Georgia Purchase Invoice

Description

How to fill out Purchase Invoice?

If you wish to obtain, download, or print authentic document templates, utilize US Legal Forms, the largest compilation of legal forms available online.

Employ the site’s simple and user-friendly search to find the documents you require.

Numerous templates for business and personal purposes are categorized by types and regions, or keywords.

Step 4. Once you find the form you need, click the Get now button. Select the pricing plan you prefer and provide your details to register for an account.

Step 5. Process the payment. You may utilize your Visa or MasterCard or PayPal account to complete the transaction.

- Utilize US Legal Forms to locate the Georgia Purchase Invoice in just a few clicks.

- If you are already a US Legal Forms user, Log In to your account and click the Download button to acquire the Georgia Purchase Invoice.

- You can also access forms you previously retrieved from the My documents section of your account.

- If you are using US Legal Forms for the first time, follow these steps.

- Step 1. Ensure you have chosen the form for the correct state/region.

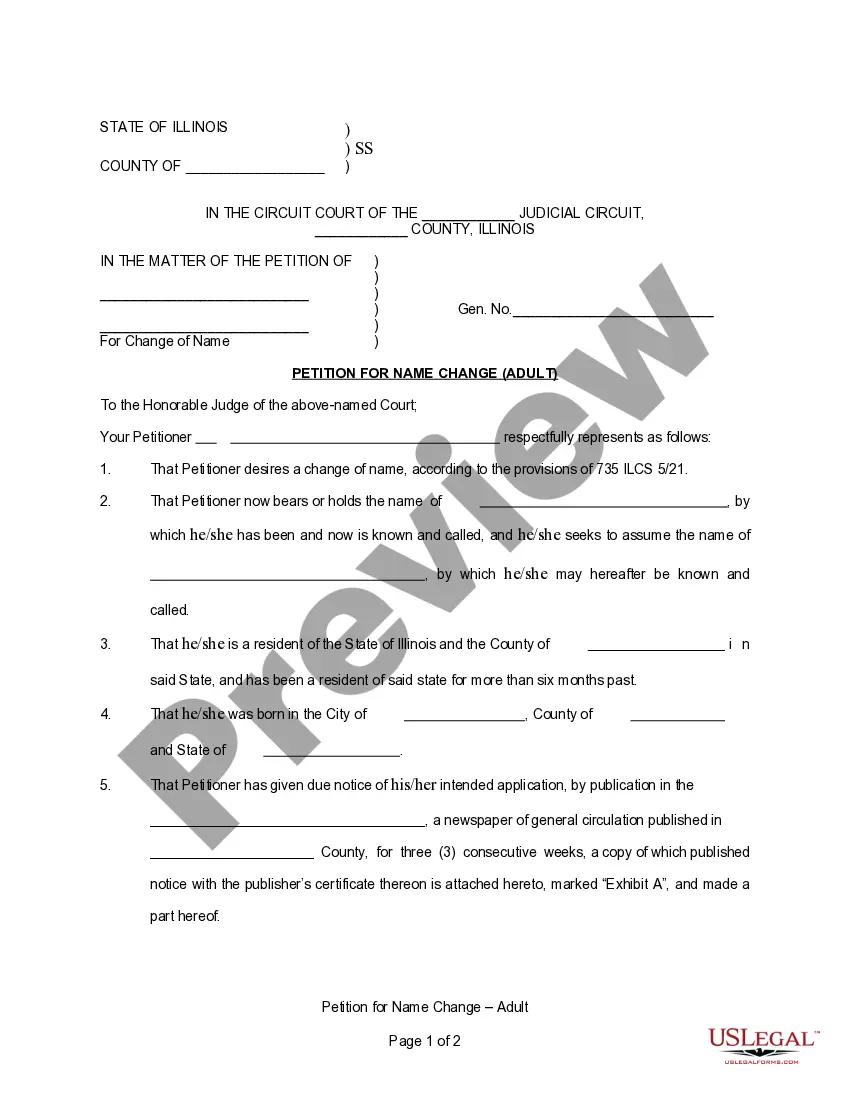

- Step 2. Use the Preview option to review the details of the form. Don’t forget to read the description.

- Step 3. If you are unsatisfied with the form, use the Search area at the top of the screen to find alternative versions of the legal form template.

Form popularity

FAQ

To file invoices, first, gather all necessary documents and create a digital or physical folder designated for Georgia Purchase Invoices. Ensure that you record essential details like date, vendor information, and amounts before filing. After organizing, you can upload your invoices to a platform such as US Legal Forms, which helps you maintain easy access and efficient tracking of all your financial documents.

The best way to file accounts payable invoices is through a systematic process that includes categorizing and labeling each Georgia Purchase Invoice clearly. You should keep digital copies organized in a secure electronic filing system. This prevents loss and makes retrieval quick and efficient. Using a reliable platform like US Legal Forms can streamline this process by keeping your invoices in one organized location.

Creating your own Purchase Order (PO) is easy and efficient with the Georgia Purchase Invoice solution. Simply choose a customizable template within our platform and fill in the relevant details including supplier information and order specifics. This approach not only streamlines your purchasing process but also ensures accuracy and professionalism in your procurement activities.

Generating an invoice for an order is straightforward with our tools at US Legal Forms. Start by selecting the Georgia Purchase Invoice template that suits your needs. Fill in the necessary details, such as the buyer's information and the items purchased. Once completed, you can save or print the invoice to finalize your transaction.

Yes, you can file most Georgia taxes electronically, which simplifies the process and shortens the processing time. Using online platforms for filing ensures accuracy and reduces the likelihood of errors in your Georgia Purchase Invoice and tax documents. For a seamless experience, you can rely on services like US Legal Forms, which facilitate easy electronic filing and provide additional support.

In Georgia, several types of purchases may qualify for sales tax exemptions. Items like groceries, certain medications, and manufacturing equipment often fall under this category. To ensure you comply with the regulations, it's crucial to document exempt purchases correctly on your Georgia Purchase Invoice. Platforms like US Legal Forms provide guidelines on acceptable exemptions, making it easier for you to navigate tax obligations.

Yes, Georgia has a state sales tax rate of 4%. However, local counties and cities may impose additional sales taxes, often bringing the total rate to around 7%. Always check local resources for the exact rate in your area, especially when preparing your Georgia Purchase Invoice. US Legal Forms can help you find relevant tax information and templates to manage these transactions.

You can file Georgia Form 500 online through the Georgia Department of Revenue's official website, or you might file it by mail to a specific mailing address provided on the form. Filing electronically can expedite processing and help you keep track of your submissions. Be sure to attach your Georgia Purchase Invoice for accurate record-keeping. Using resources like US Legal Forms can make the filing process clearer.

Yes, Georgia implements an internet sales tax applicable to online purchases. This means if you buy goods online, the vendor must collect sales tax unless you qualify for an exemption. It’s essential to keep this in mind for your Georgia Purchase Invoice to ensure compliance with state tax laws. For proper management of these types of transactions, consider utilizing platforms like US Legal Forms.