Georgia Liquidation of Partnership with Authority, Rights and Obligations during Liquidation

Description

How to fill out Liquidation Of Partnership With Authority, Rights And Obligations During Liquidation?

Have you ever found yourself in a situation where you require documents for various company or personal activities almost every day.

There are numerous legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms provides thousands of templates, including the Georgia Liquidation of Partnership with Authority, Rights and Obligations during Liquidation, designed to meet both state and federal requirements.

Once you find the correct form, simply click Buy now.

Select the pricing plan you prefer, complete the required details to create your account, and pay for your order using PayPal, Visa, or Mastercard.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- After logging in, you can download the Georgia Liquidation of Partnership with Authority, Rights and Obligations during Liquidation template.

- If you do not yet have an account and would like to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

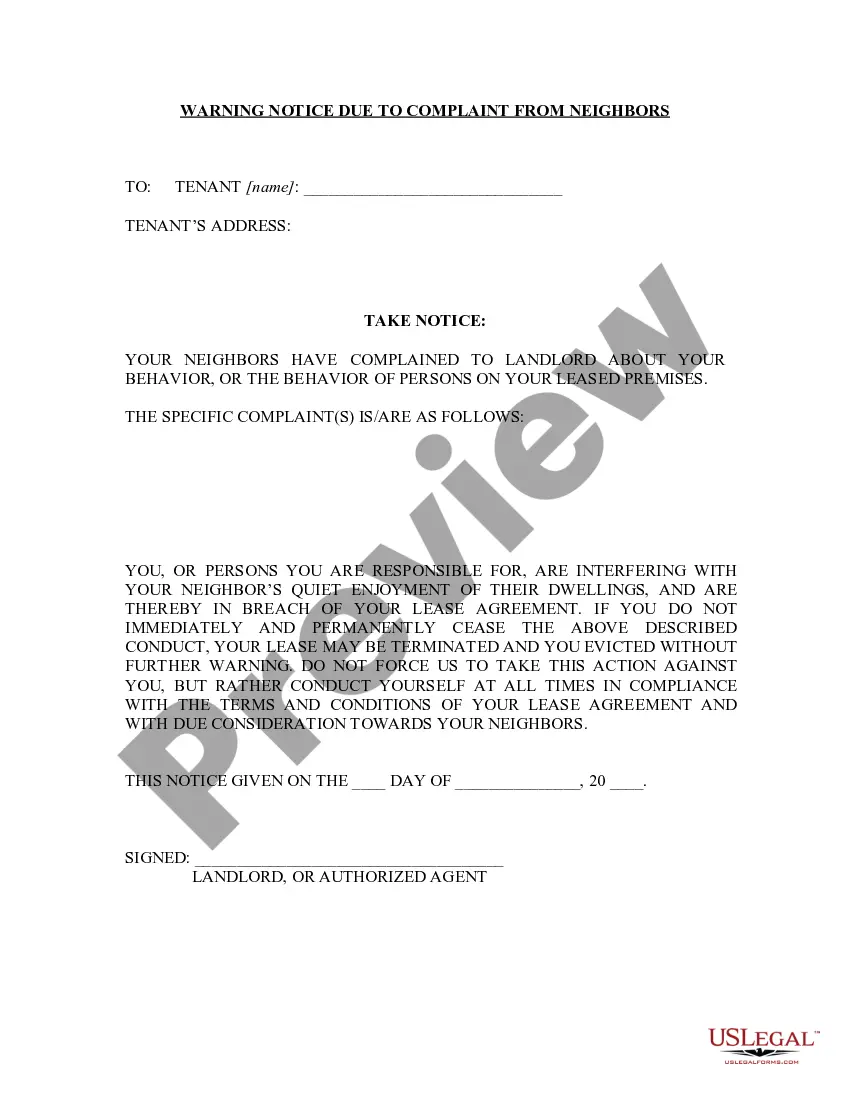

- Utilize the Review button to examine the form.

- Check the description to confirm that you have selected the right form.

- If the form is not what you are looking for, use the Search area to find the template that suits your needs.

Form popularity

FAQ

In Georgia, any partner in a partnership can participate in voluntary liquidation, provided they meet the relevant statutory requirements. It's essential for partners to understand their authority, rights, and obligations during liquidation. Each partner must agree to the decision, ensuring all voices are heard. Engaging with a reliable platform like UsLegalForms can guide you through this process effectively.

If a company goes into liquidation, all of its assets are distributed to its creditors. Secured creditors are first in line. Next are unsecured creditors, including employees who are owed money. Stockholders are paid last.

Under Chapter 7, the company stops all operations and goes completely out of business. A trustee is appointed to "liquidate" (sell) the company's assets and the money is used to pay off the debt, which may include debts to creditors and investors. The investors who take the least risk are paid first.

Once a company goes into liquidation, creditors holding personal guarantees will pursue the directors to pay the outstanding company debt. The creditors that will almost always have a personal guarantee include, a financing bank, a landlord, and any major suppliers.

If the debtor company is in possession of goods belonging to a creditor, and the creditor can prove ownership, they have the right to make a claim for their return, or reimbursement via the liquidator. Unsecured creditors can claim interest on the debt up to the date of liquidation under certain circumstances.

The court sells the business assets for you, and the proceeds are used to pay off lenders, vendors, and other creditors. Debts, long-term leases and other obligations are erased when the bankruptcy proceeding is closed.

The Insolvent Partnerships Order 1994 operates to apply provisions of the Insolvency Act 1986 and the CDDA 1986, with appropriate amendment set out in the schedules to the Order, to partnerships (including limited partnerships see Part 2).

Generally speaking, insolvency refers to situations where a debtor cannot pay the debts she owes. For instance, a troubled company may become insolvent when it is unable to repay its creditors money owed on time, often leading to a bankruptcy filing.

Creditor's rights can refer to many different aspects of creditor-debtor and creditor-creditor relations including a creditor's rights to place a lien on a debtor's property, garnish a debtor's wages, set aside a fraudulent conveyance, and contact the debtor and relatives.

A balance sheet test is a legal exercise to establish whether your company is in an insolvent state. A court will determine what value to attribute to the prospective and contingent liabilities of a company.