Georgia Charitable Contribution Payroll Deduction Form

Description

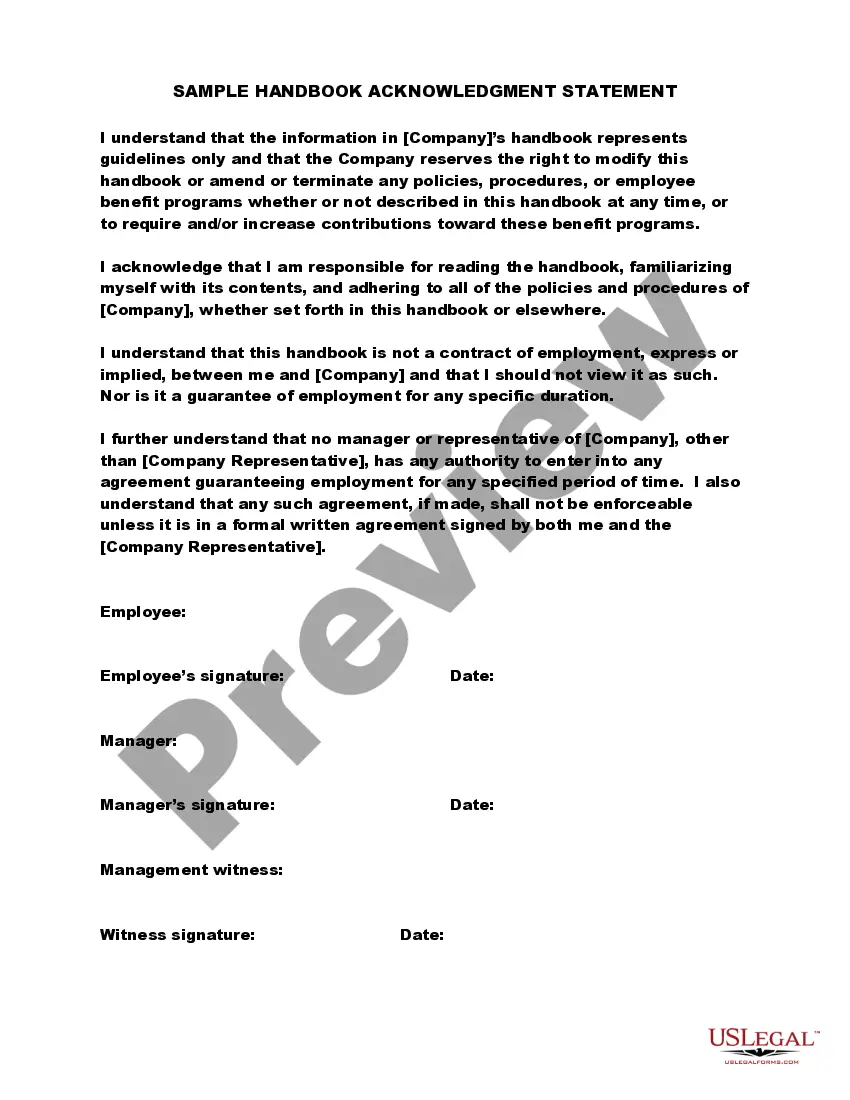

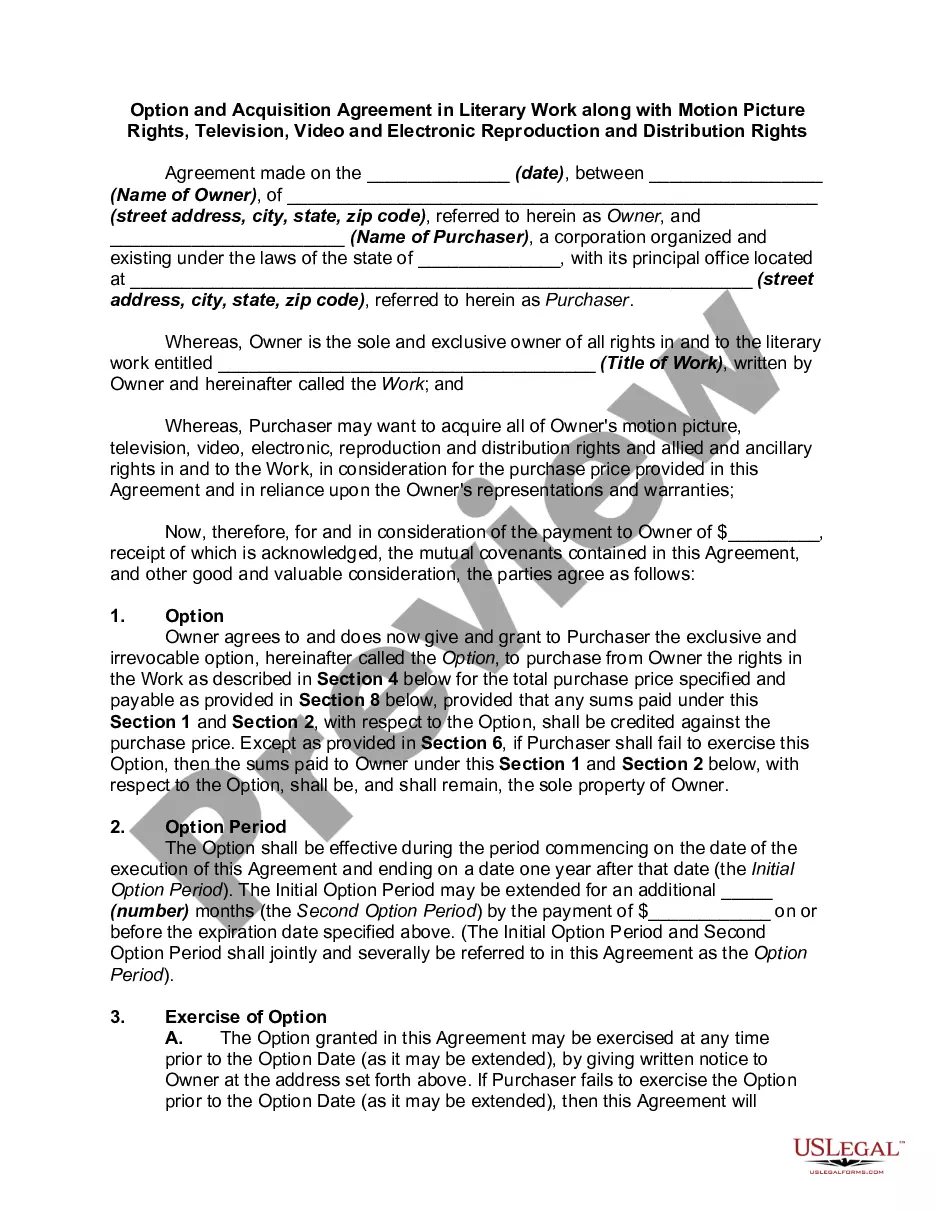

How to fill out Charitable Contribution Payroll Deduction Form?

If you need to finalize, acquire, or create legal document templates, utilize US Legal Forms, the premier collection of legal forms available online.

Utilize the website's user-friendly and efficient search to locate the documents you require. Various templates for business and personal applications are categorized by types and categories, or keywords.

Employ US Legal Forms to obtain the Georgia Charitable Contribution Payroll Deduction Form in just a few clicks.

Each legal document template you acquire is yours permanently. You have access to every form you have purchased in your account. Go to the My documents section and choose a form to print or download again.

Complete and download, and print the Georgia Charitable Contribution Payroll Deduction Form with US Legal Forms. There are countless specialized and state-specific forms you can use for your personal or business needs.

- If you are currently a US Legal Forms user, Log Into your account and click on the Download button to find the Georgia Charitable Contribution Payroll Deduction Form.

- You can also access forms you have previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the form's content. Be sure to read the details.

- Step 3. If you are not satisfied with the form, utilize the Search box at the top of the screen to find other templates from the legal form library.

- Step 4. Once you have found the form you desire, click on the Purchase now button. Choose the pricing plan that suits you and enter your details to register for an account.

- Step 5. Process the purchase. You can use your credit card or PayPal account to complete the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, modify, and print or sign the Georgia Charitable Contribution Payroll Deduction Form.

Form popularity

FAQ

2022 standard tax deductionsKeep track of your charitable contributions throughout the year, and consider any additional applicable deductions. Generally taxpayers use the larger deduction, standard or itemized, when it's time to file taxes.

