Georgia Release and Indemnification of Personal Representative by Heirs and Devisees

Description

How to fill out Release And Indemnification Of Personal Representative By Heirs And Devisees?

US Legal Forms - one of the biggest collections of legal documents in the United States - provides an extensive variety of legal paperwork templates available for download or printing.

By using the website, you can access thousands of forms for business and personal purposes, organized by categories, states, or keywords.

You can find the latest versions of forms such as the Georgia Release and Indemnification of Personal Representative by Heirs and Devisees in just moments.

Examine the summary of the form to confirm you’ve chosen the correct one.

If the form doesn’t meet your requirements, utilize the Search field at the top of the page to find the one that does.

- If you already have a membership, Log In to download the Georgia Release and Indemnification of Personal Representative by Heirs and Devisees from your US Legal Forms library.

- The Download button will appear on every form you view.

- You can access all previously saved forms in the My documents section of your account.

- If this is your first time using US Legal Forms, here are some simple steps to get started.

- Ensure you have selected the correct form for your locality/region.

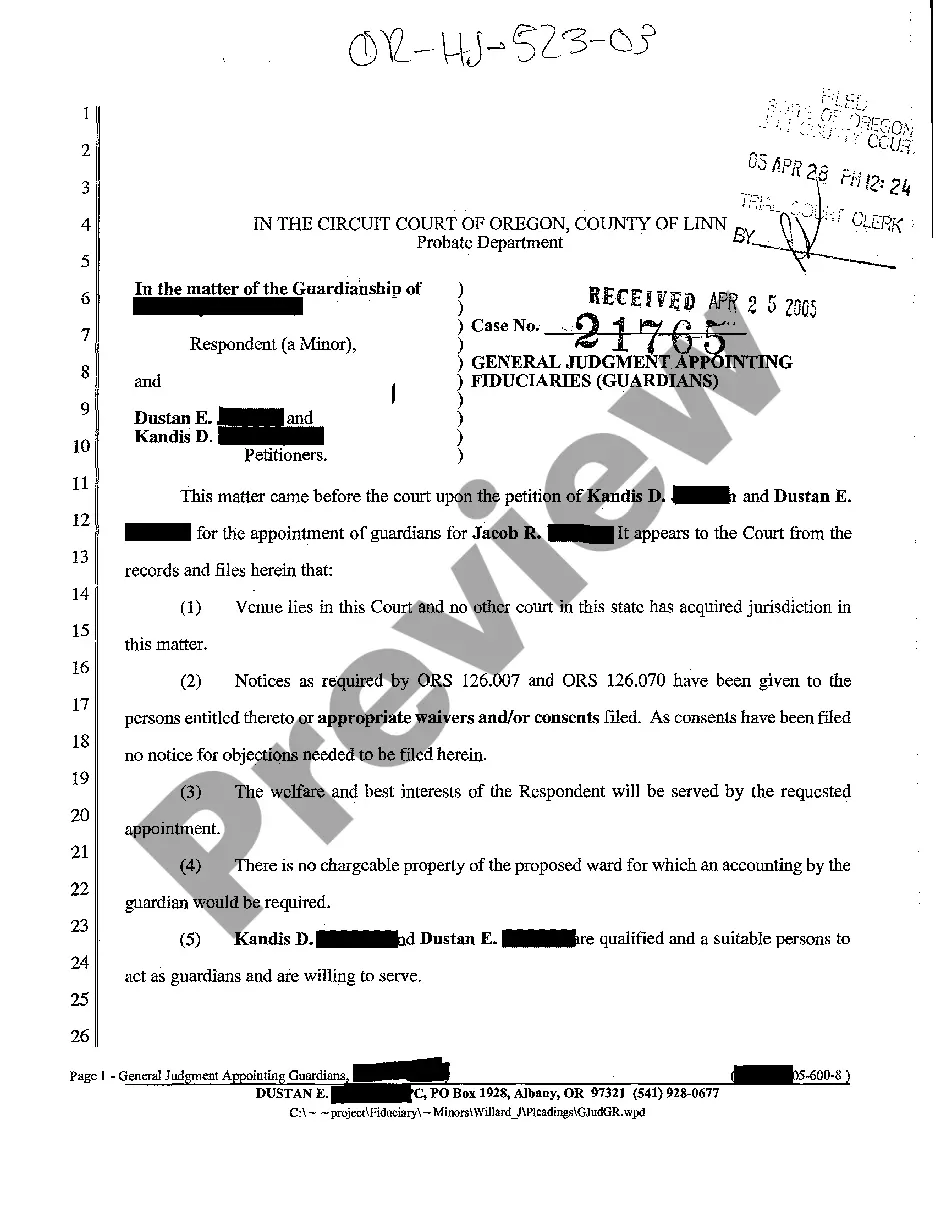

- Click the Preview option to review the content of the form.

Form popularity

FAQ

Filling out a petition for letters of administration in Georgia requires specific information about the deceased and the estate. You will need to provide details such as the name of the deceased, the date of death, and information about the heirs. To ensure accuracy and compliance with requirements like the Georgia Release and Indemnification of Personal Representative by Heirs and Devisees, using a platform like US Legal Forms can greatly simplify this process.

The executor can sell property without getting all of the beneficiaries to approve. However, notice will be sent to all the beneficiaries so that they know of the sale but they don't have to approve of the sale.

Agreements. MYTH: An heir cannot sell his or her interest in heirs property without the consent of the other heirs. FACT: An heir can sell his or her interest in heirs property to any non-family or family member and does not need the consent of any other heir.

Under Georgia law, there is no time limit on settling an estate. After your loved one passes away, there is no set number of days or months to open an estate. The usual time frame is from two weeks to as long as six months.

As the executor of an estate, you may be called on to sell a house to pay off debts or expenses, or simply to distribute the estate among the beneficiaries.

In Georgia, the Executor or Administrator files a Petition to Discharge the Personal Representative to Close a Probate Estate. This Petition is filed after all of the debts, expenses and taxes have been paid, tax returns filed, and remaining assets distributed.

Yes. An executor can sell a property without the approval of all beneficiaries. The will doesn't have specific provisions that require beneficiaries to approve how the assets will be administered. However, they should consult with beneficiaries about how to share the estate.

Is There a Time Limit on Settling a Georgia Estate? Under Georgia law, there is no time limit on settling an estate. After your loved one passes away, there is no set number of days or months to open an estate. The usual time frame is from two weeks to as long as six months.

An executor can sell the property alone if it is in the deceased's sole name. Selling a deceased's property owned in their sole name will require probate. Only an executor can sell a property in probate.

Is Probate Required in Georgia? Probate isn't always required in Georgia. It is necessary by law if the assets belonged solely to the deceased person with no named beneficiary or with the estate as the named beneficiary. If the assets were included in a revocable living trust, probate won't be necessary.