Georgia Agreement not to Compete during Continuation of Partnership and After Dissolution

Description

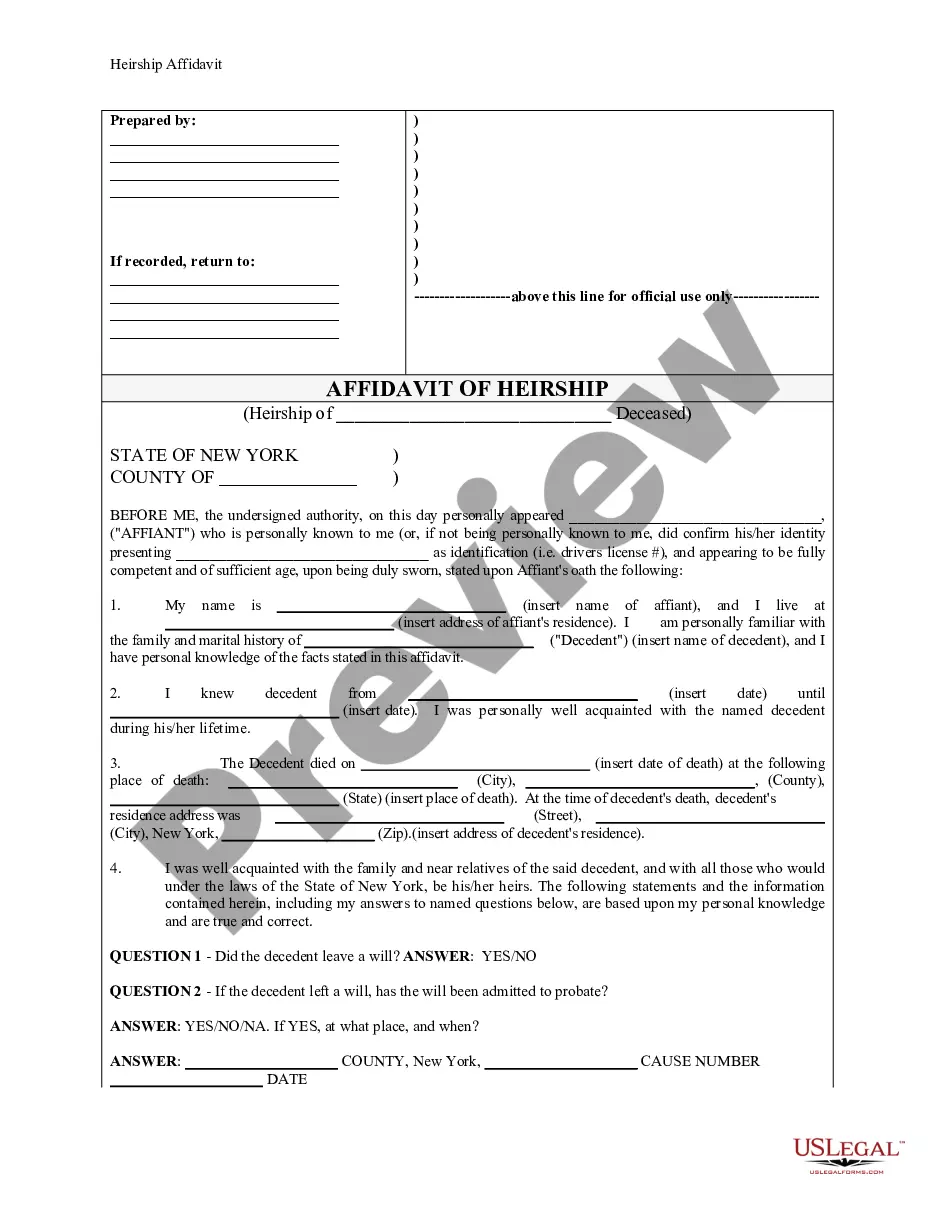

How to fill out Agreement Not To Compete During Continuation Of Partnership And After Dissolution?

It is feasible to dedicate time on the web searching for the legal document web template that complies with the state and federal specifications you require.

US Legal Forms provides thousands of legal forms that are assessed by experts.

You can conveniently obtain or print the Georgia Agreement not to Compete during Continuation of Partnership and After Dissolution from our platform.

If you wish to find another variation of the form, use the Search function to locate the template that satisfies your needs and specifications.

- If you have a US Legal Forms account, you can Log In and click on the Acquire button.

- Following that, you can complete, modify, print, or sign the Georgia Agreement not to Compete during Continuation of Partnership and After Dissolution.

- Every legal document template you purchase is yours permanently.

- To obtain another copy of any purchased form, navigate to the My documents section and click on the appropriate option.

- If you are accessing the US Legal Forms website for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/city of your choice. Review the form description to confirm you have chosen the right one.

- If available, utilize the Preview option to review the document template as well.

Form popularity

FAQ

Yes, physician non-compete agreements are enforceable in Georgia, subject to certain restrictions. The Georgia Agreement not to Compete during Continuation of Partnership and After Dissolution must align with legal requirements, such as being reasonable in duration and geographic scope. Physicians should carefully review these agreements and consult with legal experts to understand their enforceability before signing.

After the dissolution of the partnership, the partner is liable to pay his debt and to wind up the affairs regarding the partnership. After the dissolution, partners are liable to share the profit which they have decided in agreement or accordingly.

Effect of DissolutionA partnership continues after dissolution only for the purpose of winding up its business. The partnership is terminated when the winding up of its business is completed.

Settlement of accounts on dissolutionPayment of the debts of the firm to the third parties.Payment of advances and loans given by the partners.Payment of capital contributed by the partners.The surplus, if any, will be divided among the partners in their profit-sharing ratio.

Rights after dissolution It says that after the dissolution of the firm, all the partners or his representative are entitled to the property of the firm as applied in the payment of debts and liabilities of the firm and the surplus to be distributed among all the partners of the firm.

After a company is dissolved, it must liquidate its assets. Liquidation refers to the process of sale or auction of the company's non-cash assets. Note that only those assets your company owns can be liquidated. Thus, you can't liquidate assets that are used as collateral for loans.

On dissolution of the firm, the business of the firm ceases to exist since its affairs are would up by selling the assets and by paying the liabilities and discharging the claims of the partners. The dissolution of partnership among all partners of a firm is called dissolution of the firm.

Start now and decide later.Review and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.

Partnership Agreements and the Exit of One Partner A partnership does not necessarily end when a partner exits. The remaining partners may continue with the partnership. Therefore, your partnership agreement covers what happens when a partner wants to leave, becomes incapacitated, or dies.

How to Dissolve a PartnershipReview and Follow Your Partnership Agreement.Vote on Dissolution and Document Your Decision.Send Notifications and Cancel Business Registrations.Pay Outstanding Debts, Liquidate, and Distribute Assets.File Final Tax Return and Cancel Tax Accounts.Limiting Your Future Liability.