Taxpayers who take the standard deduction can claim a deduction of up to $300 for cash contributions to qualifying charities made in 2021. Married couples filing jointly can claim up to $600.

To be eligible, donations have to be made in cash or via check, credit card or debit card. (The IRS says "amounts incurred by an individual for unreimbursed out-of-pocket expenses in connection with their volunteer services to a qualifying charitable organization" count, as well.)

Taxpayers who take the standard deduction can claim a deduction of up to $300 for cash contributions to qualifying charities made in 2021.

A Charitable Contributions Deduction is allowed on the Georgia return for taxpayers who entered an amount on Form 1040 or 1040-SR, Line 12b. Normally that amount (up to $300, or $600 for married filing jointly) is included on the Georgia Form 500, Schedule 1, Line 12 with the description Charitable Ded.

Following tax law changes, cash donations of up to $300 made this year by December 31, 2020 are now deductible without having to itemize when people file their taxes in 2021.

For 2020, the charitable limit was $300 per tax unit meaning that those who are married and filing jointly can only get a $300 deduction. For the 2021 tax year, however, those who are married and filing jointly can each take a $300 deduction, for a total of $600.

Charitable contributions to qualified organizations may be deductible if you itemize deductions on Form 1040, Schedule A, Itemized Deductions PDF. To see if the organization you have contributed to qualifies as a charitable organization for income tax deductions, use Tax Exempt Organization Search.

When you don't itemize your tax deductions, you typically won't get any additional tax savings from donating to charity. However, in 2021, U.S. taxpayers can deduct up to $300 in charitable donations made this year, even if they choose to take the standard deduction.

Charitable Donation Limits: Special 2021 Rules. For 2021, single taxpayers who claim the standard deduction on their tax returns can deduct up to $300 of charitable contributions made in cash. Married couples filing joint returns can claim up to $600 for cash contributions.