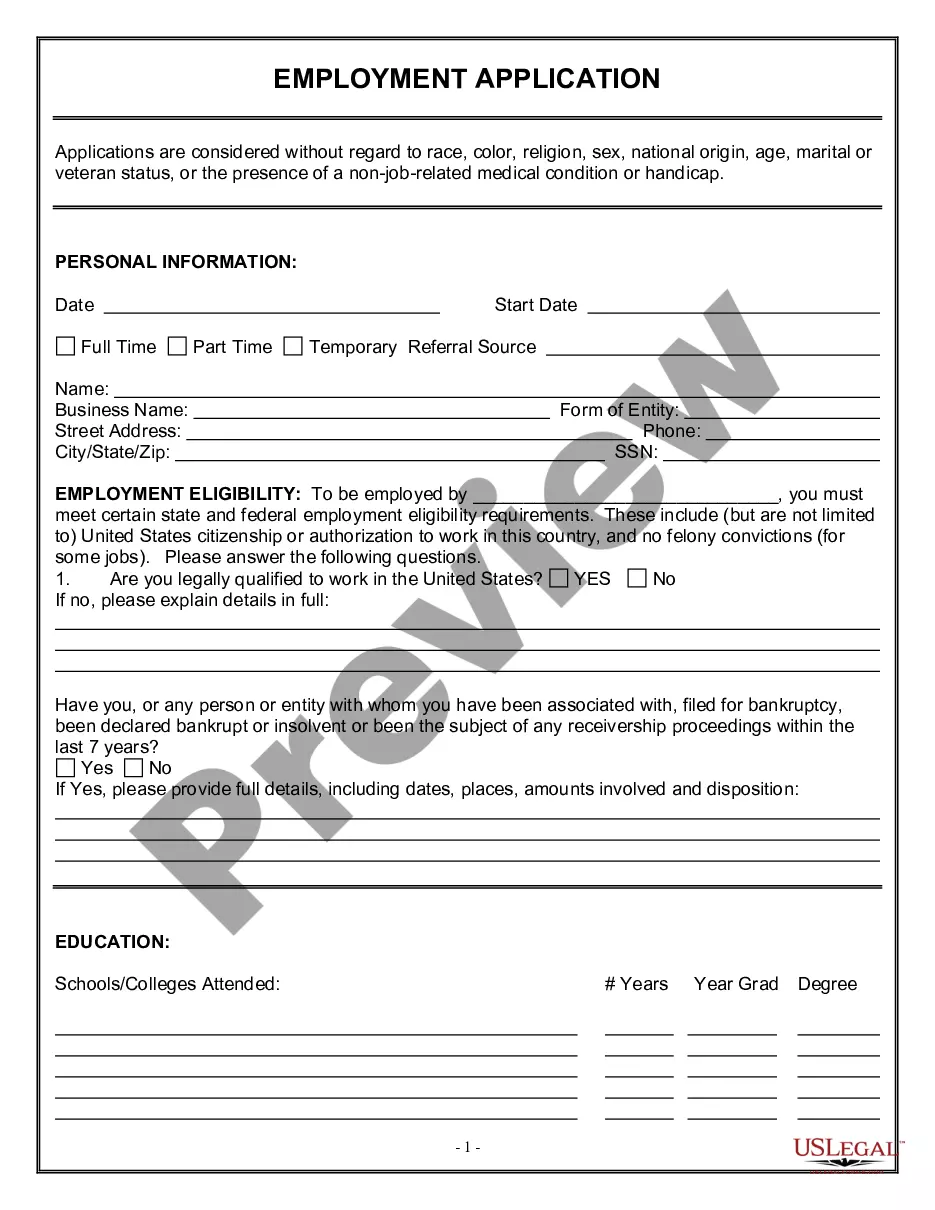

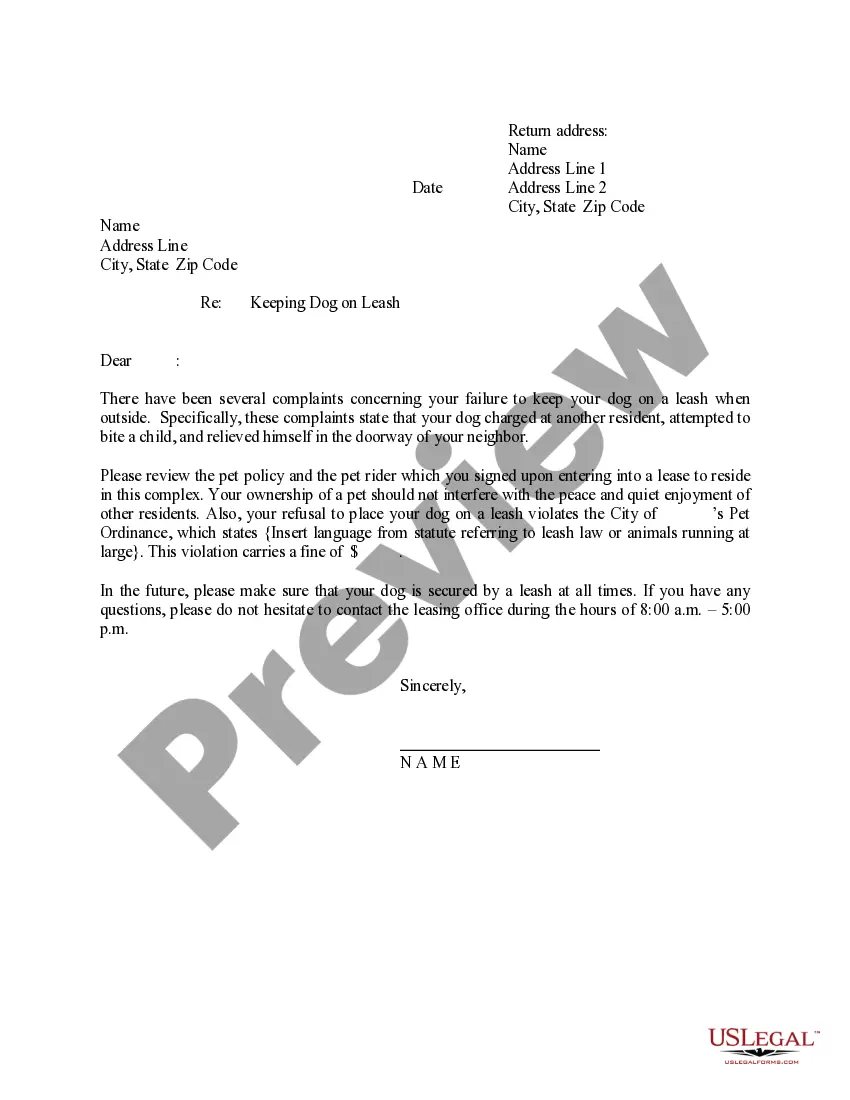

Utilize the US Legal Forms website. The service provides thousands of templates, such as the Georgia New Company Benefit Notice, that can be utilized for business and personal purposes.

First, ensure you have selected the correct form for your area/county. You can review the form using the Preview button and examine the form details to confirm this is the right choice for you. If the form does not meet your needs, use the Search field to find the appropriate form. Once you are certain that the form is suitable, click the Get now button to obtain the form. Choose the pricing plan you prefer and enter the required details. Create your account and complete a purchase using your PayPal account or credit card. Select the file format and download the valid document format to your device. Complete, edit, and print and sign the received Georgia New Company Benefit Notice. US Legal Forms is the largest repository of legal forms where you can find various document templates. Take advantage of the service to download professionally-created documents that meet state requirements.

- All of the forms are reviewed by experts and comply with federal and state requirements.

- If you are already registered, Log In to your account and click on the Download button to obtain the Georgia New Company Benefit Notice.

- Use your account to search for the legal forms you have previously purchased.

- Visit the My documents tab of your account and retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps you can follow.

Form popularity

FAQ

In Georgia, there is no legal requirement for employees to provide a 60-day notice before leaving a job. Most employees follow a shorter notice period, usually two weeks, unless their employment contract specifies otherwise. If you are involved in creating a new company, being informed about notice periods is crucial and relates to how you address the Georgia New Company Benefit Notice as part of your employee policies.

Effective June 27, 2021, the state of Georgia is no longer participating in the PUA program. The last payable week ending date for PUA benefits was June 26, 2021.

