Georgia Worksheet - Contingent Worker

Description

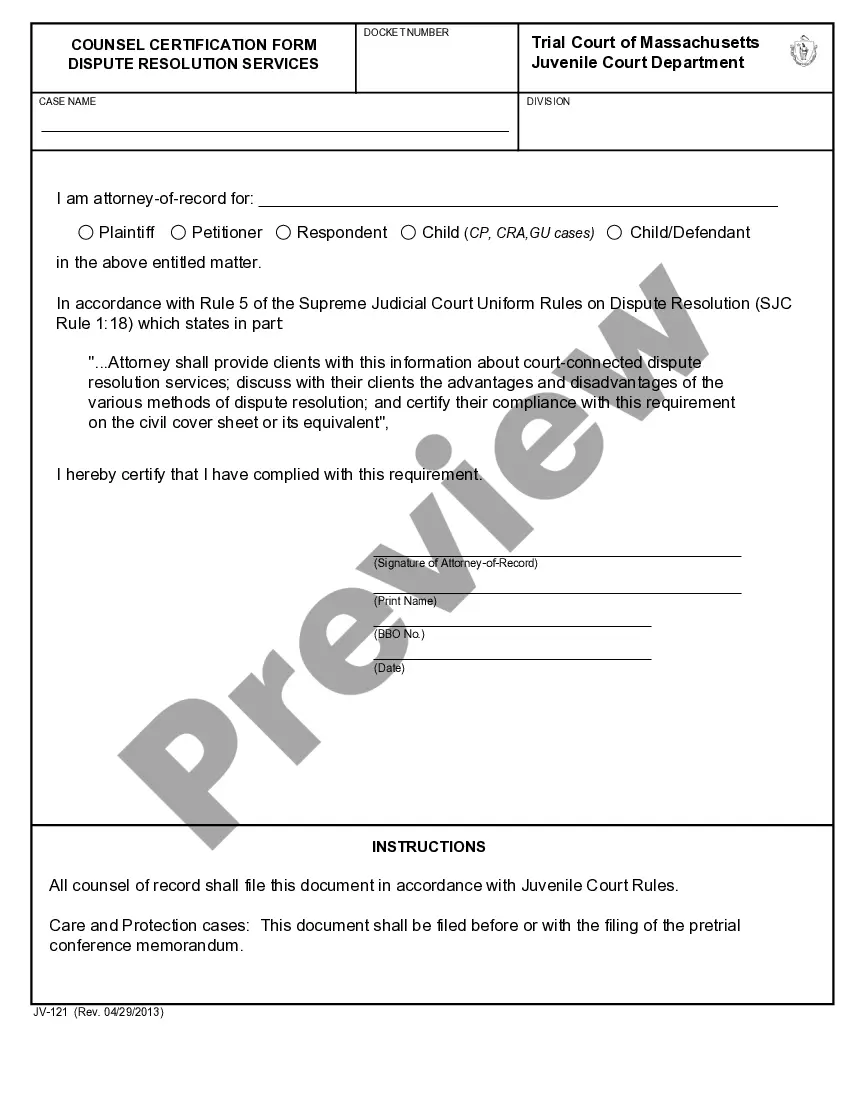

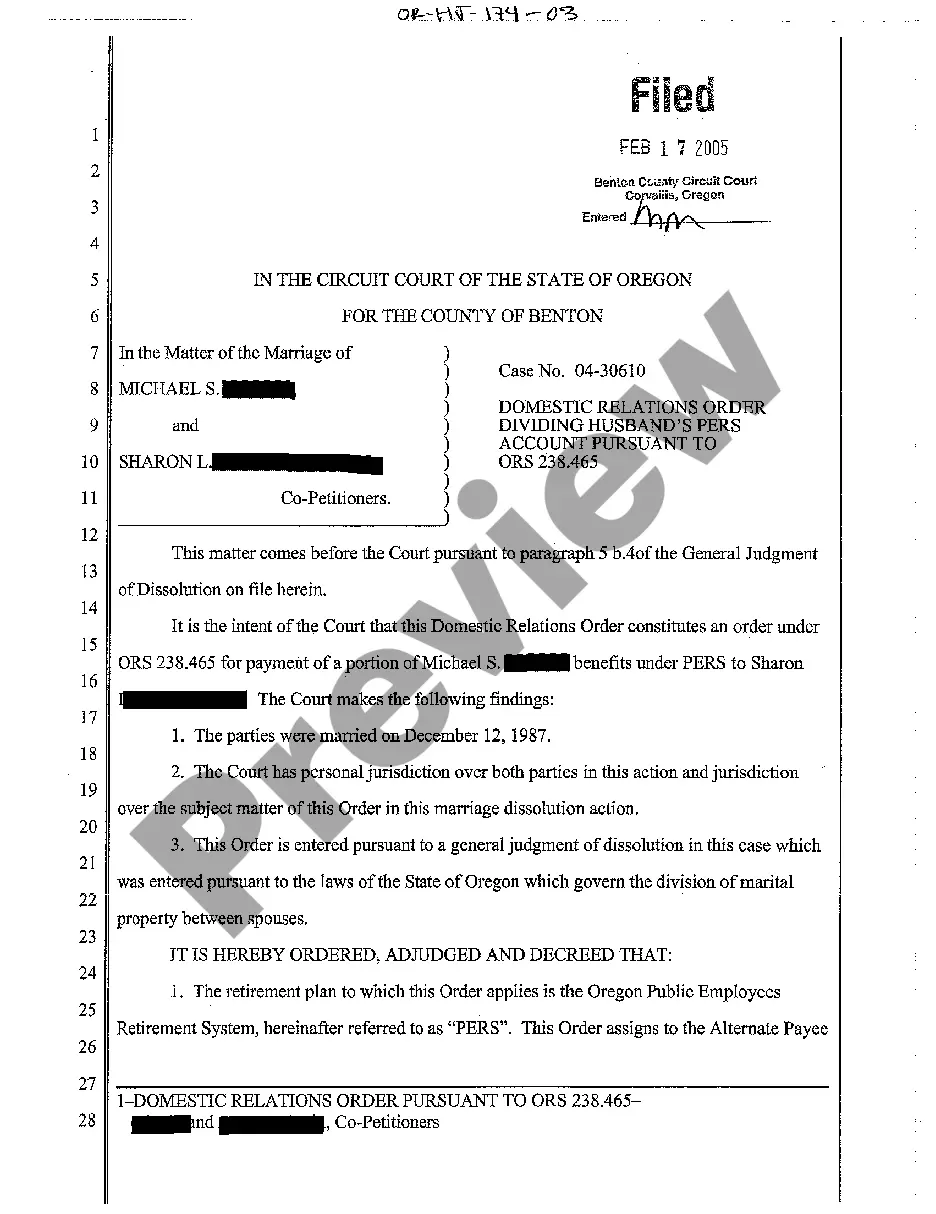

How to fill out Worksheet - Contingent Worker?

If you wish to be thorough, retrieve, or create sanctioned document templates, utilize US Legal Forms, the largest array of legal documents available online.

Employ the site’s straightforward and user-friendly search feature to find the documents you require. Various templates for business and personal purposes are categorized by type and jurisdiction, or keywords.

Use US Legal Forms to locate the Georgia Worksheet - Contingent Worker in just a few clicks.

Step 5. Complete the transaction. You can use your Visa or MasterCard or PayPal account to finalize the purchase.

Step 6. Select the format of the legal document and download it to your device. Step 7. Complete, modify and print or sign the Georgia Worksheet - Contingent Worker. Every legal document template you purchase is yours indefinitely. You will have access to every document you downloaded in your account. Click on the My documents section and select a form to print or download again. Compete and download, and print the Georgia Worksheet - Contingent Worker with US Legal Forms. There are countless professional and state-specific forms available for your business or personal needs.

- If you are already a US Legal Forms user, sign in to your account and click the Download button to access the Georgia Worksheet - Contingent Worker.

- You can also access forms you have previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure you have selected the form for the correct city/state.

- Step 2. Use the Preview option to review the content of the form. Don’t forget to read the details.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other variations of the legal document template.

- Step 4. Once you have found the form you need, click the Get Now button. Choose the pricing plan you prefer and provide your details to register for an account.

Form popularity

FAQ

Contingent workers may receive a W-2 or a 1099 form, which depends on how they classify their work relationship. If they are classified as employees, they should receive a W-2, while independent contractors receive a 1099. It's essential to refer to the Georgia Worksheet - Contingent Worker to clarify your situation and understand your tax obligations.