If a claimant exhausted regular state UI benefits on or after 2/2/2020 and have filed for PUA (regardless of payment status), the claimant will be transferred into PEUC automatically. The claimant is not required to file a PEUC claim. PEUC will be effective the first Sunday after the last PUA payment.

On the contrary, if an employer ignores these claims, they may find their unemployment taxes eating into their bottom line. If the employer does not respond or responds too late, the worker could automatically get UI benefits, in most states.

Step 2: Individual receives a Benefits Determination letter, which shows if a claimant has enough wages to determine a valid regular state unemployment claim. If so, an individual receives a second determination letter (Claims Examiner's Determination) informing the claimant if state benefits are approved or denied.

The American Rescue Plan Act of 2021 was signed into law March 11, 2021 to extend unemployment benefits for the Pandemic Emergency Unemployment Compensation (PEUC), Pandemic Unemployment Assistance (PUA), and Federal Pandemic Unemployment Compensation (FPUC) programs through September 6, 2021.

Individual Claims If you filed your own claim for unemployment, you will receive an email acknowledging that your claim was received, but not yet processed. You will receive a second email informing you when the claim has been processed, and providing a link to next steps.

Once your application has been approved, the Department of Labor will send a Monetary Determination with information on your weekly benefit amount. After making your claim, it will take between two to three weeks to receive it. Delays may be caused if the state needs additional information before sending payment.

Expect at least 21 days or more to access your weekly benefit payment. Please expect at least 21 days or more to access your weekly benefit payment if you are eligible to receive benefits.

Step 2: Individual receives a Benefits Determination letter, which shows if a claimant has enough wages to determine a valid regular state unemployment claim. If so, an individual receives a second determination letter (Claims Examiner's Determination) informing the claimant if state benefits are approved or denied.