A contingent worker is someone who works for an organization without being hired as their employee. Contingent workers may provide their services under a contract, temporarily, or on an as-needed basis.

Who are contingent workers? Independent contractors, on-call workers, freelancers, contract workers, and any other type of individual hired on a per-project basis are examples of contingent staffing. In most cases, contingent workers have specialized skills, like an accountant or electrician.

Contingent work, casual work, or contract work, is an employment relationship with limited job security, payment on a piece work basis, typically part-time (typically with variable hours) that is considered non-permanent.

When it comes to contingent workers, there are three main types:Temporary contingent workers. Though these contingent workers are employed by a staffing agency, they typically work onsite at their temporary work assignments.Consultants.Independent contractors.

Independent contractors, on-call workers, freelancers, contract workers, and any other type of individual hired on a per-project basis are examples of contingent staffing.

A contingent worker is someone who works for an organization without being hired as their employee. Contingent workers may provide their services under a contract, temporarily, or on an as-needed basis.

The US Labor Department defines this in terms of who is responsible for the taxes. When a company hires a worker, temporary or permanent, they must take care of their taxes. However, when independent contingent workers are hired, they do not become employees and thus, have to take care of their own taxes.

When you hire a contingent workforce for short-term assignments, it helps you reduce expenses. Unlike regular employees, you don't need to manage and bear their overhead costs. Moreover, companies need not provide them with other employee benefits like health insurance, perks, paid time-off, etc.

Contingent workers include independent contractors, freelancers, consultants, advisors or other outsourced workers hired on a per-job and non-permanent basis.